Nov 9, 2018

Over 40? Here’s How to Start Planning For Retirement

Better late than never: Here’s how to get started planning for retirement at 40.

Age may be just a number. But so is the balance of your retirement account—and that’s a number that can really count as you head into the home stretch of your career.

If you’re 25 and thinking about retirement, then you’re ahead of the curve. If you’re 30, you’re still in the game, but probably aware that you need to start thinking about your post-career life.

But what if you’re 40 or older? If you’ve never given any serious thought to retirement planning, or it’s just dawning on you that you should’ve been stashing money away for the past decade or two, you might feel a twinge of panic.

While you shouldn’t panic, you’re natural fight-or-flight instinct could be steering you in the right direction. It’s time to take action.

Retirement planning at 40: Take stock of your situation

Your first move should be to examine your whole financial picture. That means taking a hard look at what you’re earning, and what you’re spending money on. And then building a budget with one goal in mind: maximize your retirement savings.

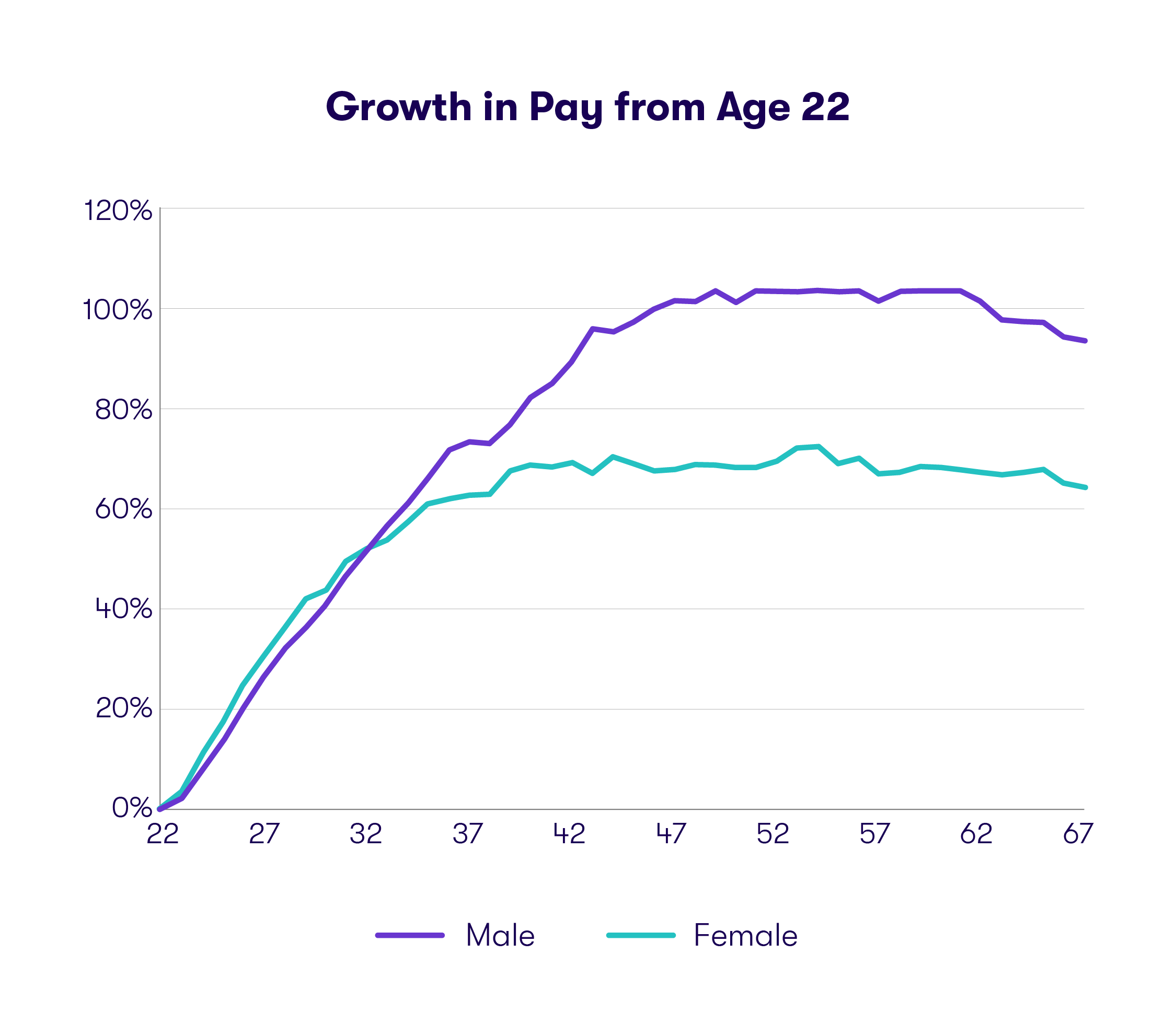

If you’re over 40, you may need to contend with some variables that younger people do not, such as kids, mortgages, and car payments. But on a positive note, you’re at an age where you’re at or near your maximum lifetime earning potential—so, hopefully, your paychecks are bigger than they were in your twenties or thirties.

Open up a retirement account

Your budget tells you how much you can save for retirement. The next step should be to start stashing those savings away in a retirement account.

First, though, build an emergency, or rainy day fund, if you don’t have one. This fund should comprise between three or six months’ worth of expenses, and be easily accessible (kept in a savings account, for example). Once you have an emergency fund as a financial buffer, you can take aim at your retirement goals.

The two main types of accounts are 401(k)s and Individual Retirement Accounts, or IRAs.

Read more: The differences between an IRA and a 401(k)

A 401(k) is usually provided through an employer and can have an employer-match benefit, whereas anyone can open an IRA at a bank or other financial institution. If you’re under 50, you can contribute up to $18,500 pre-taxed income into a 401(k) before penalties apply, and once you hit 50, up to $24,500.

For IRAs, the contribution limit is $6,000 (and $7,000 after 50). You can have both accounts at the same time, too, and it may be beneficial to open a Roth IRA or 401(k), which can offer more advantages, depending on your situation.

One key here is to figure out how much you can contribute to these accounts on an annual basis, and to get as close as you can to the contribution limit as possible.

Your retirement checklist

- Open up a traditional or Roth IRA, and a 401(k) if possible. They’re tax-advantaged accounts that can help you save for retirement.

- Max out your contributions. Again, if you’re under 50, the contribution limits are $19,000 in you 401(k) and $6,000 in an IRA annually.

- Reconsider your retirement plans. You may need to push back your expected retirement date if you’re in your 40s and are just getting started.

Want to learn more about what you expect to have saved by retirement? Check out our retirement calculator.

Get Stash Retire

If you’re in your 40s, it’s not too late start planning for your retirement.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Roth vs. Traditional IRA: Which Is Best for You in 2024?

How To Plan for Retirement

Why It Can Pay to File Your Taxes Early