Apr 12, 2023

How To Find Undervalued Stocks: An 8-Step Guide

| How can you find undervalued stocks? You can find undervalued stocks by comparing their ratios, market cap, price, and overall financial health with competitors in the same industry. |

If you care about saving money, nothing is better than taking advantage of a great deal. Whether it’s a buy-one-get-one-free deal at your favorite department store or a 60% off clearance sale, it feels good to buy something at an undervalued price.

The same applies to the stock market—though you won’t see any advertised sales.

Instead, you can get a ‘good deal’ by buying undervalued stocks. Undervalued stocks are stocks that investors believe are trading at a price lower than their true value.

But how can you find stocks that are undervalued?

To help you learn how to find undervalued stocks, we’ve created an eight-step guide:

- Look at the company’s ratios

- Investigate the company’s market cap

- Analyze the company’s dividend yield and cash flow

- Take a look at the company’s competitors

- Check out the company’s financials

- Target stocks from undervalued sectors

- Use a stock screener

- Explore emerging industries

Read along to learn more about the different ways you can find undervalued stocks and what makes a stock undervalued.

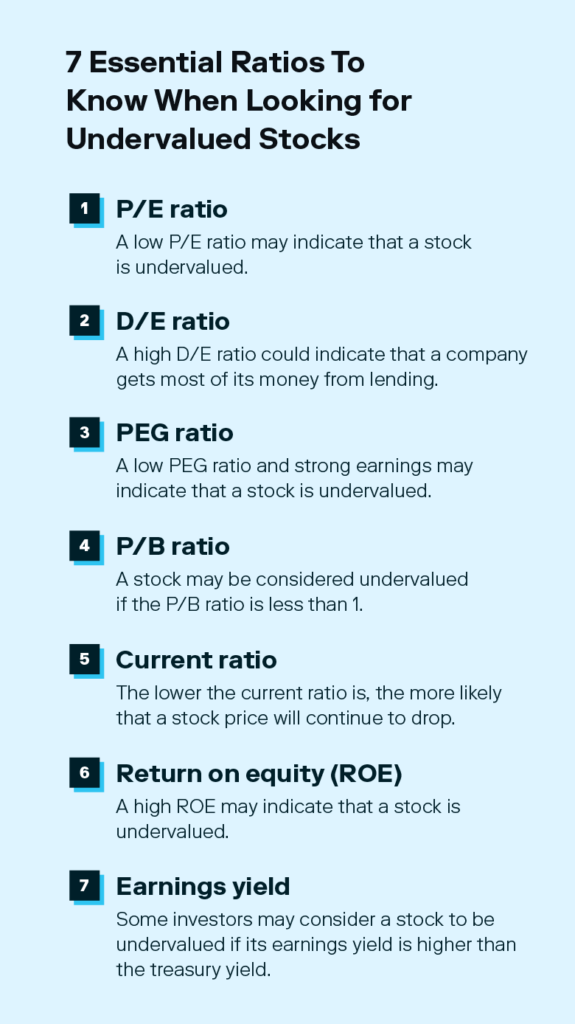

1. Look at the company’s ratios

One way to find undervalued stocks is to look at the company’s ratios. Whether you’re using a P/E ratio to find out how much you’ll spend for every dollar of earnings or calculating a company’s return on equity (ROE), these calculations are a powerful tool for providing insight into a stock’s value.

Whenever you’re on the hunt for undervalued stocks, be sure to keep these metrics in mind:

| Ratio | How To Find It | What It Can Tell You |

|---|---|---|

| P/E ratio | Price per share ÷ Earnings per share | A P/E ratio helps you calculate how much money you’d have to spend for every $1 of a company’s profits. A low P/E ratio may indicate that a stock is undervalued. |

| D/E ratio | Total debt ÷ Total shareholders’ equity | A D/E ratio helps you find out how many dollars of debt a company has for every $1 of equity. A high D/E ratio could indicate that a company gets most of its money from lending. |

| PEG ratio | P/E ratio ÷ EPS growth rate | A PEG ratio takes the P/E ratio and factors in the stock’s expected earnings growth. A low PEG ratio and strong earnings may indicate that a stock is undervalued. |

| P/B ratio | Market price per share ÷ Book value per share | The P/B ratio can help you compare the market price of the stock to its book value. A stock may be considered undervalued if the P/B ratio is less than one. |

| Current ratio | Current assets ÷ Current liabilities | The current ratio can help you determine a company’s ability to pay off its debts. The lower the current ratio is, the more likely that a stock price will continue to drop. |

| Return on equity (ROE) | Net income ÷ Shareholders’ equity | Return on equity calculates a company’s profitability against its equity. A high ROE may indicate that a stock is undervalued. |

| Earnings yield | EPS ÷ Price per share | The earnings yield is the inverse of the P/E ratio and can help you determine the percentage of a company's earnings per share. Some investors may consider a stock to be undervalued if its earnings yield is higher than the treasury yield (the interest rate the U.S. government pays when borrowing money). |

When using ratios to find undervalued stocks, it’s important to keep in mind that a “good” ratio can vary from industry to industry. Because of this, always look at similar companies’ ratios to help determine if the stock you’re looking at is an overvalued or undervalued stock.

2. Investigate the company’s market cap

Another thing you’ll want to look at when searching for undervalued stocks is the company’s market capitalization or market cap. A market cap is the total market value of a company’s outstanding shares.

You can calculate this by multiplying the total number of outstanding shares by its current stock price. For example, if a company’s stock is listed for $20 a share and they have 500,000 outstanding shares, the company’s market capitalization would be $10,000,000.

A company’s market cap can help bring added insight into a company’s profitability. Generally speaking, a company with a small market cap may be more volatile and can be seen as a growth stock, whereas companies with large market caps are often more stable. Because of this, it’s best to compare stocks with a similar market cap.

3. Analyze the company’s dividend yield and cash flow

For stocks that pay dividends, you’ll want to take a look at their dividend yield, which is a percentage that shows how much a company pays its shareholders in dividends compared to its stock price. For example, if a company’s stock price is $10 and they pay $1 in dividends per year, their dividend yield would be 10%.

If a company has a high dividend yield, it means that a lot of its profits are being used to pay dividends. This may leave the company with less cash flow to invest in growth or pay off any debts they may have.

When using the dividend yield to find undervalued companies, you’ll want to look for consistency. If a company has a history of paying a high amount of dividends—even if the share price is low—that’s often a sign that the company’s financials are strong.

4. Take a look at the company’s competitors

Focusing on the stock price of competitors is another way to evaluate whether or not a stock is undervalued. When comparing competing companies, it can be helpful to look at the stock’s moving average, which is the average stock price over a set time. That way, you can see the big picture of both the short- and long-term price changes.

During this apples-to-apples comparison, you should also consider the possibility that competing companies may not always be appropriately valued. It’s possible that you could be comparing a stock to one that’s overvalued, therefore making the other stock seem undervalued—even if it isn’t.

To avoid this, be sure to always look into multiple factors before considering a stock to be undervalued.

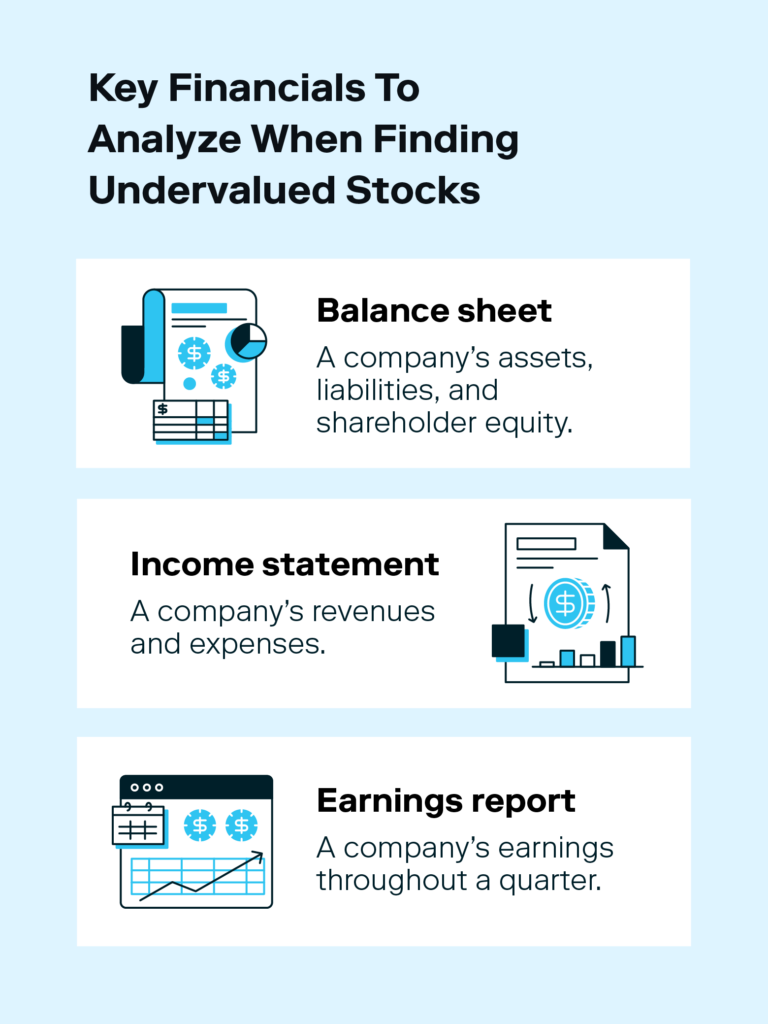

5. Check out the company’s financials

While valuable metrics like the P/E ratio and earnings yield can help uncover undervalued stocks to buy, you should also investigate the company’s financial statements to help understand the bigger picture. Examples of these statements include:

- Balance sheet: A balance sheet showcases a company’s assets, liabilities, and stockholders’ equity.

- Income statement: An income statement lists a company’s revenues and expenses during a set time.

- Earnings reports: An earnings report is a financial statement issued quarterly by companies on the stock market and can determine a company’s earnings.

Looking over these statements can help you get a sense of whether or not the company is set up for financial success. For example, if a company consistently reports positive earnings and minimal debt but hasn’t seen an increase in stock price, it could be because the stock is undervalued.

On the other hand, if a company continues to perform well and also sees a rising share price, it is less likely that the stock is undervalued.

6. Target stocks from undervalued sectors

Another helpful method for finding undervalued stocks is to look at undervalued sectors. For example, if stocks from the energy sector are seeing an overall decline in stock price, you can seek out a declining energy stock that you believe has the potential to grow over the long term.

This can be a stock that has a strong cash flow and minimal debt despite the sector-wide downturn. If you’re able to find one of these stocks, you can reap the benefits of growth once the sector rebounds.

7. Use a stock screener

If you’re looking for something that can help do some of the work for you, you may want to use a stock screener. A stock screener helps you build a list of stocks based on the criteria you provide. There are plenty of stock screening tools to choose from, from paid options like Benzinga Pro to free tools like Yahoo! Finance.

When you select your stock screener of choice, you can add filters such as market cap, stock price, sector, P/E ratio, and more. Like panning for gold, this process allows you to sift through numerous stocks until you find ones that appear to be undervalued.

From there, you can dwindle your list by further researching the stock, comparing it to its competitors, or looking at its financial statements for more context.

Another benefit of using a stock screener is that it allows you to make your own discoveries. Alternatively, relying on a list of top undervalued stocks from a published source can send thousands of other investors rushing toward the stock and cause a rise in stock price, making it no longer undervalued.

8. Explore emerging industries

In some instances, underpriced stocks aren’t just ones that have seen a price decrease but instead could be those in an emerging industry. For example, let’s consider the marijuana industry.

As legalization becomes more common across the country, investing in marijuana becomes more popular. This can be an example of an emerging industry. To help you seek out emerging industries, stay informed on any market trends or evidence that an industry is gaining popularity among investors.

Why do stocks become undervalued?

When you know how to tell if a stock is undervalued, you may begin to wonder what causes a stock to become undervalued in the first place. While the exact reason a stock is undervalued can vary on a case-by-case basis, here are some common things that can cause undervalued stocks:

- A down market: In some cases, a bear market can make a company’s stock price fall—even if they are performing well overall, leading many stocks to become undervalued.

- Change in business: If a company decides to go in a new direction or comes out with an improved product or service, it can sometimes take time for the stock’s market value to catch up.

- Seasonal trends: Some businesses may face a seasonal decline in profits, potentially leading to the stock becoming undervalued when profits are down. On the other hand, the stock price may rebound once the company’s earnings pick back up. These are also known as cyclical stocks.

- Herd mentality: Investors often react based on the overall market momentum. When things are looking good, investors will be excited to buy stocks. When things start to look bad, many investors will panic and sell, which may decrease the stock’s value.

- Lack of trendiness: Whenever a specific industry or company is trending, it can attract increased investor attention, leading stocks in less popular sectors to become undervalued.

- Bad press coverage: If a company gets caught in a scandal that leads to negative public perception, it can often tank a company’s share price, even if the company is still doing well financially.

Whether it’s due to a bear market or an unforeseen news event, it’s important to remember that factors outside of ratios and financial documents can impact the value of a stock.

Now that you know how to find undervalued stocks, you can use this knowledge to help strengthen your long-term investing strategy. And remember, building long-term wealth takes time, so the sooner you start investing, the better.

How to find undervalued stocks FAQs

Do you have more questions about how you can find undervalued stocks? We’ve got you covered.

Why are undervalued stocks popular?

Buying undervalued stocks is a popular investment because the investment may increase in value over time.

Do undervalued stocks always go up?

While an undervalued stock may seem like a guaranteed winner, there is no way to predict the value or future performance of a stock with 100% accuracy. Because of this, be sure to invest only the amount of money you’re comfortable with.

How do you find undervalued stocks like Warren Buffett?

Famed businessman and philanthropist Warren Buffett is known for his investing success and has his own criteria for selecting stocks. Examples of what Warren Buffett looks for when looking for undervalued growth stocks include:

- Clear and understandable business model

- Favorable long-term prospects

- Unique competitive advantage

- Strong earnings

- High return on equity

- Stable profit margins

- Honest leadership

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024