Jun 20, 2017

Most Americans Are Really, Really Bad at Saving for Retirement

Think saving for retirement is tough? Take heart, you’re not alone.

Think saving for retirement is tough? You’re not alone.

It requires work. You have to take dollars you earn today–and could easily spend today–and put them away, perhaps for many decades in the future.

Those dollars will support you once you’ve stopped working and are no longer earning an income.

Unfortunately, consumers in the U.S. don’t really do a very good job of saving. In fact, there’s a retirement savings crisis in the U.S., according to the Economic Policy Institute, a policy think tank, which released a report in 2016 on the retirement situation in the U.S.

How much should you be saving for retirement?

But it’s confusing figuring out how much you’ll actually need, especially because estimates vary widely among financial experts.

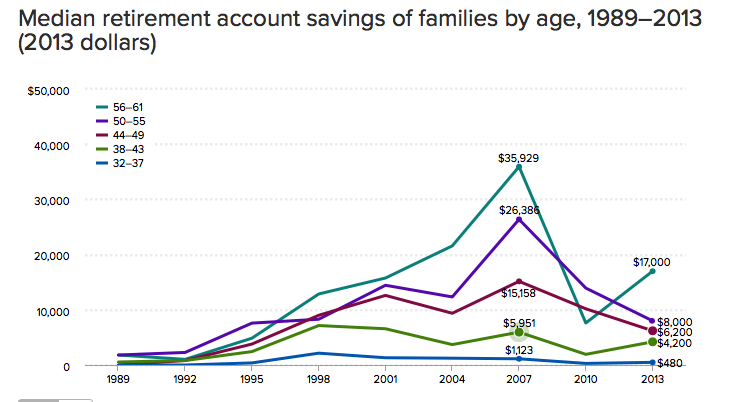

Here’s what the report found:

On average, all working age families, defined as those between 32 and 61 years old, have saved $95,776.

Average retirement savings

By age, here’s a look at average family savings:

56-61: $163,577

50-55: $124,831

44-49: $81,347

38-43: $67,270

32-37: $31,644

The problem with an average is that people with higher incomes and savings rates tend to skew totals upward, the EPI says.

Median retirement savings:

The truth might be closer to the median amounts saved. A median is an exact middle, meaning the number represents the place where half had higher amounts, and half had lower amounts saved.

Here’s what those numbers look like:

56-61: $17,000

50-55: $8,000

44-49: $6,200

38-43: $4,200

32-37: $480

Get serious about saving for retirement

As a rule of thumb, most financial advisors recommend saving enough to replace 70% to 80% of your income in retirement.

That formula is somewhat debatable, as what you’ll need after you’ve finished working differs from person to person. (For many people, expenses could be significantly lower after retirement than at working age.)

The general rule would say that if you earn $100,000 currently, you should have about $1.8 million saved by retirement age, assuming standard yearly withdrawals of 4% annually.

Don’t panic

It’s okay if your savings more closely resemble the far lower amounts of average and median savers above.

While you may not need to make up 70% of your income, you probably need to get serious about putting money away. If you can, try to put 15% to 20% of your pre-tax income annually, financial experts say.

Take advantage of tax-favored accounts. If you have access to a 401(k), you can put up to $19,000 away annually.

An IRA will let you put $6,000 away, with catch-up amounts up to $7,000. Contributions to Traditional IRA accounts will lower your taxable income, whereas contributions to Roth IRA accounts are not tax deductible, however in both account types, earnings will grow tax-free until retirement.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Roth vs. Traditional IRA: Which Is Best for You in 2024?

How To Plan for Retirement

Why It Can Pay to File Your Taxes Early