Mar 3, 2021

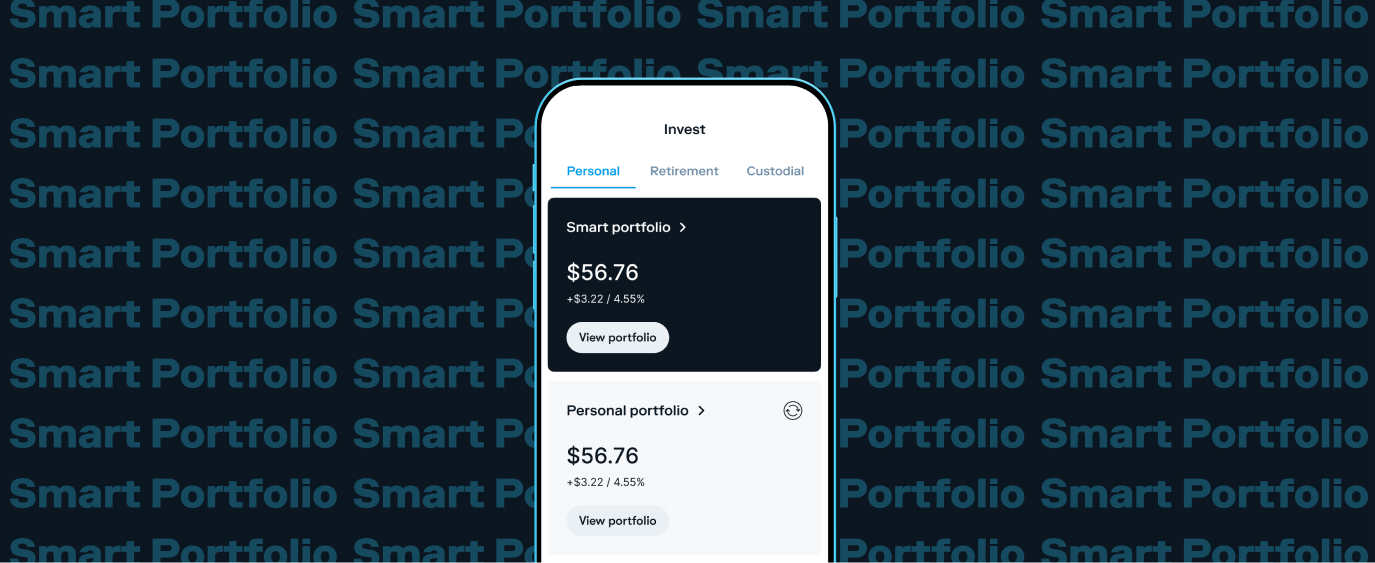

Smart Portfolios: Investing Made Even Easier!

Stay diversified and invested according to your risk profile.

Investing can seem complicated at times, especially when it comes to building your first portfolio and figuring out how to properly diversify your investments. Diversification means not loading up too much on one type of investment, or in too few sectors, and it can be critical to weathering market volatility and achieving your long-term financial goals.

A diversified portfolio will hold a variety of investments that are not all subject to the same market risks, including stocks, bonds, and cash, as well as ETFs. It’s also important to invest in different markets globally, not just in the United States.

With that in mind, Stash is excited to launch something called Smart Portfolios, a new type of account that can help take the guesswork out of building a diversified portfolio. Here’s how it works. A Smart Portfolio1 is a personalized portfolio that Stash’s Investment Team of financial experts has created for you based on your risk profile. Stash actively monitors and manages the account for you, and rebalances when necessary. (We’ll explain more about rebalancing later.) All you have to do is put money—a minimum of $5— into the account, and Stash does the rest.

What’s a risk profile?

When you signed up for Stash, we asked you a few questions about your investment style, and financial circumstances. We used this information to place you into one of three risk profiles–conservative, moderate, and aggressive. The information you provided also helps us calculate your risk tolerance and investment time horizon.

Here’s what that means:

- Conservative risk profile investors prefer stability, even if that means smaller gains—but may still want some growth potential for their portfolio. These investors might have more bonds in their portfolios than aggressive or even moderate investors. They may need their money sooner rather than later and cannot endure additional risks.

- Moderate risk profile investors are looking to build stable portfolios, but may also have the capacity to take on a little more risk in exchange for potentially higher long-term growth. Their portfolios might be balanced between bonds and equities, or stocks.

- Aggressive risk profile investors may be looking to maximize the long-term growth potential of their portfolio, even if that means sacrificing some stability and incurring greater risk.These investors have the ability to own more stocks in their portfolios than bonds. They probably will not need their money for a while, meaning they have a longer time horizon.

We’ll use these risk profiles to create a diversified mix of exchange-traded funds (ETFs) for you, calculating the correct allocation based investing risk level, which can act as guardrails for your investing.

What’s in a Smart Portfolio?

Stash’s Investment Team believes that a well-diversified portfolio should consist of a mix of stocks and bonds. Within stocks, you can invest in different regions such as the U.S., developed economies such as Western Europe, and emerging markets like China. Similarly, you can invest in different types of bonds, such as corporate bonds, which are issued by companies, or U.S. Treasuries, issued by the federal government. You want to consider spreading your investments across various asset types, because different assets will respond differently to different market conditions, potentially reducing volatility in your portfolio.

With that in mind, the Investment Team has picked the following ETFs, with low expense ratios, that represent each of these categories.

The funds represent a diversified group of stocks in the U.S. and internationally, as well as bonds. While the three risk profiles will be invested in the same funds, how much money goes into each fund will vary based on the allocation that was initially recommended for you.

Here’s what that means. Let’s say you are assigned to the aggressive risk profile. Our Smart Portfolios may place a greater percentage of your money in stocks versus bonds. Whereas if you have a conservative risk profile, a greater percentage of your money might be placed in bonds. Stash’s Investment Team will help make sure your portfolio stays diversified according to your risk profile as your investments grow and as markets change.

Smart Portfolios and the Stash Way

Smart Portfolios also align with the Stash Way, our investing philosophy, which includes investing regularly, thinking long term, and diversification. With Smart Portfolios, you can invest regularly without having to make decisions about where your money should go. Smart Portfolios can also free you from the worry of short-term volatility by making sure you stick to your long-term financial goals.

Diversification and rebalancing

From time to time, we will rebalance your Smart Portfolio. Rebalancing can help you stay properly diversified, and it can ensure you are exposed to the appropriate amount of risk.

Stash designed each Smart Portfolio with a different target allocation of investment categories based on an investor’s risk profile. Based on how the underlying investments move over time, it’s possible an investor’s actual portfolio allocation may drift away from its target. In that case, the portfolio may need to be rebalanced by selling some investments that are overweight and buying others that are underweight in order to get back on track.

Here’s a hypothetical example. Let’s say that based on an investor’s risk profile, his or her portfolio has a target of 80% stocks and 20% bonds. For example, let’s say you invest $100 in this portfolio—$80 in stocks and $20 in bonds. Now imagine that the stock market declines, but bond prices go up. As a result, the investor’s portfolio would look a little different. Maybe the investor’s stock portion shrinks to 75% and the bond portion grows to 25%. In other words, you’d have $75 in stocks, and $25 in bonds. The investor’s portfolio has “drifted away” from its target. In order to get it back on track, the portfolio would need to be rebalanced. By selling some of the bond position and buying more stocks, the investor’s portfolio can be reset to the target allocation.In this case, the portfolio would sell $5 worth of bonds and purchase $5 of stocks to get back on track.

The good news is that Smart Portfolios automatically rebalance. Stash takes care of all of the hard-work. Stash sets the targets and regularly monitors market moves. If a Smart Portfolio account drifts too far away from its target goal, Stash will automatically sell some of the positions that have grown too fast and buy more of the positions that may have decreased in value. Rebalancing will occur when a portfolio increases or decreases by 5% or more from its target in a quarter. Stash will reset all portfolios by rebalancing at the end of the year.

Dividend reinvestment

Stash believes in investing regularly in order to increase your growth potential. Reinvesting dividends is an easy way to do this. Instead of receiving dividends in cash, we will reinvest in additional shares of your Smart Portfolio investments.

Withdrawals and deposits

Stash will automatically invest your deposits in your Smart Portfolio. Your deposits will be invested in securities that are underweight, or have decreased in value, in an effort to bring you closer to the target allocation appropriate for your risk profile. Similarly, if you need to withdraw money, Stash will manage this in an efficient way, trimming your overweight positions to raise cash.

With market movement, the weight of your portfolio holdings will deviate over time. The way we deposit and withdraw your money within your investments allows us to “buy low and sell high,” and presents us with the opportunity to realign your portfolio to the appropriate risk outside of a rebalance period.

More about Smart Portfolio Investing

Any customer who subscribes to the Stash Growth and Stash+ tiers is eligible for a Smart Portfolio account. It is included in your growth and premium tier subscriptions. There are no additional subscription fees. Customers may add or withdraw money to and from their Smart Portfolio accounts to and from their external bank account, but they will not be able to trade individual stocks from these accounts.

Good to know: All investing involves risk, and you can lose money on your investments. While no one can predict the future, diversifying your portfolio with Smart Portfolio can help protect you against the uncertainty of the market, and can help you reduce your risk. Smart Portfolio investing is a resource for you to help achieve your financial goals.

Open a Smart Portfolio*

Sign UpOpen a Smart Portfolio*

Sign UpOpen a Smart Portfolio*

Sign Up*Please note that Smart Portfolio is only available in the mobile app.

This type of account is a Discretionary Managed Account. This is an individual taxable brokerage account that Stash has full authority to manage according to a specific investment mandate. The investment team at Stash built these portfolios with the goal of optimizing risk-adjusted returns. This is achieved by utilizing the diversification benefits highlighted by modern portfolio theory. The portfolios consist of well diversified ETFs that provide clients with broad exposure to the stocks of companies of all sizes across all industries and geographies and bonds of various issuers. The portfolios aim to optimize returns given a user’s overall risk profile. Stash will automatically manage a Client’s portfolio based on an algorithm that evaluates the Client’s risk profile and selects appropriate investments for the client. Stash does not guarantee any level of performance or that any client will avoid losses in the Client’s Stash Account(s). Any investment in securities involves the possibility of financial loss.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024