Apr 26, 2023

The 9 Best Roth IRA Investments of 2023

Retirement might seem far away, but now’s the time to plan for it. The sooner you start, the better off you’ll be. One way to get started is by joining the 27 million American households holding a Roth IRA.

Roth IRAs are one of the most common retirement accounts available today, behind 401(k)s and traditional IRAs. The biggest benefit of Roth IRAs is tax-free growth and withdrawals since you pay taxes upfront.

When starting a Roth IRA, a financial advisor may select investments and fully manage your account or guide you through different options to pick what most appeals to you. Or, if you’re a savvy investor, you can open a self-directed Roth IRA.

The best investments for Roth IRAs experience high growth over a long period. They aren’t overly risky so by the time you retire, you should have a good chunk of change to rely on.

Key takeaways:

- Some Roth IRA investments, like dividend stocks and bond index funds, provide payments before retirement.

- Roth IRA accounts should reallocate investment from high risk to low risk as retirement nears.

- The best investments for Roth IRAs highly depend on the individual’s risk tolerance and age.

Follow along as we dive into some of the best investments for Roth IRAs and what to avoid in a Roth IRA.

| Investment | Best for | Risk level | Benefit |

|---|---|---|---|

| Bond index funds | Conservative investors building a diverse portfolio | Low | Safe, frequent payouts |

| Target-date funds | Investors wanting a single retirement plan | Low | Safe, hands-off |

| High dividend stocks | Investors close to retirement age looking for steady cash flow | Moderate | Consistent payouts, opportunity to reinvest |

| High-growth stocks | Investors decades away from retirement | Moderate | High reward, exciting |

| Value stock funds | Investors with low starting funds who can tolerate risk | Moderate | Potential for dividends, lower investment cost |

| S&P 500 index funds | Millennials and Gen X focused on long-term growth | Moderate to high | Diverse, low expense ratios |

| Nasdaq-100 index funds | Investors looking for exposure to tech markets | Moderate to high | High potential return |

| Global stock funds | Investors looking for exposure to the global economy | Moderate to high | Diverse, more opportunities |

| Small-cap stocks | Investors who can stomach volatility and aren’t retiring soon | Moderate to high | Less competitive, inexpensive investment |

Bond index funds

Best for: conservative investors building a diverse portfolio

Investing in bond index funds is similar to investing in stock index funds, except they are composed of different bonds—like government and corporate bonds.

Though bonds are less risky than stocks, it’s wise to invest in fewer bonds than stocks. That’s because the low risk associated with bonds typically leads to smaller returns. Additionally, bonds aren’t as predictable as stocks. Past performance isn’t indicative of future gains due to interest rate volatility.

With bond index funds, fund managers rarely hold onto bonds until their maturity date. Instead, they trade frequently to keep the index alive and maintain an average portfolio maturity of fewer than 10 years. Due to the revolving door of bonds, shareholders often receive interest payments monthly.

Benefits: safe and frequent payouts

Risk: low

Target-date funds

Best for: investors wanting a single retirement plan or a hands-off investing experience

Target-date funds are meant to be the only investment vehicle used to save for retirement goals. The assets in a target-date fund grow and restructure until the “target date” of when you’ll retire.

The funds start with a higher allocation to riskier assets—like stocks, growing most significantly in the early years. The strategy reverses as the target date approaches, and assets move to conservative investments, like bonds, keeping funds secure.

Target-date funds are one of the simplest and most common retirement plans. Many people already have target-date funds through employer 401(k)s and may not know it.

Benefits: safe and hands-off

Risk: low

High-dividend stocks

Best for: investors close to retirement age looking for steady cash flow

For some stock investments, you don’t have to wait until you sell your shares to earn money back. Dividends are a portion of a company’s profits, payable to shareholders on a quarterly basis. What shareholders do with their dividends is up to them—they can either cash them in or reinvest to continue building their investment.

High-dividend stocks have above-average returns compared to similar stocks on the market. High-dividend stocks make a good Roth IRA investment—especially for those close to retirement—because of the consistent funds they bring in.

Benefits: consistent payouts and opportunity to reinvest

Risk: moderate

High-growth stocks

Best for: investors decades away from retirement

High-growth stocks are those whose earnings grow faster than average. To be considered high-growth, companies must have substantial room for capital appreciation. They often deliver innovative products and own a large percentage of the market.

Some small-cap companies can blend into the high-growth market once the company starts to pick up speed—again, think of Amazon.

Since growth comes quickly, you may be thinking that means you can cash in sooner, but that’s not necessarily the best move. Since growth stocks are competitive and fast-moving, it’s wise to hold on to them. The longer you do this, the higher the return likely will be.

With high demand and limited shares, high-growth stocks can sometimes be costly to invest in. They’re often overvalued, unlike value stocks.

Benefits: high rewards, long-term, and exciting

Risk: high

Value stock funds

Best for: investors with low starting funds who can tolerate risk

Value stocks funds consist of undervalued stocks priced below what’s characteristic. Essentially, investors get a bargain by opting for value stocks. Because once the market realizes the stocks’ true value, share prices increase, which is when current shareholders profit. This is also where their risk lies—if their worth is never revealed, then the return could be nominal.

Value stocks are typically less volatile and preserve portfolio worth long term, making value stock funds a good investment for Roth IRAs. Many value stock companies also provide investors with dividends.

Benefits: potential for dividends and lower investment cost

Risk: moderate

Investing made easy.

Start today with any dollar amount.

S&P 500 index funds

Best for: Millennials and Gen X investors with moderate risk tolerance focusing on long-term growth

The S&P 500 index fund (Standard & Poor’s 500) is a type of stock index fund that consists of the U.S.’s top-performing 500 publicly traded companies. Within the S&P 500, you’ll find big names like Tesla and Johnson & Johnson, but it encompasses all industries from travel to health care to consumer products. First introduced in 1957, the S&P 500 index fund is well-established and a common IRA investment.

When you invest in the S&P 500, your money is distributed amongst all 500 companies. Of course, advanced investors can hand-pick specific companies to invest in. However, investing in the fund as a whole makes for a diverse portfolio and mitigates risks. Investing in the S&P 500 still comes with some risks, as there’s always a possibility that the companies within the index can go under.

On average, the annual rate of return hits around 10%.

Benefits: diverse and low expense ratios

Risk: moderate to high

Nasdaq-100 index funds

Best for: investors looking for exposure to tech markets

The Nasdaq-100 is another index fund investors can add to their portfolio through a Roth IRA. The 100 companies listed are some of the largest corporations in the world. The tech industry dominates holdings of the index, featuring companies like Meta and Adobe. Unlike the S&P 500, it doesn’t list financial companies.

Launched in 1985, the Nasdaq-100 index is newer than the S&P 500 index, but it often outperforms the S&P 500’s annual return rate. The lack of diversity within the Nasdaq-100 lends to a risky profile but heightens the reward potential.

Benefits: high potential return

Risk: moderate to high

Global stock index funds

Best for: investors looking for exposure to the global economy to expand their portfolio beyond the U.S. market

U.S. stocks do not always outperform global stocks, so investing in global stocks can be a strong way to diversify your investment portfolio and see a positive return.

The risk really depends on the index you invest in. For the risk-averse, opt for developed markets like Germany, Japan, and Canada. If you can tolerate risks, invest in an emerging market, like China, Mexico, or India, with high but volatile growth. With a managed Roth IRA, you can prioritize higher-risk markets initially to capitalize on high returns and then transition to lower-risk markets as retirement nears to keep funds safe.

Benefits: diversification and more opportunities

Risk: moderate to high

Small-cap stocks

Best for: investors who can stomach market fluctuations and aren’t retiring soon

Small-cap stocks are shares of small public companies whose market capitalization—the total value of stock shares—ranges from $250 million to $2 billion on average. Small-cap stocks have their own indexes, like the Russell 2000 Index and S&P SmallCap 600.

Investing in small companies can be risky. About 10% of businesses fail within their first year, so small-cap stocks are much more susceptible to market volatility. Not only that, securities fraud isn’t uncommon with small-cap stocks.

However, with high risk comes high reward. Individual small-cap stocks often yield higher growth potential than individual large companies—Amazon was once a small-cap company. The caveat is that you have to be willing to wait until the company’s value starts growing.

Since many small-cap companies aren’t well-known and rocky financial standings don’t appeal to all investors, there are often fewer hands in the money pot. The reward potential makes small-cap stocks a good Roth IRA investment for those who won’t run from the volatility.

Benefits: less competitive and inexpensive

Risk: moderate to high

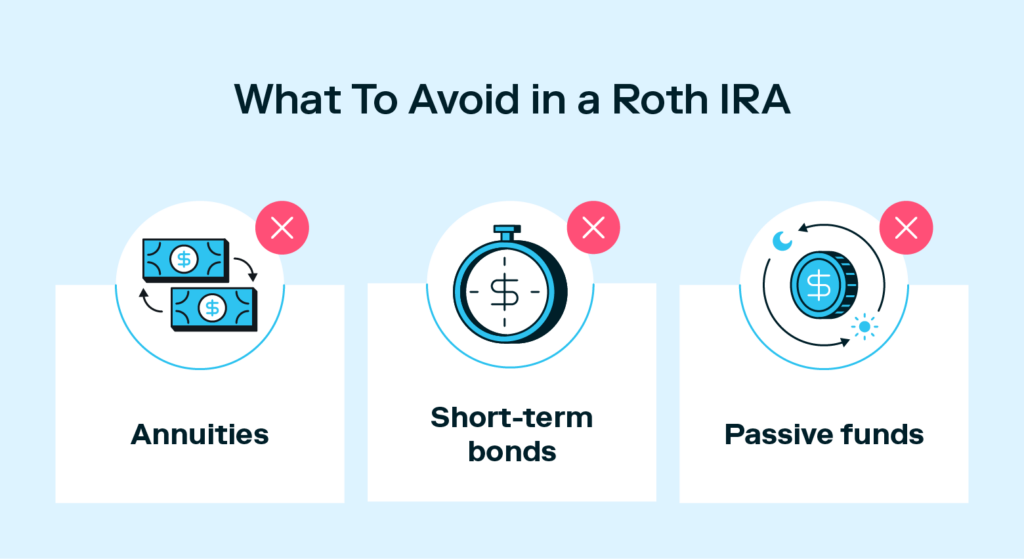

What to avoid in a Roth IRA

Not all assets make for the best investments for Roth IRAs. Here are four examples of what to avoid when selecting assets for your Roth IRA.

Annuities

One mistake retirees make with their Roth IRA funds is reinvesting them into an annuity.

Financial institutions and insurance companies sell annuity contracts to provide guaranteed income throughout retirement. It’s certainly reassuring to have retirement cash stored away and payments released steadily—that way, you know you won’t blow through your life’s savings. But, it’s often unnecessary to switch to an annuity.

Reasons to avoid annuities for Roth IRA:

- There’s an accumulation period before payments begin and withdrawals at this time are subject to withdrawal penalties.

- You have less control over your funds.

- No added tax benefits.

- Annuities grow due to interest only.

Short-term bonds

Americans work 48–52 years before retirement—that’s a long time to save, hence why long-term investments make the best assets for Roth IRAs.

Investors using short-term bonds, like Treasury bills, are typically saving for short-term saving goals, like a mortgage down payment or a wedding. Short-term bonds don’t see returns as quite high as long-term investments like stock shares. When saving for retirement with a Roth IRA, you want an asset that will bring high returns over a longer period.

Passive funds

There are few eligibility requirements for Roth IRAs, but having an income is one of them. However, passive income from rental properties, securities, non-taxed alimony, child support, or other assets count as unearned income. This means you can’t invest it into a Roth IRA.

FAQ

Need some more questions answered about the best investments for Roth IRA? Let us help.

How does a Roth IRA work?

Roth IRA growth occurs from your post-tax contributions and the earnings accumulated through investment returns. Contribution limits vary depending on income but start at $6,500 and lower the more money you make. Growth earnings and withdrawals in retirement are tax-free. Some of the most common assets within a Roth IRA are stocks, bonds, mutual funds, and more.

How do you invest in a Roth IRA to maximize its return?

To maximize your Roth IRA returns, you need to start early. Opening a Roth IRA as a young adult allows assets to compound over time.

You should also contribute as much as you comfortably can throughout the year, ideally maxing out your annual Roth IRA contribution limits.

Lastly, ensure your Roth IRA assets are diversified, and don’t be afraid to make risky but smart investments. Risky investments yield the highest returns.

What investments are best for a Roth IRA?

The best investments for a Roth IRA have high growth potential and payout dividends—such as stock and bond index funds. However, the exact assets depend on the individual’s risk tolerance and age. For example, investors close to retirement age shouldn’t invest in an asset that requires time to yield returns.

Can you have two Roth IRAs?

Yes, you can have two Roth IRAs. Or you can have more. There is no limit on the number of Roth IRAs you can hold. The caveat is your total contributions can’t exceed the IRS limit between all of your Roth IRAs.

What happens if you put too much in a Roth IRA?

If you contribute more than the IRS limit set for Roth IRAs, you need to take action before the tax year is up or you may face tax penalties.

You can withdraw or move your excess contributions to a traditional IRA without penalty. If you never remove the excess contributions, you’ll be hit with a 6% tax penalty every year.

If your income changes, check here to see if you still qualify for the same Roth IRA contribution limit.

What investments are best for a Roth IRA?

The best investments for your Roth IRAs are largely dependent on your individual investing style. Are you a high or low risk investor? Your age also plays a role. The investments that make sense for a 25-year-old might not be right for a 55-year-old. Take these factors into consideration when opening or adjusting your Roth IRA.

Let Stash help you make informed decisions for your long-term investments and retirement accounts. Get started today.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Roth vs. Traditional IRA: Which Is Best for You in 2024?

How To Plan for Retirement

Why It Can Pay to File Your Taxes Early