Jan 5, 2024

Roth vs. Traditional IRA: Which Is Best for You in 2024?

| What is the difference between Roth and traditional IRAs? The key distinction between Roth and traditional IRAs comes down to taxes. With a Roth IRA, you contribute after-tax dollars. With a traditional IRA, you contribute pretax dollars, which means your money is taxed when you make withdrawals in retirement. |

You’ve heard it before—it’s never too early to start saving for retirement. The earlier you start, the more comfortable you’ll be sitting on a beach with the rest of the snowbirds in Florida. But how do you start stashing away for your later years?

Individual retirement accounts (IRAs) are one of the most common types of investment accounts. If you’re debating between a Roth IRA vs. traditional IRA, you’ll want to consider the pros and cons of each. Both offer tax benefits, but they differ in important ways, including the timing of those tax benefits, accessibility of funds, and income limits.

Read along to learn the pros and cons of Roth vs. traditional IRAs to determine which is best for you.

Comparing Roth vs. Traditional IRA

| Roth IRA | Traditional IRA | |

|---|---|---|

| Income limits for contributions | To contribute to a Roth IRA, joint filers need a Modified AGI (MAGI) below $240,000, or $161,000 for single filers. Contribution limits vary based on income and filing status.$228,000 (joint filers) or $153,000 (single filers). Other limits based on filing status. | None. |

| 2024 Contribution limits | $7,000, or $8,000 for ages 50 and older. | $7,000, or $8,000 for ages 50 and older. |

| Taxes on contributions | Taxed before contributing. | Generally, taxed at withdrawal. |

| Taxes on earnings | None for qualified withdrawals. | Taxed as income at withdrawal. |

| Tax deductions | Contributions are not deductible. | Contributions are generally deductible for the contribution year. |

| Qualified withdrawals | May begin at age 59½. Subject to five-year rule. | May begin at age 59½. |

| Taxes on withdrawals | None for qualified distributions. Non-qualified distributions subject to tax and may be subject to additional 10% penalty. | Taxed as income for qualified distributions. Non-qualified distributions subject to tax and additional 10% penalty. |

| Early withdrawal rules | No penalty on withdrawal of contributions. Taxes and penalties for withdrawal of earnings. Some exceptions apply. | Taxes and penalties for withdrawal of contributions and earnings. Some exceptions apply. |

| Required Minimum Distributions (RMDs) | None. | Must begin at age 73 (so long as the account owner turned 72 after 12/31/2022). |

| Age requirements | There are no age limits on Roth contributions as long as you have earned income. | There are no age limits on traditional IRA contributions as long as you have earned income. |

What is a Roth IRA?

A Roth IRA is an individual retirement account you fund with after-tax income. This is separate from an employer-sponsored retirement plan. You can reap tax benefits by keeping your money in the account until retirement age. Your money grows tax-free while in the account and you don’t pay any taxes on withdrawals after age 59½. Plus, you can withdraw funds you’ve contributed at any time without penalty (early withdrawals on earnings are subject to a 10% tax penalty).

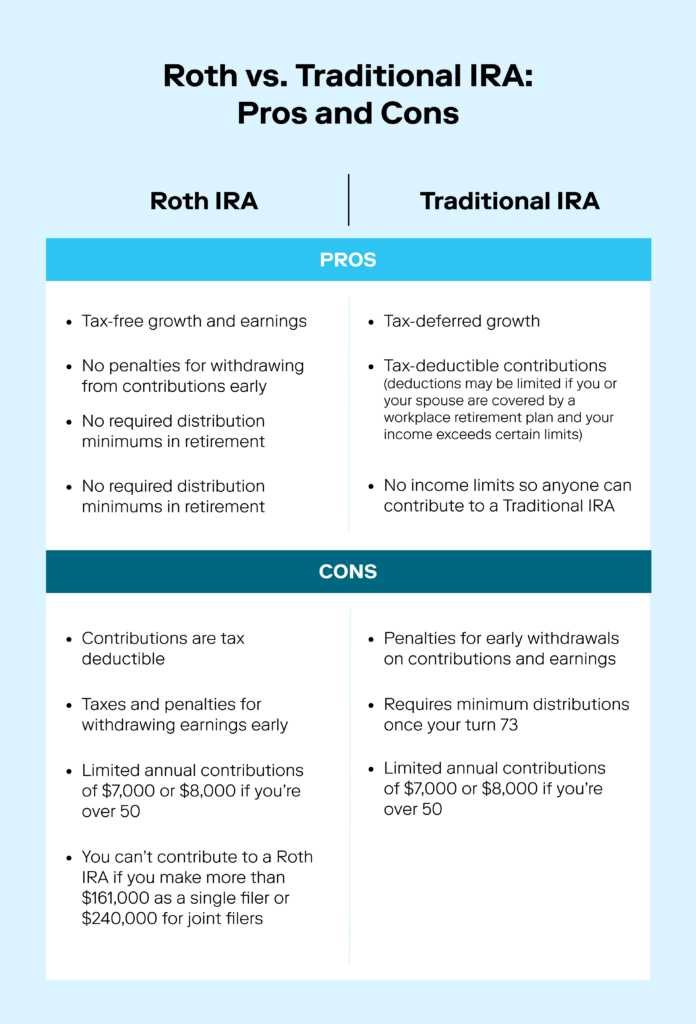

Benefits of a Roth IRA

Saving for retirement with a Roth IRA can have some notable advantages.

1. Tax-free growth and earnings

In exchange for contributing after-tax dollars, your money grows tax-free. Basically, you pay your taxes on contributions up front, let your money compound, and then pay no taxes when you withdraw earnings after age 59½.

Note that this tax benefit is subject to the five-year rule: you must hold a Roth IRA for five years, or earnings you withdraw may be subject to taxes and penalties. If you have multiple Roth IRAs, once you satisfy the five-year rule for the first one you open, the IRS generally considers the rule satisfied for all of them, even those you opened more recently.

2. Withdraw contributions penalty-free

At any time, you can withdraw the money you’ve contributed without paying penalties or additional taxes. That flexibility can be helpful, but remember that it applies to contributions only; any earnings on your investments will usually be subject to taxes and penalties if withdrawn early.

3. No required distributions

Required minimum distributions (RMD) force you to make withdrawals from your account annually starting at a certain age. Roth IRAs don’t have RMDs, allowing your money to compound for as long as you like. You can even pass along the untouched money to your heirs, tax-free.

Disadvantages of a Roth IRA

When you’re considering a Roth IRA, you may want to take into account the potential downsides.

1. Contributions are not tax-deductible

Because you’re contributing after-tax dollars, your annual Roth IRA contribution isn’t tax-deductible at the end of the year, meaning your contributions don’t reduce your taxable income in the year you make them.

2. Taxes and penalties for some withdrawals

While you can withdraw contributions to your Roth IRA without penalty, you may owe income tax and a 10% penalty if you withdraw earnings before you’re 59½ years old. There are, however, a few exceptions to IRA withdrawal penalties.

3. Limited annual contributions

In 2024, Roth IRA contributions are limited to 7,000 per year until age 50, at which point you can start contributing up to $8,000 annually. If you earn less than the contribution limit, you can only invest up to the amount of your earned income for the year. Contribution limits may also be reduced based on how much money you make. See the next item.

4. Annual income limits

The IRS restricts your ability to contribute to a Roth IRA based on your income. For instance, single filers earning over $146,000 in 2024 are limited to making a reduced Roth IRA contribution. Once they earn over $161,000 (in 2024), they are not eligible to contribute to a Roth IRA at all.

The contribution limit starts to reduce for joint filers when their earnings reach $230,000, and they are not eligible to contribute to a Roth IRA when they’re income reaches $240,000. Income in this case is measured by your Modified AGI (MAGI).

There is a loophole for high earners to get around the income limit while still reaping tax benefits. This is known as a backdoor Roth IRA. This strategy allows individuals to make contributions to a traditional IRA and then later convert the account into a Roth IRA. Conversions aren’t subject to income thresholds but are still subject to contribution limits. You should consult with a financial planner or tax advisor before making a backdoor Roth contribution, because if done incorrectly it may result in an unwanted tax liability.

Take control of your tomorrow with an IRA.

Set aside money for retirement-and save on taxes-with a traditional or Roth IRA.

What is a traditional IRA?

A traditional IRA is also a tax-advantaged individual retirement account, but it functions differently than a Roth IRA. You may contribute pretax dollars, and your investments grow tax-deferred until you withdraw them during retirement.

Generally contributions are tax-deductible which can lower your taxable income for the year. After age 59½, you can withdraw your contributions and earnings and pay income tax on your money at that time.

Benefits of a traditional IRA

For some investors, the benefits of a traditional IRA outweigh those of a Roth IRA.

1. Tax-deferred growth

Once the money is in your traditional IRA account, it grows tax-free. Earnings and gains are not taxed until you make a qualified withdrawal during retirement. This can be an appealing tax benefit because many people are in a lower tax bracket after they retire.

2. Tax-deductible contributions

Note that if your or your spouse are eligible to participate in an employer-sponsored retirement plan, like a 403(b) or 401(k), it can impact the deductibility of your traditional IRA contributions. As of 2024, single filers who are covered by a workplace retirement plan, and with incomes over $77,000 ($230,000 for married filing jointly) may face limitations on the amount they can deduct. For married individuals filing separately, the income threshold is notably lower; those earning over $10,000 might not qualify for a full deduction of their traditional IRA contribution.”

3. No income limits

Anyone with earned income can contribute to a traditional IRA, regardless of how much you make.

Disadvantages of a traditional IRA

A traditional IRA tends to be a bit less flexible than a Roth IRA. Depending on your circumstances, that might be a disadvantage.

1. Penalties for early withdrawals

Unless you qualify for an exception to early-withdrawal penalties, any withdrawals from a traditional IRA before age 59½ are subject to income tax and an additional 10% penalty. That applies to both your contributions and gains.

2. Limited annual contributions

The contribution limits for 2024 are the same as Roth IRAs: $7,000 or $8,000 if you’re over 50.

3. Required minimum distributions

As of 2023, RMDs must be taken from a traditional IRA each year once you turn 73. The RMD for each year is calculated by dividing the IRA account balance as of Dec. 31 of the prior year by the applicable distribution period or life expectancy.

Roth IRA vs. Traditional IRA: Key Similarities

| Contribution limits | Both Roth and traditional IRAs have an annual contribution limit of $7,000, or $8,000 for ages 50 and older. |

| Tax-sheltered growth | Both traditional and Roth IRA accounts are eligible for tax-sheltered investment growth, as long as the assets stay in the account. |

| Early withdrawal exceptions | The IRS provides penalty-free withdrawal exceptions, like buying a first home or paying for certain education expenses. |

| Investment options | Both include different investment types like stocks, bonds, exchange-traded funds, mutual funds, and real estate. |

| Administration | For either kind of IRA, you’ll need to open an account with a brokerage, which will custody your account. |

| Risk | Both Roth and traditional IRAs are investment accounts with the risk of losing money. |

IRA pop quiz: Check your knowledge

Test your knowledge of Roth vs. traditional IRAs by answering true or false to the following questions in this quick pop quiz.

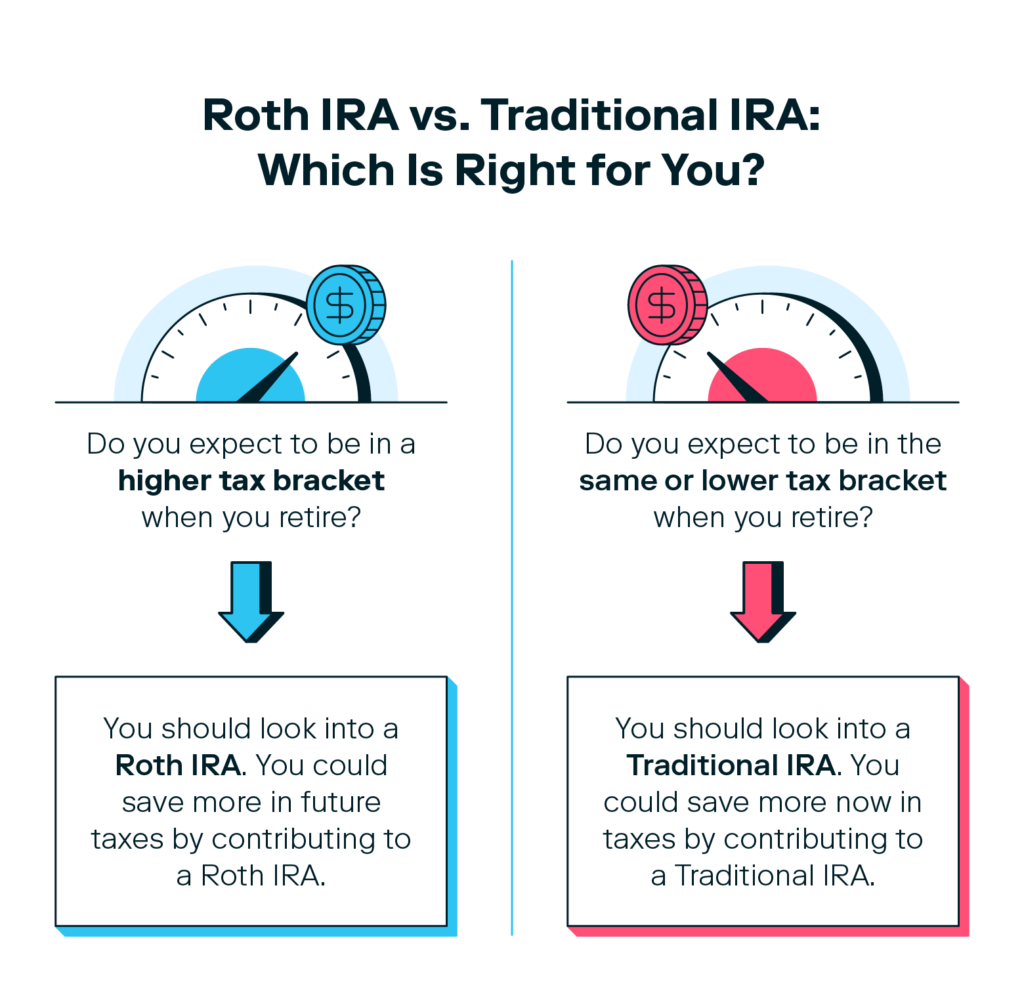

How to choose between a Roth vs. traditional IRA

You have many options when saving for retirement, and an IRA of any type could offer tax benefits. When deciding between a Roth or traditional IRA, ask yourself the following questions:

- Am I eligible for an IRA? Do you meet the income requirements to open an IRA account?

- How much can I contribute? Roth IRAs and traditional IRAs hold the same contribution limit. But if you can afford to max out on IRA contributions on an IRA, it makes the most sense to opt for a Roth IRA and avoid paying taxes later.

- Am I close to retirement age? A traditional IRA might be best if you’re within five to 10 years of retirement. The tax-free growth benefit of Roth IRAs works better if you have a long time before retirement.

- Do you foresee your IRA as a potential nest egg for heirs? Since Roth IRAs don’t require minimum distributions, you can pass them on to heirs. You cannot do this with traditional IRAs.

- Do you want your IRA to benefit you now or later? Traditional IRAs offer immediate tax benefits since they count as tax deductions, putting more money in your pocket now but leaving you to pay taxes down the road. With Roth IRAs, you reap the tax benefits later. You have to decide whether you prefer the extra cushion now or later.

- Do you want flexible access to your money before retirement, just in case? Roth IRAs allow you to withdraw penalty-free from your contributions five years after opening the account. With a traditional IRA, nonqualified distributions incur tax and a 10% penalty.

For many investors, a deciding factor is whether you want to pay taxes now or in the future. You may want to consider whether your annual income and tax bracket will likely be higher or lower when you retire than it is now.

- If you think you’ll be in a higher tax bracket when you retire, a Roth IRA may be right. Your tax rate will be lower now, and you can withdraw those funds, plus earnings, tax-free in retirement.

- If you think you’ll be in a lower tax bracket when you retire, a traditional IRA may be the right choice. You’ll get the tax deductions today and pay a lower tax rate on your money later.

Saving for retirement is generally a good idea, and the right investment option for you depends on your current circumstances and goals. The tax benefits of both Roth and traditional IRAs could help your investments grow, so whichever you choose may help you build a brighter financial feature.

FAQ

Still unsure about which type of IRA you should have? Let us help.

Can you have multiple IRAs?

As long as you meet the eligibility requirements, you can invest in both a Roth IRA and a traditional IRA. You can also hold multiple Roth IRAs or multiple traditional IRAs. However, your combined annual contribution to all your IRA accounts will still be capped at $7,000 or $8,000 if you’re over 50.

Can my employer match my IRA contributions?

Employers cannot contribute to your individual Roth or traditional IRA because they are set up by you as an individual, separate from your employer plan. However, your employer can offer a different type of IRA plan, including an employer match. Smaller businesses often use these plans to help employees save for retirement without the costs of more complex plans like 401(k)s.

- Payroll Deduction IRA: This allows you to contribute to your Roth or traditional IRA through direct deposit from your paycheck. There is no option for an employer match.

- Simplified Employee Pension (SEP): This type of IRA allows an employer to open and contribute to an IRA for you. You cannot make contributions yourself; all the funds come from your employer.

- SIMPLE IRA plan: These plans are designed for small businesses that want to offer an employer match. Your employer must make matching contributions; plus, they have to contribute some funds even if you don’t.

Which IRA is right for you?

Whether you should choose a Roth or traditional IRA depends on your circumstances and goals. A Roth IRA may work well for you if you want more flexibility with your money and anticipate being in a higher tax bracket when you retire. A traditional IRA may be a better investment option if you want tax deductions now and expect to be in a lower tax bracket upon retirement.

Once you’ve decided which IRA is best for you, you’ll need to set a retirement investment strategy. Try our retirement calculator for a guided look into how much you’ll need to retire and the monthly contributions to get you there.

Investing made easy.

Start today with any dollar amount.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

How To Plan for Retirement

Why It Can Pay to File Your Taxes Early

Stash’s Tax Checklist: Things You Need to Know Before You File