Jun 18, 2019

Change Your Financial Life With These 6 Steps

A one-stop shop for financial wellness.

- Start good money habits by automating your savings with Recurring Transactions or recurring transfers to your debit account.

- Get a bank account with zero monthly, maintenance or overdraft fees1.

- Jumpstart saving for your future with Stash Retire.

- Protect your loved ones.

- Open a custodial account for a child you love.

- Safeguard your home, whether you rent or own.

Item #1. Automate your savings

We have the best intentions when it comes to putting money aside for the future. We promise ourselves we’re going to put money aside every week. But often, we don’t.

Automation can make saving easier. Recurring Transactions puts it into action for your investments. It’s part of The Stash Way.

You can also now schedule recurring transfers into your debit account! You choose the amount of money to transfer into your Stash debit account and the frequency.

By automating sums of money into your savings or investments, on a regular basis, you’re reinforcing good money habits.

Item #2. Get rid of hidden banking fees

A dollar here, $20 there—these bank fees can really add up. In 2016, for example, consumers were charged $34 billion in overdraft fees—and that’s just one of many kinds of fees many banks charge.

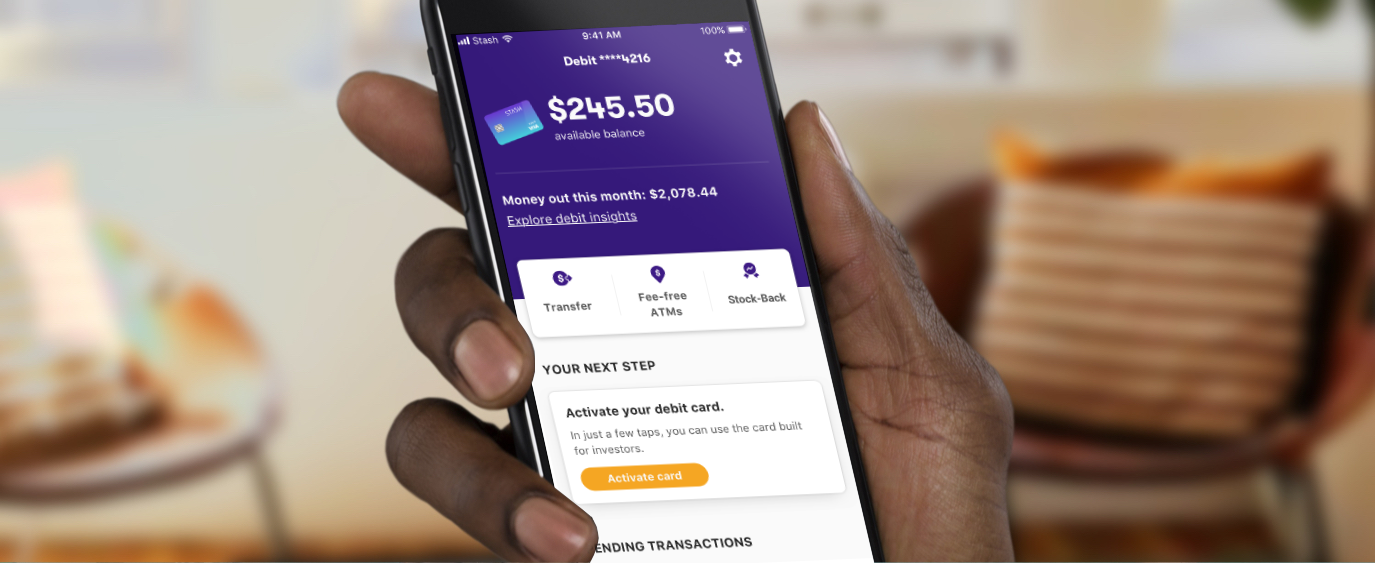

Stash debit doesn’t cost you anything to set up, there are no minimum balance requirements, and we won’t charge you any monthly or annual fees to maintain the account1.

Item #3. Start saving for retirement

There’s a wonderful life to be led after you stop working. You don’t need a lot of money now to start saving for retirement. Worried you don’t have enough money (or that you’re too young to get started)? Trust us, the best time to start is today.

Consider your retirement savings are a love letter full of cash for when you need it most.

Item #4. Protect your family

We get it. Buying life insurance seems like a really adult decision. But a long-term life insurance policy can provide a financial safety net for partner or kids. in case of your unexpected passing.

It can help your family pay the bills, outstanding student loans, medical debt, or other outstanding expenses. It could be the most important decision you make for your family.

Item #5. Give a child you love a financial head start

Send a child you love into the world with money in their pockets and a solid financial education.

With a custodial account, you can start contributing to it when they’re young–and teach them all about investing along the way. Once they’re over 18 (or 21 in some states), they can use it for college, a down payment for a home or they can take it over and keep contributing to it.

Item #6. Protect your stuff

Good news for homeowners and renters: It doesn’t cost a lot of money to protect your stuff. You can insure all your valuables in case disaster strikes (think fire, busted pipe, or burglary). It can even pay for a hotel if you have to be out of your apartment or home for a while.

1Other fees may apply

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Budgeting for Young Adults: 19 Money Saving Tips for 2024