Jan 8, 2024

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

| How much do you need for retirement? Experts say the average individual will need $1.2 to $1.5 million to maintain their lifestyle with 80% of their annual pre-retirement income. |

The average American retires with $200,000 to $250,000 between various retirement savings accounts—just a measly one million dollars shy of the recommended amount. This explains why so many retirees return to work either part-time or full-time—34% of the American workforce is 65 or older, with almost 9% being 75 or older.

For some people, retirement can seem like an impossibility. Even retiring by the standard retirement age of 65 can seem out of reach.

While we all have different ideas of what retirement can or should be—from moving into an old missile silo to long days spent playing bird bingo with the grandkids—everyone eventually hopes to punch the clock one last time and enjoy life without work.

But getting there takes resources and planning. Specifically, how much you’ll need in retirement savings.

How much do I need to retire?

The most common recommendation to save for retirement is between $1.2 and $1.5 million. However, if you are hoping for an exact amount, there isn’t a one-size-fits-all number. Everyone has different retirement goals and methods of reaching them. Though, there are formulas to use as starting points to determine how much you’ll need in retirement.

The table below lists a 20- to 35-year retirement plan with access to 80% of pre-retirement salary. For example, to retire early at 50, an individual earning $50,000 a year should have $1.4 million in their retirement account to support a 35-year retirement. If that person were to retire at 60, they would need $1 million in retirement savings.

Two important considerations for early retirement:

- Some retirement accounts penalize withdrawals before 59 ½. You can contribute more to account for the penalties or plan on how to pay for it.

- Realistically, if an individual retires early, they don’t solely rely on their retirement funds. Setting up a steady stream of passive income is a common way retirees bring in money while enjoying retirement.

How Much Do You Need to Retire: By Income

| Current income | Age 50 | Age 55 | Age 60 | Age 65 |

|---|---|---|---|---|

| $50,000 | $1,400,000 | $1,200,000 | $1,000,000 | $800,000 |

| $75,000 | $2,100,000 | $1,800,000 | $1,500,000 | $1,200,000 |

| $100,000 | $2,800,000 | $2,400,000 | $2,000,000 | $1,600,000 |

| $150,000 | $4,200,000 | $3,600,000 | $3,000,000 | $2,400,000 |

| $200,000 | $5,600,000 | $4,800,000 | $4,000,000 | $3,200,000 |

| $250,000 | $7,000,000 | $6,000,000 | $5,000,000 | $4,000,000 |

| $300,000 | $8,400,000 | $7,200,000 | $6,000,000 | $4,800,000 |

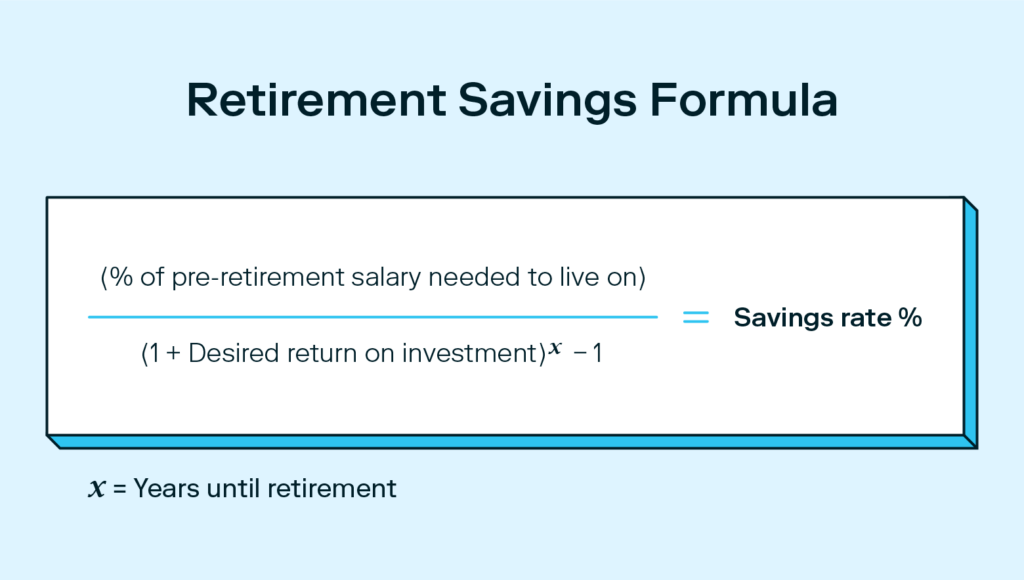

How to calculate retirement savings

While the numbers above are a good benchmark for how much you’ll need in retirement by age, the exact amount varies on your specific situation. Many free tools can help you calculate exactly what you need.

Savings calculators can help you see how much money you need to set aside each month to reach your financial goals and retire by 65 or any other age. Check out Stash’s retirement calculator. Simply plug in your age, income, and current savings, and it can help you calculate how much you’ll need to save to reach your retirement goals.

How much do you need to retire?

Use our retirement calculator to find out.

Try playing with these calculators and inputting different numbers to see what’s possible. Even minor changes to your saving and spending habits can greatly affect the eventual outcome.

If your salary isn’t in the table above or you are a couple looking for your combined retirement savings benchmark, use the following calculations.

High earners should consider contributing on the higher end of the scale to maintain their typical lifestyle while in retirement. For example, the retirement account of a Chief Financial Officer making $275,000 a year should hold about $2,200,000—eight times their salary—when they turn 55.

Retirement Savings Benchmark By Age

| Age | Savings benchmarks |

|---|---|

| 30 | .5x to 1x annual salary |

| 35 | 1.5x to 2x annual salary |

| 40 | 2.5x to 3.5x annual salary |

| 45 | 3x to 4.5x annual salary |

| 50 | 5x to 6x annual salary |

| 55 | 7x to 8x annual salary |

| 60 | 9x to 11x annual salary |

| 65 | 10-15x annual salary |

How to save for retirement

There are numerous ways you can start saving for retirement. If you’re looking to build your wealth by investing for retirement, the most common retirement investment accounts are 401(k)s, Roth IRAs, and traditional IRAs. Stay with us as we break each one down.

| Traditional 401(k) | Roth 401(k) | Traditional IRA | Roth IRA | |

|---|---|---|---|---|

| Income eligibility | None | None | None | Must have an annual salary less than $161,000 (single filers) or $240,000 (combined for joint filers). Other limits based on filing status. |

| Annual contribution limit | $23,000, or $30,500 if you’re 50+ (between all 401(k) accounts) | $23,000, or $30,500 if you’re 50+ (between all 401(k) accounts) | $7,000, or $8,000 if you’re 50+ (between all IRA accounts) | $7,000, or $8,000 if you’re 50+ (between all IRA accounts). Contribution limit may be reduced based on income |

| Taxation | Taxed at withdrawal | Taxed at contribution | Taxed at withdrawal | Taxed at contribution |

| Distribution | Required | Effective 2024, distributions will no longer be required | Required | No requirements |

| Average fees | Moderate to high | Moderate to high | Low | Low |

| Investment types | Primarily mutual funds. Limited by plan provider and employer. | Primarily mutual funds. Limited by plan provider and employer. | Mutual funds, bonds, stocks, certificates of deposit (CDs), and real estate. | Mutual funds, bonds, stocks, certificates of deposit (CDs), and real estate. |

| Employer match | Eligible | Eligible, although employer contributions are treated as pre-tax and taxed at withdrawal | Ineligible | Ineligible |

| Maintained by | Employer | Employer | Self | Self |

401(k)

A 401(k) plan is an employer-sponsored retirement plan offered to employees. Contributions are invested and grow over time. However, the employer and plan provider determines what investment options are available.

401(k)s can be either traditional or Roth—about 88% of 401(k) plans offer a Roth version. The main difference between the two is how they’re funded. Those enrolled in traditional 401(k)s contribute pre-tax dollars, whereas Roth 401(k)s use after-tax dollars.

While both traditional and Roth 401(k) employee contributions are generally eligible for an employer matching contribution (if available), the employer’s contribution will be deposited as traditional 401(k) funds. Approximately half of all employers offer some degree of matching.

| Pros | Cons |

|---|---|

| Potential free money from employer matching | Fewer investment opportunities |

| High contribution limits | Penalties for early withdrawal |

| Traditional contributions reduce taxable income in the same tax year | High administrative fees |

Traditional IRA

A traditional IRA is a tax-advantaged retirement account where investors contribute pre-tax dollars into investment types like stocks, bonds, and mutual funds. Balances grow tax-deferred, meaning investments accumulate tax-free until withdrawn. If you expect to be in a lower tax bracket after retirement, a traditional IRA might be best for you.

| Pros | Cons |

|---|---|

| Tax-deductible contributions (Note: If you or your spouse are covered by a workplace retirement plan your ability to deduct a traditional IRA contribution may be limited) | Penalties for withdrawing early on contributions and earnings |

| Tax-deferred growth | Requires minimum distributions after age 73 |

| No income limits so anyone can open a traditional IRA | Lower annual contribution limit |

Roth IRA

A Roth IRA is another type of investment retirement account, but unlike traditional IRAs, Roth IRAs are funded by after-tax dollars. After contributing, investments continue to grow tax-free and do not face further taxes when withdrawn. Stocks, bonds, and mutual funds are also common Roth investment types.

Roth IRAs are appealing due to their high-growth nature. If you started maxing out your Roth IRA in your twenties, you could retire as a millionaire in your sixties.

However, Roth IRAs have high-income eligibility limits meant to prohibit those earning over $161,000 from profiting from Roth tax benefits. However, high earners can get around this stipulation by converting a traditional IRA to a backdoor Roth IRA.

| Pros | Cons |

|---|---|

| Tax-free growth | Contributions aren’t tax deductible |

| Tax-free withdrawals | Penalties for withdrawing from earnings early |

| Withdraw from contributions penalty-free | Lower annual contribution limit |

| No RMDs (unless it’s passed on to a beneficiary) | Income threshold reduces eligibility for high earners |

Retirement savings considerations

Think ahead, and consider the costs related to your future retirement plans. Bills don’t go away when you retire, so you need a plan for how you’ll pay living expenses like healthcare and property taxes. There are also factors beyond your control that impact your retirement savings, like where you live and inflation.

1. How much can you contribute?

You shouldn’t put yourself in financial trouble now to save for retirement. But that doesn’t equate to skipping out on saving for retirement altogether. Analyze your financial standings and create a budget to determine how much you can contribute to your retirement savings. Remember, some retirement savings is better than none.

2. Where do you want to retire?

Perhaps the biggest factor in figuring out how much you’ll need to retire is where you hope to live. Ask yourself:

- Do I plan on downsizing and moving into a smaller house? Selling your home for a smaller, cheaper one may provide additional extra money for your retirement savings.

- Will I move to a different country? A European villa will cost much more than a small house in Indiana or Ohio.

- If I don’t plan on moving, will my maintenance costs, property taxes, and home improvements rise with time?

Think about where and how you want to live to understand how your cost of living might change. Also, if you plan on moving away from friends and family, you could spend more on frequent trips to visit—just one more thing to consider.

3. What do you envision retirement to be?

Another important question to ask yourself: “What do I want to do when I retire?”

For example, if you hope to retire at 65 and spend your retirement golfing at the local country club, you’ll need far less than the person who retires at 50 and travels the world.

Read more: How to calculate opportunity costs

4. How can you account for inflation?

It’s impossible to know how much the prices of goods will increase over time, making it difficult to plan for inflation in retirement savings. You could look at historical inflation rates, but even that might not be a completely accurate prediction of the future. For example, the COVID-19 pandemic, which led to inflation spikes in 2022, couldn’t have been predicted.

The best way to account for inflation in your retirement savings is to save for more than you’ll need if you can afford to. Additionally, Social Security increases with inflation, though this shouldn’t be your primary source of income in retirement.

Frequently Asked Questions (FAQ)

Still have questions about how much you’ll need in retirement? Let us help!

How much does a couple need to retire?

On average, couples should have about eight to 10 times their combined pre-retirement salaries saved for retirement. For high earners, that amount should be closer to 15 times their combined salaries.

Can I retire with $1.5 million comfortably?

Yes, it’s possible to retire with $1.5 million and live a comfortable life if you retire at a typical retirement age. However, this is only true for those used to living with a salary of less than $100,000.

Can I retire at 60 with $500,000?

It’s not impossible to retire at 60 with $500,000 if you live a frugal lifestyle. This savings amount would provide a $16,000 to $25,000 annual salary. But people retire with much less. The average American has less than half this amount in their 401(k) accounts.

However, if you want to truly retire and not pick up a part-time job, you would need much more savings. Or, you may consider putting passive income streams in place to supplement your retirement savings.

Why you should start saving now

Now that you’ve calculated how much you’ll need in retirement to live comfortably, it’s time to get started saving. Compound interest can heavily impact long-term retirement savings, which is why it’s important to start saving early to reach your goals.

The earlier you start saving, the more time your money has to compound and the more interest or returns you could earn. Even if your current contributions are small, compounding can help them add up by the time you reach 65.

The sooner you start, the better. Saving small amounts over longer periods is typically easier than scrambling to save several thousands of dollars per year in your 50s and 60s. Starting to save at a young age could give you a huge head start.

You can start saving for retirement now on Stash.

Investing made easy.

Start today with any dollar amount.

This information should not be relied upon as research, investment advice or Tax advice. This information is strictly for illustrative and educational purposes and is subject to change. For additional tax related questions, please consult a Tax professional.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

Roth vs. Traditional IRA: Which Is Best for You in 2024?

How To Plan for Retirement

Why It Can Pay to File Your Taxes Early

Stash’s Tax Checklist: Things You Need to Know Before You File