Jan 11, 2019

Believing These Retirement Myths Might Leave You in a Lot of Trouble

These retirement tall tales can leave you in a world of hurt.

Flying saucers, the Boogie Man and the Tooth Fairy are myths that aren’t necessarily going to wreck your financial life. Unless, of course, you sink all of your savings into becoming a professional “Squatcher.”

There are, however, some myths that can have a real, tangible effect on your life. Especially financial myths, including those related to investing, the stock market, or even the Federal Reserve.

But perhaps the most dangerous myths involve retirement—a longstanding but false belief about retirement, for example, can leave you financially crippled just as you’re getting ready to leave the workforce.

Here are some common retirement myths that could lead you down a path to financial ruin.

Myth: Retirement happens at a certain age.

Wrong. Retirement is a financial state, not an age.

While you will qualify for Social Security benefits at age 62, those payouts likely won’t be enough to live on. (The average monthly check, as of late 2018, was approximately $1,300.)

That’s why you won’t necessarily be able to stop working in your 60s—you’ll need enough money to supplement any benefits you do receive in order to cover your expenses without a paycheck.

Worth noting: 10% of respondents to a recent Stash retirement survey say they’ll never be able to retire.

Myth: Life is less expensive as a retiree.

You may think that life is cheaper when you retire. You’re not spending money commuting to work, for example, and you’ll be able to take advantage of all those senior discounts!

While some things may be less expensive, you’re likely going to be spending more on things like health care.

Industry data shows that the average couple should plan to spend $280,000 or more throughout the course of your retirement on health care after they retire. Even if you eat strictly from Denny’s 55+ discount menu, you might find it difficult to offset those kinds of costs.

Myth: Medicare will cover all of your health care expenses.

Of course, you may be thinking that Medicare will cover your health-care expenses. It won’t, unfortunately, which is why you’ll need to have enough money squirreled away to supplement Uncle Sam’s health care plan—for someone age 65, out-of-pocket expenses tend to be around $4,500 every year.

It’s also important to remember that Medicare isn’t completely free. The plan is divided into four parts, which cover different medical services, and some of these have individual monthly premiums.

While the actual costs will vary from person to person, health care, as a whole, is getting more and more expensive. So, you may need more money than you anticipate to cover those costs years from now.

Myth: You can count on Social Security.

You can depend on Social Security, right?

Maybe. The Social Security trust fund could run out of money—as soon as 2026, according to some estimates. That means that, at some point, government officials will have to make some tough decisions, otherwise, tens of millions of people could lose their benefits.

While the inevitable fight to fund so-called entitlement programs lies ahead, you should also be concerned that any benefits you do receive will be enough to cover your bills.

Myth: “I’m too young to worry about retirement.”

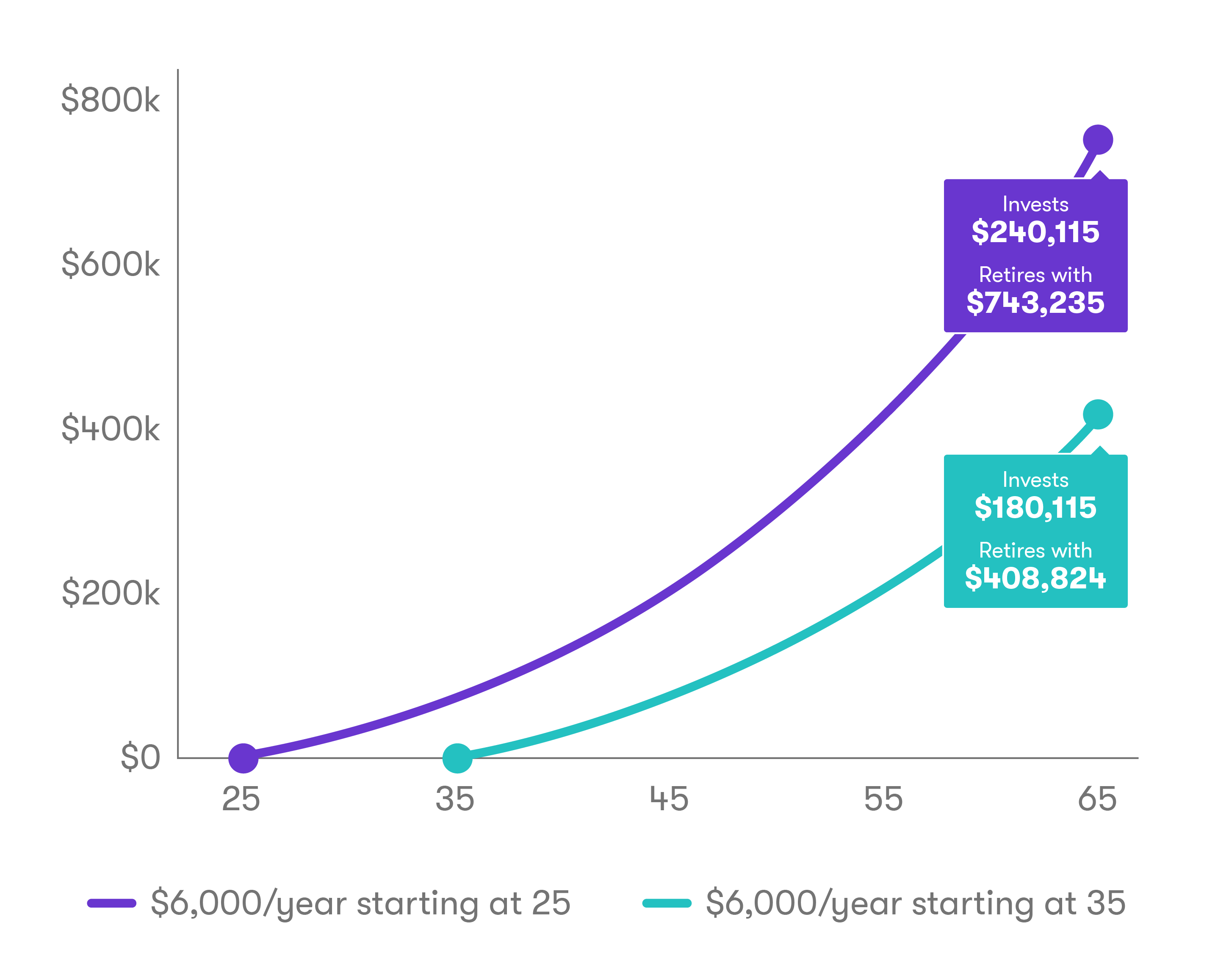

You’re never too young to start thinking about retirement. Remember, you don’t necessarily retire once you hit a certain age—you retire when it’s financially feasible. And the sooner you start planning and saving, the sooner you’ll hopefully be able to stop working.

Start saving for a long retirement today, rather than putting it off.

You can sign up for an IRA using Stash.

Disclosures:

1: The survey of 2,167 adult consumers, was conducted online by SurveyMonkey in November 2018. Of those surveyed, 47% (1022) identified themselves as male, 53% (1145) identified themselves as female. Seventy percent reported earning less than $75,000 annually.

2: This is a hypothetical illustration of mathematical principles, is not a prediction or projection of performance of an investment or investment strategy, and assumes weekly contributions at an annual rate of a 5% return (compounded annually) and does not account for fees or taxes. It is for illustrative purposes only and is not indicative of any actual investment. Actual return and principal value may be more or less than the original investment.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Roth vs. Traditional IRA: Which Is Best for You in 2024?

How To Plan for Retirement

Credit Cards vs. Debit Cards: The Differences Can Add Up