Jul 27, 2023

How To Buy Stocks in 5 Steps: Quick-Start Guide for Beginners

If you think you need thousands of dollars and years of investment knowledge to start buying stocks, think again—learning how to buy stocks is actually pretty simple.

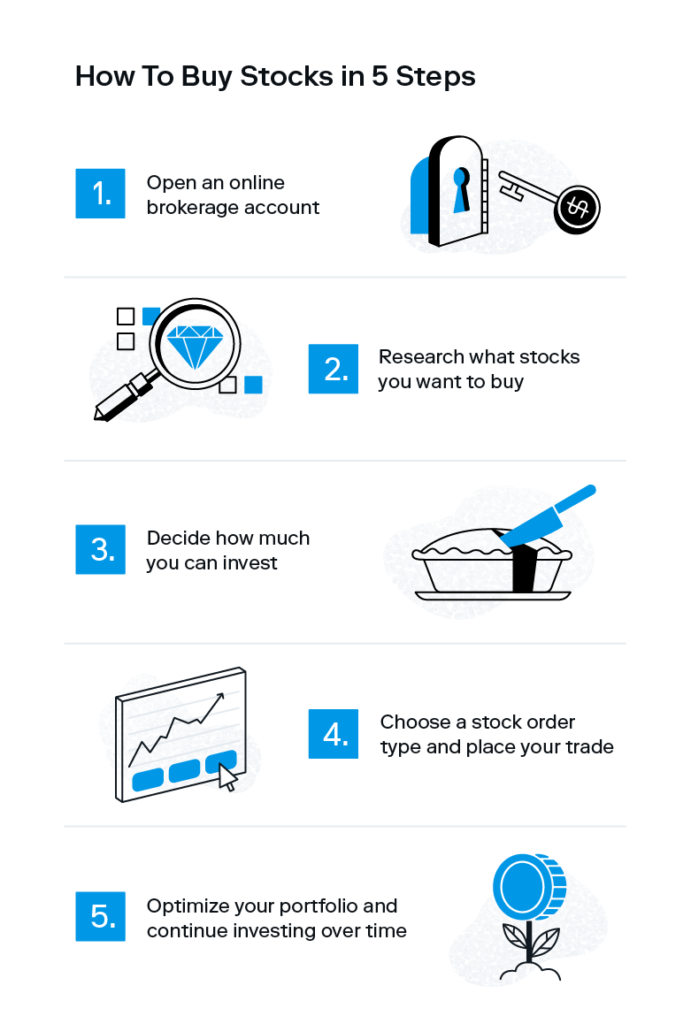

As complex as the stock market may be, even the most novice investors can start investing in stocks in a few simple steps. So, where do you begin with how to buy a stock? All it takes is five steps:

- 1. Choose an online broker

- 2. Research potential stocks to buy

- 3. Determine how much you can invest

- 4. Pick a stock order type and place your trade

- 5. Optimize your stock portfolio and build wealth over time

Now, let’s dive into how to buy stocks for beginners, shall we?

1. Choose an online broker

To get started, you might be wondering where to buy stocks. You’ll need to open an account with a brokerage, which is the firm that facilitates buying and selling of your stocks and other investments. You deposit money into your brokerage account, and your brokerage uses those funds to buy and sell stocks on your behalf.

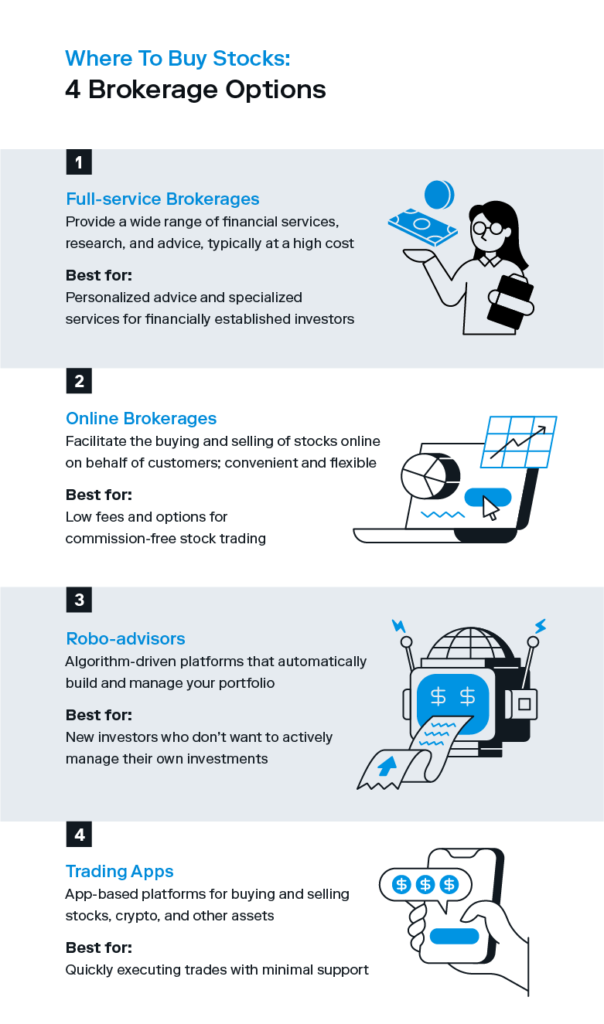

Brokerage account options run the gamut from full-service firms with professional advisors to robo-advisors and online brokerages.

Full-service brokerages

Best for: high-net worth individuals and those with limited investment knowledge

Full-service brokerage firms offer a comprehensive range of financial services, including personalized advice from professional financial advisors. These advisors work closely with clients to understand their financial goals, risk tolerance, and investment preferences. They then create tailored investment strategies and actively manage clients’ portfolios, making adjustments as needed based on market conditions and changes in financial goals.

Online brokerages

Best for: self-reliant investors seeking more control

Online brokerages are digital platforms that allow investors to buy and sell securities, including stocks, bonds, and ETFs, on their own. These platforms offer a wide range of investment options and tools to assist investors in making informed decisions. Online brokerages are perfect for investors looking for more control over their investment portfolio as well as those seeking lower fees.

Robo-advisors

Best for: new investors and passive investors

Robo-advisors are a great option for automating investing for new investors starting to build portfolios and passive investors interested in a hands-off approach. Robo-advisors are automated platforms that use algorithms and artificial intelligence to build and manage investment portfolios. These platforms rely on users’ input, such as risk tolerance, investment goals, and time horizon, to create diversified portfolios of low-cost exchange-traded funds (ETFs) or index funds.

Automated investing, simplified.

Let us invest for you with Smart Portfolio.

That said, online brokerages are a simple and convenient way to get started as a beginner investor, and you can get signed up in just a few minutes. Many come with low fees and options for commission-free stock trading, so you won’t need a ton of capital upfront.

To get started, you’ll need to submit an account application and share some basic information like proof of identification, your Social Security number, and your bank account numbers.

| Investor tip: While getting set up with an online brokerage is a simple process, keep in mind that you’ll be in charge of selecting your investments, choosing an asset allocation, and periodically rebalancing your portfolio. If you don’t feel confident making those decisions yourself, consider a robo-advisor instead. Simply fill out a questionnaire with your financial goals and preferences, and they’ll automatically build and manage your portfolio for you. |

2. Research potential stocks to buy

Once you have a funded brokerage account up and running, it’s time to decide what stocks to buy.

Buying a stock means buying a share of ownership in a company (as a reminder, a stock is a piece of ownership in a company, and those individual pieces are called shares), and the value of the shares you choose rise or fall depending on the company’s performance. Because of this, you’ll need to do some research into the potential companies you want to buy stock in. Neglecting research could expose you to unnecessary risks and may result in investing in companies that don’t align with your financial goals.

With thousands of different companies to choose from, researching stocks might seem daunting. But by paying attention to a few key metrics, you can get a grasp on the company’s performance, and in turn, the potential of your investment.

All publicly traded companies must file information about their performance each quarter with the Securities and Exchange Commission (SEC), which is packaged in a publicly available earnings report. You can find reports on any publicly listed company through the SEC’s search tool.

Once you’ve identified a company you want to research, here’s what to pay attention to:

- Revenue: a company’s revenue offers a high-level view into whether or not they’re growing. Companies whose revenue has increased over time is a positive sign of business growth.

- Net income: this is a company’s profits after subtracting things like production expenses, debt payments, and revenue taxes. A high-revenue company with a weak net income is a negative sign.

- Earnings per share (EPS): EPS is a company’s profit divided by its number of shares that are available for sale to the public, and is used to gauge how much money a company has to invest in its operations. An increasing EPS indicates positive profitability.

- Price-earnings (P/E) ratio: this is used to determine the market value of a stock compared to the company’s earnings. A high P/E ratio suggests investors are willing to pay a higher share price due to the company’s anticipated future growth. But a high P/E could also mean that a stock’s price is high relative to its earnings, and possibly overvalued.

In addition to analyzing earnings reports, also consider non-numerical information like company press releases, recent company news, and annual letters to shareholders. Together, this information will help you make a more informed prediction about how a company’s shares might perform.

Ultimately, thorough research empowers you to make sound investment choices and positions you to navigate the stock market with confidence. It allows you to make investment decisions based on data and analysis rather than emotions and speculation.

| Investor tip: If all this research feels overwhelming, you might consider buying a basket of many different stocks through an Exchange Traded Fund (ETF). ETFs are a low-cost way to own many different stocks at once, and are a great option if you don’t have the time, energy, or desire to keep tabs on individual companies. |

3. Determine how much you can invest

Determining how much you can invest depends on your financial situation and investment goals. You might start small by purchasing a single share in a company—or you can start even smaller with fractional shares, if your brokerage offers them. These let you buy a portion of a single share that may otherwise be out of your budget. For example, if a stock costs $500 per share, you could buy a one-tenth fractional share for just $50.

If you don’t yet have an emergency fund, it’s smart to build that up (aim to save at least three to six months’ worth of expenses) before investing a large sum in stocks. If you have any high-interest debt, you may also want to prioritize paying that down first.

Once you have those bases covered, you can gauge the right amount to contribute to investments—10%–15% of your income is a good starting point, but there’s no right or wrong answer. Some start by investing an affordable lump sum and incrementally adding to it each month through a dollar-cost averaging strategy. Others dedicate annual lump sums of money, like tax refunds and bonuses, to their investment fund.

| Investor tip: The best guiding principle for deciding how much to invest in stocks might be this: don’t invest any money you can’t afford to lose or might need in the near future. |

4. Pick a stock order type and place your trade

If you’re using a robo-advisor, you won’t need to worry about this step, as they’ll handle it for you. Otherwise, you’ll likely need to place the order yourself. To do so, you’ll need to specify an order type: a market order or limit order.

- Market order: a market order instructs your broker to buy the stock immediately at the current best available price. This is often the default order of choice for most investors. It ensures the order will be executed, but doesn’t guarantee a specific price.

- Limit order: limit orders allow investors to set a maximum acceptable purchase price, meaning the trade will only be executed at the specified price or better. If the stock fails to reach that specified price before the order expires, the trade is canceled.

Market orders are generally the most common choice, and are suitable for long-term investors whose main goal is ensuring the trade is fully executed rather than assessing small price differences. Limit orders offer more control over the price of your trade, and are typically favored by short-term investors looking to time their trades or buy shares with highly volatile prices.

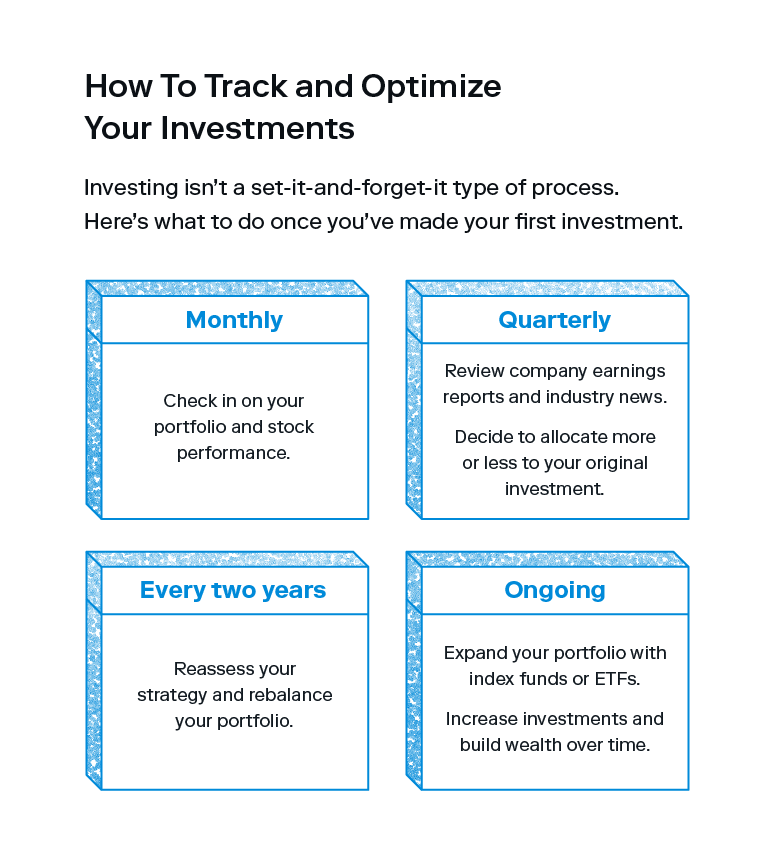

5. Optimize your stock portfolio and build wealth over time

Investing in stocks isn’t a set-it-and-forget-it type of process. Periodically check in on your investment and continue to stay aware of the company’s performance—consider setting aside time each quarter to review quarterly earnings reports and balance sheets and take stock of any relevant industry news. As you gain confidence with the process, you’ll be able to make more informed decisions about allocating more (or less) toward your original investment or deciding on additional stocks you want to buy.

Once you’re familiar with how to buy stock, keep in mind there are other investment options available to further diversify your portfolio, like index or mutual funds. A mutual fund is a basket of hundreds of stocks within a single fund that provides broader market exposure compared to a single stock, and removes the intensive research required to analyze individual stocks.

| Investor tip: Whatever investment you choose, always keep your long-term wealth goals top of mind. An excellent wealth-building strategy is dollar-cost averaging, which is periodically buying stocks or other assets using a set amount of money. |

Similar to how one might set up an auto-draft to send a portion of their income to savings each month, dollar-cost averaging invests the same dollar amount every month.

Instead of fretting over the right or wrong time to buy stocks, dollar-cost averaging allows investors to make a disciplined habit of investing on a regular basis. By doing so, you can make investing a routine that adds up in the long term, despite the presence of market volatility.

Ultimately, the best way to buy stocks is the way you’re most comfortable with, but dollar-cost averaging is also ideal for investors who are just starting out. You might not have much to invest right now, but you’re better off investing what you can consistently than putting it off until you build up your balance.

Learning how to buy and sell stocks might seem complex at first, but getting started is quite simple. Once you know the basics of researching potential stocks and have an idea of how much you want to invest, you’ll gain confidence quicker than you might think. There’s a brokerage out there for everyone, and the sooner you make your first investment, the faster your money can grow. Still trying to decide on the best investment for you? Check out our guide to cryptocurrency vs. stocks next.

Investing made easy.

Start today with any dollar amount.

FAQs about how to buy stocks

Buying stocks for beginners can be intimidating. Find answers to any lingering questions you have about how to buy stocks below.

How can I buy stocks online without a broker?

You don’t have to work directly with an actual broker to buy stocks online—online brokerages can do that for you. While you don’t need a hired broker, you do need a brokerage, which is simply the firm that administers the buying and selling of stocks. You can also find companies that offer a direct stock purchase plan, although it’s less common.

How much money do I need to buy stocks?

Technically, there’s no minimum amount required to buy stocks. Many online brokerages allow you to start investing with no account minimums or transaction fees, so the amount you’d need to buy stocks could be as low as a $10 single share.

Is now a good time to buy stocks?

For long-term investors, the best time to buy stocks is as soon as possible—regardless of the current state of the market. A passive buy-and-hold strategy has historically provided greater returns over time than any short-term strategy, and a longer time horizon gives you more time to make up for any short-term losses.

Are stocks and shares the same thing?

While stocks and shares are often used interchangeably and many people think they refer to the same thing, they’re technically different. Stocks represent pieces of ownership in one or more companies, while shares more specifically represent pieces of ownership in one particular company.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024