Feb 2, 2024

How to Start a Roth IRA: A 5-Step Guide for 2024

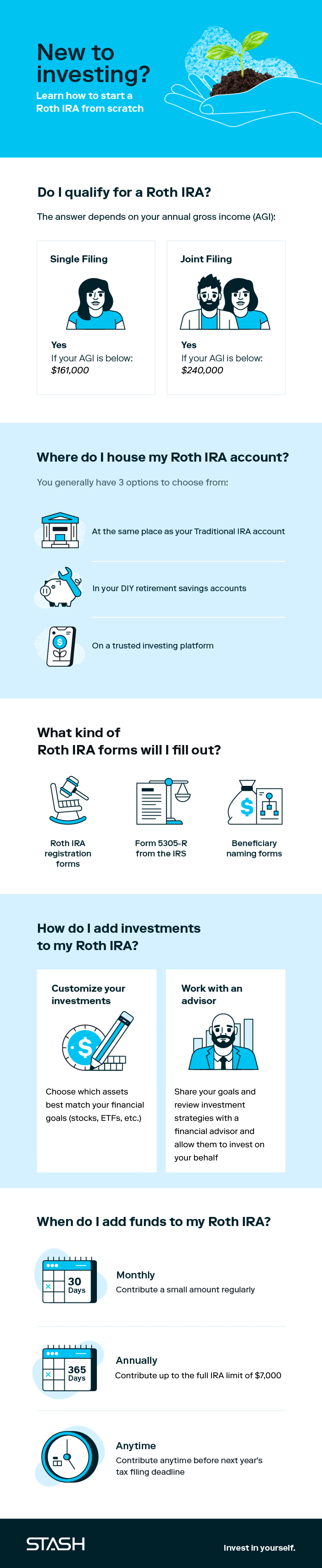

Ready to begin contributing to an individual retirement account (IRA)? You can easily set up a Roth IRA account in five simple steps. Before we learn how to start a Roth IRA, let’s review the basics of this account type.

What is a Roth IRA? Similar to a traditional IRA, a Roth IRA is a tax-advantaged account that allows investors to save for retirement and withdraw funds without penalty once they reach a certain age.

In this article, we’ll show you how to:

- Determine if you are eligible

- Find a home for your account

- Provide the necessary information

- Create an investment portfolio

- Schedule regular contributions to your IRA

After learning how to start your own Roth IRA account, stay tuned for tips on how to maximize your new retirement account.

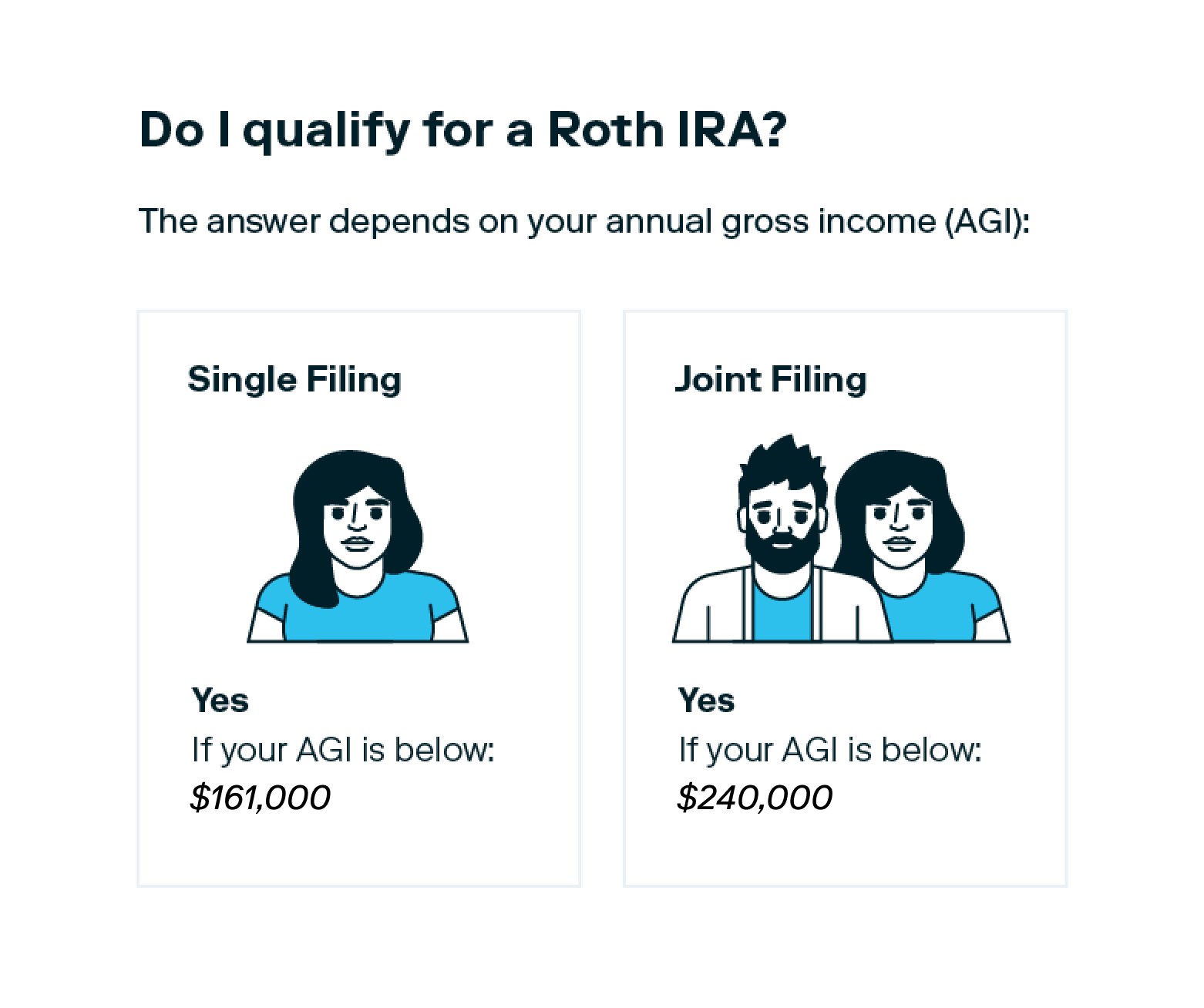

1. Determine if you are eligible

According to the IRS, those who file taxes as a single individual and earn an annual modified adjusted gross income (MAGI) below $161,000 are eligible to enroll in a Roth IRA. If you file taxes with a spouse, your joint income must be below $240,000 to qualify. As the investor, you are responsible for making sure you are eligible to contribute to a Roth IRA based on these limits. An online broker for a Roth IRA will not limit your ability to make a Roth IRA contribution, even if you are ineligible for making a contribution based on your income. However, if you do contribute to a Roth IRA and you are not eligible, you should correct this mistake as soon as possible. You will face a 6% penalty each year until you remedy your mistake.

Your annual gross income will also determine if you are eligible to make the full IRA contribution limit of $7,000 or if you are subject to reduced contribution amounts.

Aside from the IRS eligibility criteria, consider tackling your debt and creating an emergency savings fund before investing in a Roth IRA. Using this strategy, you can focus on cultivating an early retirement game plan without the stress of lingering debt or unexpected expenses on your mind.

2. Find a home for your account

Remember, a Roth IRA is an account type, not an investment that lives within a retirement account. If you have little interest in maintaining your retirement account, consider housing your Roth IRA with an online broker.

The best Roth IRA accounts are ones that come fully equipped with tons of investment options. Here are some questions to consider while scouting for the best home for your Roth IRA account:

- Are you interested in passive or active retirement investment strategies? If passive, consider an investing platform. If active, opt for a DIY retirement savings account. A financial advisor can help you find the perfect match.

- Are there any opening or maintenance fees you should be aware of? Although it is generally free to open a Roth IRA account, some providers may have account minimums or transfer fees.

- Is there an abundance of investment options to choose from? Long-term investment accounts like a Roth IRA generally benefit from asset diversity. Ask your provider what kind of assets and investments are available.

- Is the investment platform well-suited for buying, selling, and trading investments? Active investors should know of any fees, restrictions, or settlement periods associated with investment transactions. Passive investors should also be prepared to handle any cost when it is time to liquify their assets.

Once you answer these questions, you will be able to learn how to open a Roth IRA on the platform of your choosing.

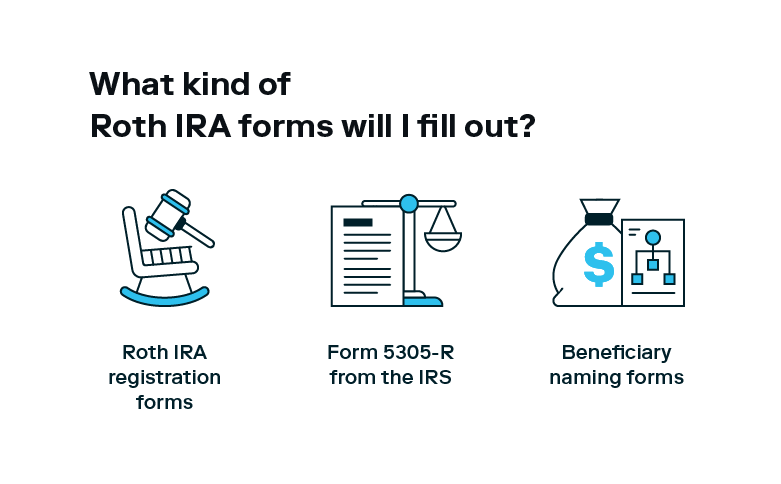

3. Provide the necessary information

Setting up your Roth IRA account is a breeze when you have these necessary documents at your fingertips:

- A social security number (SSN)

- A valid driver’s license or state ID

- A bank routing number

- Your bank account number

- Employer’s name and address

- Beneficiary’s name, SSN, and address

4. Create an investment portfolio

Aim to diversify the investments within your Roth IRA account. A diverse array of assets within an investment portfolio is a common way to hedge against inflation and market volatility.

Here are a few of the most popular assets that investors can incorporate into their Roth IRA account:

- Stocks: earn dividends or payouts from shares of a business

- Bonds: earn interest from the money you lend to an entity

- ETFs: benefit from value appreciation of a group of securities

- Mutual funds: pool your money together with other investors to buy a basket of securities

Your time horizon, income level, and financial goals will ultimately determine which assets are the best match for your Roth IRA.

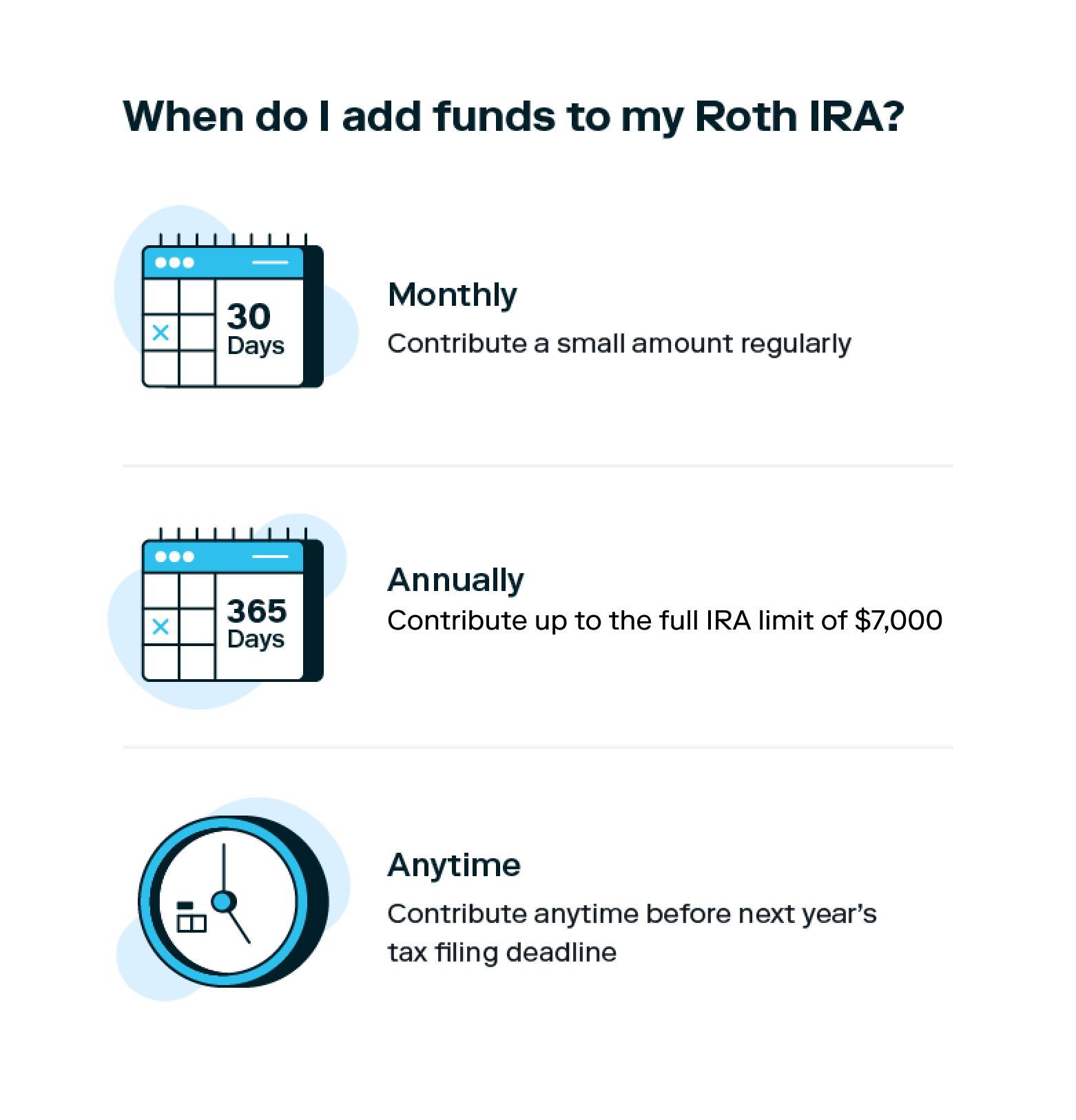

5. Schedule regular contributions to your IRA

Unlike a traditional IRA, Roth IRA contributions are taxed before they go to your account. So, the sooner you add your contributions, the sooner your money can start to grow in a tax-free way.

Scheduling regular contributions to your Roth IRA account can ensure that you set money aside each month for your retirement goals. Before contributing, check with your hosting platform about their contribution limits and transfer costs.

Although you have until the next tax filing date to add contributions, you can schedule regular contributions throughout the year. However, you are also allowed to make one larger contribution annually. Some investors may choose to wait until the end of the year so they understand their income if they are close to the income limits, or to make sure they have enough earned income to make a full contribution. Select the option that best fits your individual needs.

Tips for maximizing your Roth IRA accounts

A Roth IRA is a long-term investment account that you can maximize in the following ways:

- Invest as early as possible

- Speak with a financial advisor

- Diversify the assets in your account

- Allow your contributions to compound

- Learn Roth IRA withdrawal rules

- Name a beneficiary

Since Roth IRA contributions are already taxed, you will be able to withdraw from your account tax-free after you reach age 59 ½. Contributing now will allow your investments to compound until then.

If a traditional IRA nor a Roth IRA sound capable of meeting your retirement goals, consider exploring the benefits of a self-directed IRA.

Take control of your tomorrow with an IRA.

Set aside money for retirement-and save on taxes-with a traditional or Roth IRA.

FAQs about how to start a Roth IRA

Still have questions about how to start a Roth IRA? We’ve got answers.

What does IRA stand for?

IRA stands for individual retirement account.

How does a Roth IRA work?

Investors contribute taxed funds into their investment account and can then make tax-free withdrawals after they reach the age of 59 ½ years old.

How much money do you need to start a Roth IRA?

The answer depends on which Roth IRA account you choose. You will potentially have to pay registration fees, account minimums, trading fees, and withdrawal fees.

Can I open a Roth IRA myself?

Yes, you can open a Roth IRA on your own. However, you should speak with a financial advisor to ensure you are aware of the rules and obligations of the account.

Where can I open a Roth IRA for a beginner?

A beginner can open a self-directed account or a Roth IRA on an investment platform.

Can I open a Roth IRA at my bank?

Yes, you can open a Roth IRA at the same bank as your traditional IRA.

How much can you put in a Roth IRA?

You can make the full IRA contribution limit of $7,000 if you meet the IRS requirements. Those over age 50 can make an additional catch-up contribution of $1,000 for a total annual contribution limit of $8,000.

Is a Roth IRA or 401k better?

A Roth IRA might be a good option for investors who want to pay tax on their earnings today, in exchange for tax-free distributions in the future. If they plan to be in a higher tax bracket once they retire this can be a good strategy. However, if your employer offers a 401k matching contribution you may want to start investing in the 401k until you qualify for the maximum matching contribution from your employer. This will increase your retirement savings by accumulating dollars contributed from your employer. Everyone’s situation is unique, and the answer depends on your financial goals, tax situation, and retirement plans.

Related Articles

What Is a Traditional IRA?

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Roth vs. Traditional IRA: Which Is Best for You in 2024?

How To Plan for Retirement

Why It Can Pay to File Your Taxes Early

Stash’s Tax Checklist: Things You Need to Know Before You File