Jan 24, 2023

Stash vs. Acorns: A Comparison Guide for 2023

Stash vs. Acorns: Bottom Line

| Stash caters to new investors who want to build long-term wealth and may be best for investors who want to choose their own individual stock and ETF investments. Acorns completely automates investing, which appeals to investors who want a truly simplified set-it-and-forget-it investing approach. |

If you’re ready to start investing but unsure where to begin, Stash and Acorns are two popular platforms in the world of investing apps. Both are suitable choices if you’re dipping your toes into investing for the first time, but how do they compare?

Both Stash and Acorns let you invest in stocks, exchange-traded funds (ETFs), and fractional shares, and you can start investing on either platform with just $5. They have a similar monthly fee structure, and each basic plan starts at $3 per month.

One of the biggest differences between Stash and Acorns may be the level of flexibility you have over your portfolio investments. Given that investing with Acorns is completely automated—their portfolios are preset and tailored to your age and risk tolerance—Acorns tends to appeal to those who want a more hands-off investing experience. If you want both personalized support in building your portfolio and the freedom to choose your own investments, Stash may be the best fit for you.

So, is Stash better than Acorns, or is Acorns better than Stash? The answer depends on what you’re looking for. Here’s what to know about Acorns vs. Stash.

How Stash works

Best for:

- New investors who want to learn about, manage and grow wealth over time

- Investors who want personalized portfolio recommendations

- Investors who want more control over their investments

Stash is a holistic investing and personal finance app that aims to help beginner investors build wealth. Our focus is taking the guesswork out of choosing investments by providing education on investing regularly, thinking long-term, and diversification.

We offer a variety of tools for investing, banking1, and saving for retirement and cater to new investors seeking support with long-term financial goals.

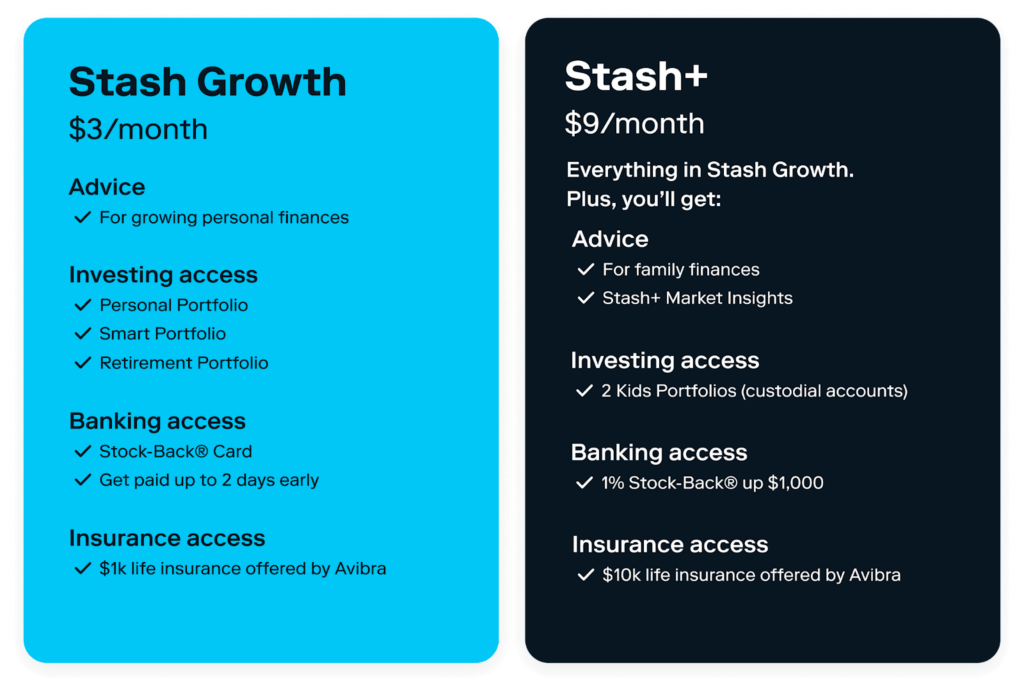

As a subscription-based platform, we offer two monthly plans costing between $3 and $9. Every Stash plan comes with personalized advice and ongoing financial education, along with the option for an automated, managed portfolio based on your unique goals and risk tolerance.

Even if you don’t use the managed portfolio, Stash offers an array of investments to choose from yourself. This includes thousands of ETFs and stocks, cryptocurrency investing with eight coins available, and fractional shares, which is a helpful option if you want to start investing but don’t have a ton of funds to invest upfront.

While Stash is primarily an investment app, we go beyond investing with services like mobile banking that features debit card reward options and early direct deposit2, as well as custodial and retirement accounts.

Top features:

- Recurring Transactions for regular, automated investing

- Portfolio diversification analysis tool helps keep your portfolio balanced and aligned with your goals

- Stock-Back debit card lets you earn up to 3% back in stock rewards on all purchases3

| Pros | Cons |

|---|---|

| Automated investing option for brokerage account | No automated investing for IRAs |

| Banking perks like Stock-Back debit rewards and Round-Ups | Not ideal for short-term and day traders—only 4 trading windows per day |

| Ability to choose your own stocks or ETFs | No SEP IRA offer if a small business |

| Fractional shares available for as little as $0.01 |

How Acorns works

Best for:

- New investors looking for a simple, hands-off way to start investing

- Building better saving habits

- Earning cash-back rewards

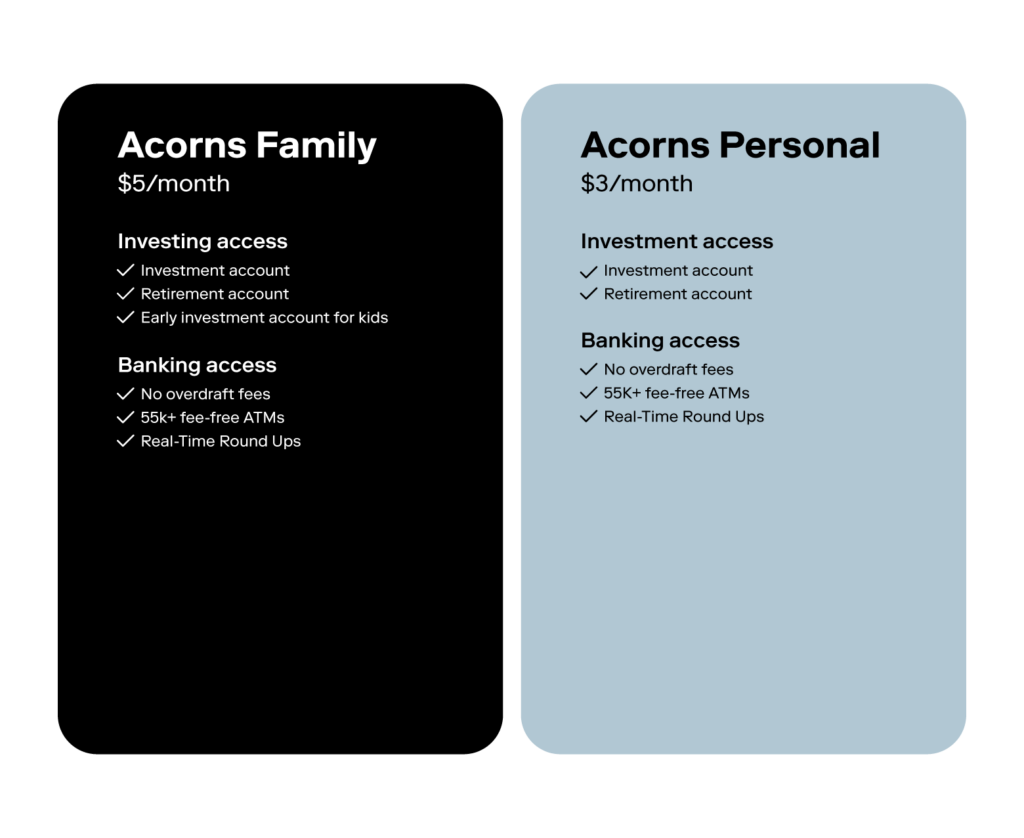

Acorns offers the following two service tiers:

- Personal ($3/month): Includes an individual brokerage account, IRA (Roth, Traditional, or SEP), and checking account

- Family ($5/month): Includes all of the above, as well as an unlimited number of custodial accounts for kids

The only difference between the Personal plan and Family plan is the Family plan includes Acorns Early, which gives access to custodial accounts for kids. If you don’t yet have children and just want a personal investment account, retirement account, and banking perks, Acorns Personal is likely the best fit for you.

If you open an investing brokerage account with Acorns, you’ll be able to invest with one of five pre-set portfolios containing low-cost ETFs. Each portfolio is adjusted based on different risk tolerances based on information about your age, time horizon, and goals, which you specify in a questionnaire upon opening your account.

Investing with Acorns also allows you to allot up to 5% of your portfolio to a Bitcoin-linked ETF, which may appeal to investors interested in cryptocurrency exposure (although the expense ratio is rather high at 0.95%).

Acorns also offers sustainable portfolios made up of Environmental, Social, and Governance (ESG) funds, giving users access to investments that meet these three categories of ESG criteria. That said, there is no conservative portfolio option available if you opt for an ESG portfolio.

The Acorns Personal checking account also offers a slew of banking and savings perks, such as their Round-Ups feature that rounds up purchases to the nearest dollar and invests it automatically in your investment account. Checking account access comes with both Acorns Personal and Acorns Family and includes a debit card, mobile check deposits, direct deposit.

Top features:

- Round-Ups to round up purchases made with a linked bank account to the nearest dollar and deposit it into your investment account

- Acorns Earn earns you bonus investments when you shop with associated brands

- Acorns Later offers automated retirement account investing

| Pros | Cons |

|---|---|

| Reasonable fund expenses | Unable to choose individual stocks or adjust portfolio funds |

| Automatically invests spare change | High fees on small account balances |

| Automated retirement investing with Acorns Later | Limited portfolio customization |

Stash vs. Acorns: 5 factors to consider

Choosing between Stash vs. Acorns boils down to what features matter most to you in an investing app. For a thorough comparison, we weighed both across five important factors to consider when deciding between Stash or Acorns.

Stash vs. Acorns: Accounts supported

| Stash | Acorns |

|---|---|

| DIY brokerage account and an automated brokerage account (Smart Portfolio) | Individual brokerage account (automated) |

| Retirement accounts (Traditional and Roth IRAs) | Retirement accounts (Traditional, Roth, and SEP-IRAs) |

| Custodial accounts for kids (with Stash+ plan) | Custodial accounts for kids (with Acorns Family plan) |

| Personal banking account | Personal banking account |

Stash and Acorns both offer individual brokerage accounts, retirement accounts, custodial accounts, and a personal banking account that comes with a debit card. However, the biggest difference between the two lies in the structure of their investment portfolios.

For investors seeking support building their portfolio from scratch, Stash offers Smart Portfolio, a robo-advisor built by Stash and Stash’s Smart Investment Team who have experience executing successful trade strategies for users. If you prefer a more DIY approach to building your portfolio, you can select your own individual stocks and ETFs.

On the other hand, Acorns takes a more hands-off approach to investment portfolios. Contrary to Stash, you won’t be able to choose the specific investments in your portfolio. Instead, Acorns assigns you one of five preset portfolios based on data like age, income, time horizon, and goals. The portfolios are adjusted to different risk tolerances ranging from conservative to aggressive.

While you can accept or reject your portfolio assignment in favor of one with more or less risk, you can’t change or select the specific funds in your portfolio. This could be an advantage or a disadvantage depending on how experienced you are with investing.

For brand-new investors who aren’t comfortable making investment selections, a preset portfolio might be more appealing. On the other hand, worth considering is that as you grow and gain confidence as an investor, Acorns’ pre-set portfolios leave little room to grow if you eventually want to try your hand at choosing your own investments.

Stash vs. Acorns: Fees

| Stash | Acorns | |

|---|---|---|

| Account minimum | $0 to open an account ($5 to start investing with Smart Portfolios) | $0 to open an account ($5 minimum to start investing) |

| Account management fees | $3-$9/month depending on plan | $3-$5/month depending on plan |

| Trading and commission fees | $0 | $0 |

| Account transfer fees | $75 for full transfer to another broker $0 for standard transfers (or 1% fee for instant transfers) | $50 per ETF to transfer to another broker $0 to sell your assets and transfer the cash |

| Annual fees | None | None |

Both Stash and Acorns use a subscription-based fee structure with two tiers of plans to choose from. Acorns’ plans go for $3 per month and $5 per month, while Stash’s plans go for $3 and $9 per month.

Stash’s $3/month plan, Stash Growth, includes financial advice, a taxable investing account and automated taxable investing account through Smart Portfolio, a retirement portfolio (Roth or traditional IRA), an online banking account and Stock-Back debit card,1 and $1,000 in life insurance.4

For $9 per month, Stash+ includes everything Stash Growth offers, as well as family financial planning advice, market insights, two custodial accounts, a Stock-Back debit card that earns more in rewards (up to 3% back),3 and $10,000 in life insurance.4

As for Acorns’ $3/month plan, Acorns Personal, users get access to a taxable automated investing account, a checking account, and a retirement account (Roth or traditional IRA, or SEP for small businesses). Their second-tier Acorns Family plan for $5 per month, includes the option of custodial accounts for children in addition to everything Acorns Personal includes.

While Stash and Acorns have similar account management fees, the same isn’t true about their transfer fees—that is, the cost to transfer your investments to another brokerage if you ever decide to do so. Stash has a one-time full transfer fee of $75 if you want to move your investments elsewhere, similar to what most companies charge. By contrast, Acorns charges $50 per ETF, which could add up fast.

Stash vs. Acorns: Services and features

| Investment Types | Stash | Acorns |

|---|---|---|

| Stocks |  |  (not individual) (not individual) |

| Fractional shares |  |  |

| ETFs |  |  |

| Cryptocurrencies |  |  (Bitcoin-linked ETF only, capped at 5% of your investments) (Bitcoin-linked ETF only, capped at 5% of your investments) |

| Bonds |  |  |

| REITs |  |  |

| IRAs |  (Roth and traditional) (Roth and traditional) |  (Roth, traditional or SEP) (Roth, traditional or SEP) |

| Custodial accounts |  |  |

| Options | ✘ | ✘ |

| Socially responsible investing |  |  |

Both Stash and Acorns offer taxable brokerage accounts for investing. With Stash, you can pick individual stocks and ETFs, but only those listed on the Stash platform. You’ll find many big company names to choose from if you’re after specific individual stocks.

If you just want to put some money into a basic, low-cost index fund ETF like Vanguard Total VTI, you can do that as well. It’s easy to browse investment options on Stash, where you can filter stocks by sector and ETFs by category.

Acorns portfolios consist of ETFs that cover four to six asset classes, including small to large company stocks, international company stocks, bonds, and real estate assets in the form of REITs. Unlike Stash, you can’t choose individual stocks or other investments. Acorns also has a sustainable portfolio containing ESG-approved ETFs, as well as the option to invest in a Bitcoin-linked ETF (up to 5% of investments).

If you want preselected investments, you may favor the preset ETF portfolios offered by Acorns. If you’d rather have the option of control and flexibility in specific investments, Stash could be the better option.

Beyond these broad portfolio differences, many of the differences between Stash vs. Acorns come down to the features they offer. Here’s an overview of Stash’s features:

- Smart Portfolios for a managed, automated portfolio with automatic rebalancing

- Automatic portfolio rebalancing: Automatic rebalancing once a year; Stash also reviews your portfolio quarterly to see if it needs to be rebalanced

- Socially responsible investing (SRI) options that let you invest in companies that align with your values

- Stock Round-Ups 5 automatically rounds up debit card purchases to the nearest dollar and invests the spare change in your Stash account

- Fractional shares at any amount (as little as $0.01)

- StockParties where users can claim bonus stock at party.stash.com weekly

- Stock-Back rewards debit card rewards you with fractional shares of stock every time you spend with your debit card1

- Recurring Transactions automatically transfers money to your investment accounts

- Banking perks like instant transfers, early direct deposit (up to two days),2 mobile check deposits, and no overdraft fees6

In comparison, here’s an overview of Acorns’ features:

- Automated investing tool allows you to automate recurring investments

- Automatic portfolio rebalancing is free on all accounts

- Automatic dividend reinvesting automatically reinvests any dividends

- Sustainable ESG portfolios let you invest in companies rated for their impact on environment, social, and governance issues

- Round-Ups round up your spare change from purchases and deposits it into your investment account

- Acorns Earn earns you bonus investments when you shop with 350 retailer partners

- Acorns Later offers automated retirement account investing

- Banking perks like mobile check deposits, no minimum balance or overdraft fees, access to 55,000 fee-free ATMs, and early direct deposit (up to two days)

Both Stash and Acorns offer an array of automation tools to help users consistently save and invest. They share many mobile banking perks like roundups, cash- or stock-back rewards, and automatic savings tools, and both Stash and Acorns banking accounts are FDIC insured. They also both offer socially responsible investing options. Only Stash offers fractional shares, which you can purchase at any amount (as low as $0.01).

Stash vs. Acorns: Mobile experience

| Stash | Acorns | |

|---|---|---|

| iOS (iPhone) app store rating: | 4.7 (out of 5) | 4.7 (out of 5) |

| Google Play rating: | 3.9 | 4.6 |

The Stash and Acorns mobile apps are available for both iOS and Android devices. While you can also access each via desktop, both platforms feature mobile-first functionality. In comparing the Stash app vs. Acorns’ app, we found the main dashboards are fairly similar across both platforms.

Stash’s main dashboard has two different sections—one for investing and one for banking—giving an at-a-glance view of your accounts and current balances, rewards activity, and your next milestone according to the goals you specify when creating an account.

The invest section displays the combined value of your personal and retirement portfolios, but you’ll also find the current balances broken out for each portfolio right below. The dashboard also has a quick-navigation button for Recurring Transactions (formerly known as Auto-Stash), where you can adjust your automatic investments and view how much you’ve earned in Round-Ups.

Similarly, Acorns’ main dashboard also has different sections—invest, later and spend—giving a quick view of your investment, retirement, and checking accounts and balances. If you have a custodial account, you’ll see a section for this on your main dashboard as well.

One helpful feature of the Acorns app is the three quick-navigation buttons perched at the top of the main dashboard—Round-Ups, One-Time, and Withdraw. This allows you to seamlessly make a one-time investment deposit, initiate a withdrawal, or see how much you’ve saved in Round-Ups.

Overall, both apps are similar in form and function and offer a simple and intuitive mobile experience that even the most novice investors can confidently navigate.

Stash vs. Acorns: Customer Support

| Stash | Acorns | |

|---|---|---|

| Phone support: | Yes (8:30 a.m.–6:30 p.m EST) | Yes (daily, 5 a.m.–7 p.m. PT) |

| Email support: | Yes | Yes |

| Chatbot support: | Yes | Yes |

| Support via social media: | Yes | Yes |

| Personalized portfolio advice: | Yes | No |

Stash offers live human support via phone and email. You can also find answers and information on their FAQ page, or through their chatbot functionality for broader questions. Users can also submit questions on the FAQ page if it hasn’t already been covered.

As for Acorns, customer support is available seven days a week between 5 a.m. and 7 p.m. PT via phone and email. You can also contact support via chat, which is available 24 hours a day, seven days a week. Additionally, users can visit the Acorns Help Center to find answers to common questions.

Choosing between Stash or Acorns comes down to your preferred investing approach. Stash may be best for beginner investors who want to learn how to invest and build investing confidence through ‘learning by doing’. With both automated investment accounts as well as DIY investment accounts, the platform grows with the investor as they progress in their investing journey.

Acorns offers many of the same features as Stash, but aims to simplify the investing process for beginners with preset portfolios. If you’d rather delegate your investments to someone else, Acorns may be the best choice for you.

Still can’t decide? Here’s a high-level look at Stash vs. Acorns.

Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. Investing involves risk and investments may lose value.

Stash has full authority to manage a “Smart Portfolio,” a discretionary managed account. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in their account. Crypto is relatively new and can be volatile. Investments are Delaware Statutory Trusts and offer indirect exposure to Crypto.

Cryptocurrency trading and execution services are provided by Apex Crypto LLC (NMLS ID 1828849) through a software license agreement between Apex Crypto LLC and Stash Financial, Inc. Apex Crypto is not a registered broker-dealer or a member of SIPC or FINRA and is licensed to engage in virtual currency business activity by the New York State Department. Cryptocurrencies are not securities and are not FDIC or SIPC insured. Advisory products and services are offered through Stash Investments LLC, an SEC registered investment adviser. Cryptocurrency is a highly volatile investment; please ensure that you fully understand the risks involved before trading crypto. Visit apexcrypto.com/legal. If you are a resident of New York State, your ability to purchase one or more digital coins may be limited by Apex Crypto. Nothing in this material should be construed as a recommendation to buy or sell a particular digital asset.

Ancillary fees charged by Stash and/or its custodian are not included in the subscription fee.

1 Stash Banking services provided by Stride Bank, N.A., Member FDIC. The Stash Stock-Back® Debit Mastercard® is issued by Stride Bank pursuant to license from Mastercard International. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Any earned stock rewards will be held in your Stash Invest account. Investment products and services provided by Stash Investments LLC, not Stride Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. In order for a user to be eligible for a Stash banking account, they must also have opened a taxable brokerage account on Stash.

All rewards earned through use of the Stash Stock-Back® Debit Mastercard® will be fulfilled by Stash Investments LLC and are subject to Terms and Conditions. You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash. In order to earn stock in the program, the Stash Stock-Back® Debit Mastercard must be used to make a qualifying purchase. Stock rewards that are paid to participating customers via the Stash Stock Back program, are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. What doesn’t count: Cash withdrawals, money orders, prepaid cards, and P2P payment. If you make a qualifying purchase at a merchant that is not publicly traded or otherwise available on Stash, you will receive a stock reward in an ETF or other investment of your choice from a list of companies available on Stash. See Terms and Conditions for more details.

2 Early access to direct deposit funds depends on when the payor sends the payment file. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

3 Limitations apply; 3% Stock-Back rewards available only for qualified bonus merchants on Stash+.

4 Group life insurance coverage provided through Avibra, Inc. Stash is a paid partner of Avibra. Only individuals who opened Stash accounts after 11/6/20, aged 18-54 and who are residents of one of the 50 U.S. states or DC are eligible for group life insurance coverage, subject to availability. Individuals with certain pre-existing medical conditions may not be eligible for the full coverage above, but may instead receive less coverage. All insurance products are subject to state availability, issue limitations and contractual terms and conditions, any of which may change at any time and without notice. Please see Terms and Conditions for full details. Stash may receive compensation from business partners in connection with certain promotions in which Stash refers clients to such partners for the purchase of non-investment consumer products or services. Clients are, however, not required to purchase the products and services Stash promotes.

5 This Program is subject to terms and conditions. In order to participate, a user must comply with all eligibility requirements and make a qualifying purchase with their Stock-Back® Card. All funds used for this Program will be taken from your Stash Banking account.

6 For a complete list of fees please see the Deposit Account Agreement for details.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024