Nov 6, 2018

How to Be a (Financially Independent) Single Woman

Depend on yourself, and create a financial plan

If you’re a lady in the US of A, you may have grown up with some contradictory messages about personal finance.

Think of Belle from Disney’s Beauty and the Beast.

She’s a heroine because of her independent mind, her great work ethic, her intellectual curiosity, and her strong personality.

But she only really ends up rich and happy in a magical castle because she developed a codependent relationship with her weirdo kidnapper. Great lesson, right?

Women get dumb lessons about money

Countless popular books, films, and TV shows still carry the same basic message for women: Work hard, get an education, look flawlessly beautiful at all times, and a rich husband will find you and take care of the electric bill (or provide a dancing, talking candlestick to light your gigantic home).

But how realistic is that? Um, not very.

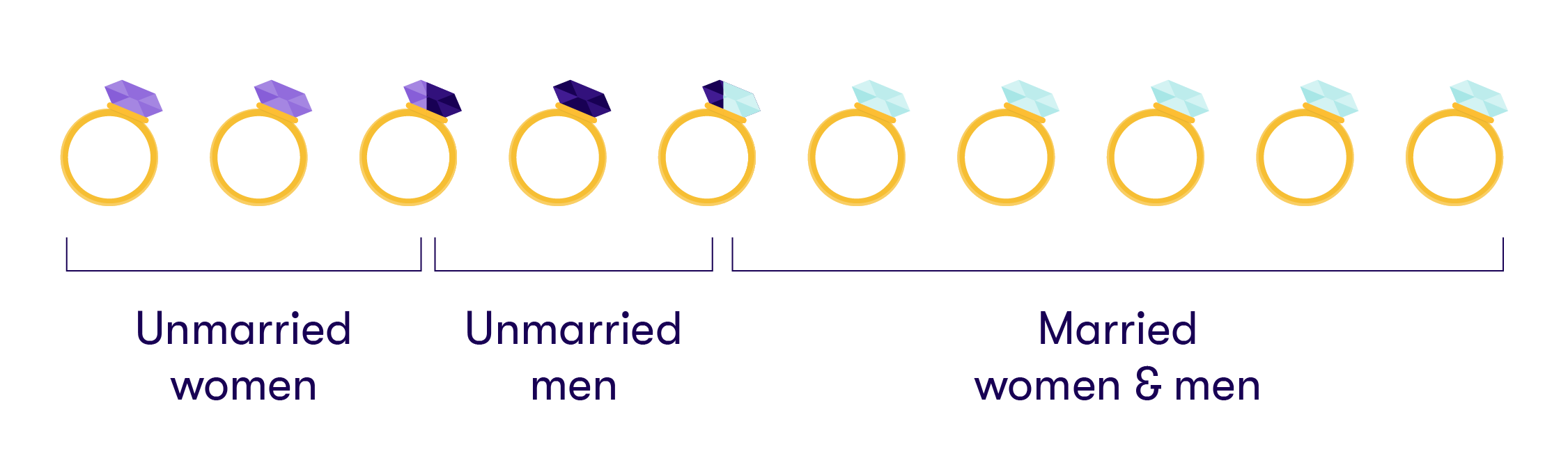

There were 110 million unmarried people in America age 18 and older in 2016, according to the most recent data from the U.S. Census Bureau. That accounted for 45.2% of all U.S. residents over the age of 18. And of that number, 53.2% were women.

So if you’re a single lady, you’re in good company. And chances are you’ve got to pay your own damn bills.

Women have to fight harder

It’s commonly accepted that boys should fend for themselves financially. It’s a sign of conventional contemporary masculinity to be “financially independent” as a man. We don’t always teach girls the same lesson. They may not know how hard they’ll have to fight for equal pay when they enter the workplace.

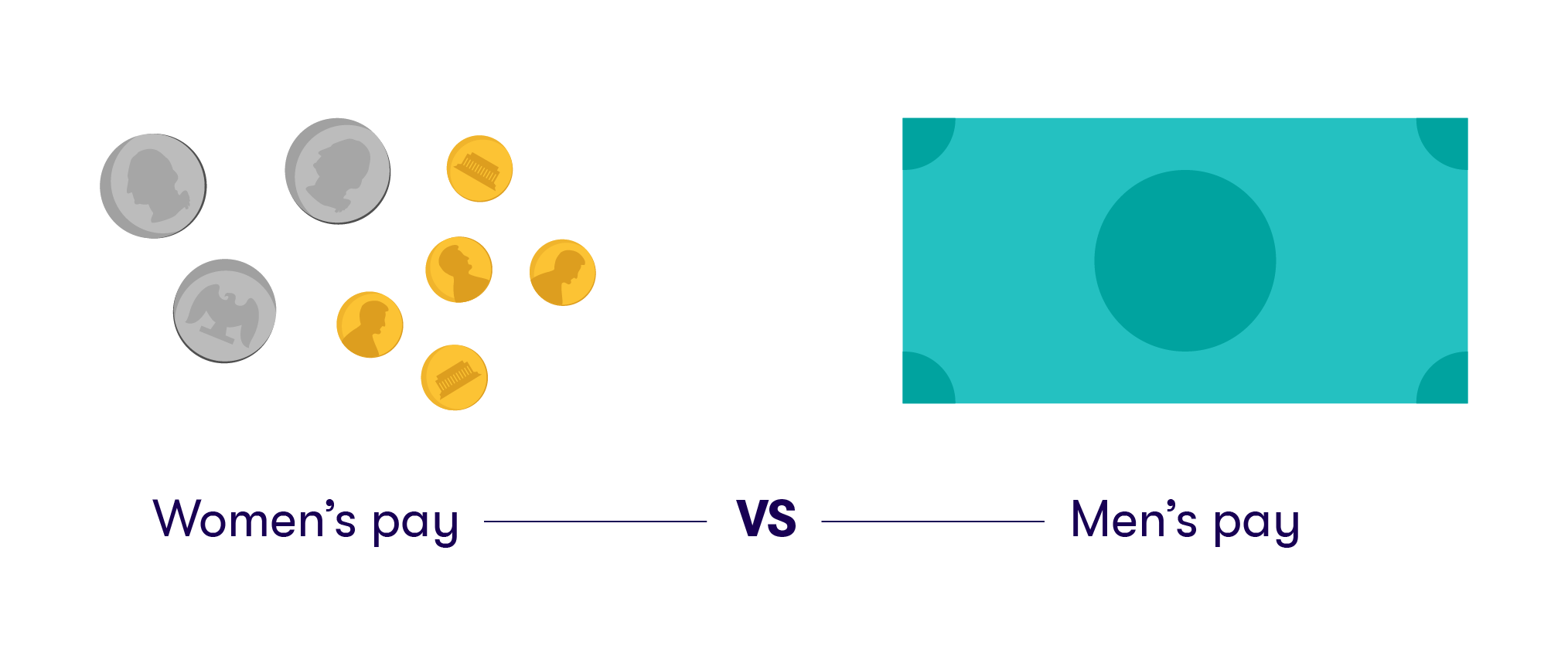

This is a big deal when many businesses certainly don’t value women’s work on par with men’s work. According to U.S. Census Bureau data, on average, an American woman earns 80.5 cents for every dollar a man earns. Women’s median annual earnings are $10,086 less than men’s.

The gulf grows much wider when we look at salaries for women of color versus white men. And while many women (and a few good male allies) advocate for change, we’ve also got to be extra invested in our own financial future.

Be your own Princess Charming

Now, I’m not saying you won’t marry a rich man (or extremely, fabulously wealthy person of any gender!) I’m just saying you shouldn’t depend on it.

Having your own income and savings will hopefully help you feel stronger, more confident, and less dependent when you do get into a serious relationship.

Maybe you aren’t making enchanted Disney prince (or princess) money, but you can start dealing with your actual financial reality right here and now, regardless of your dreams for the future or your regrets about the past.

All the single ladies (can achieve financial independence)

Here are a few easy tips that can help you get going on your badass single lady financial plan.

Open a retirement account and make regular contributions

The positive effect of compound interest is real and it’s powerful. You can set up a Roth or traditional IRA on your own—I did when I was a full-time freelancer.

But some companies provide a 401(k) and will match your contribution up to a certain dollar amount (usually 4%). Let’s say you get a regular paycheck, and you choose to contribute 10% of each paycheck to your 401(k), pre-tax. The company will match 4% of your contribution. They’re giving you free money! That’s great!

You won’t be able to tap into that fund until you hit a certain age, at least not unless you want to incur very high penalties, taxes, and fees. But it’s your superpowered future-cool-old-lady savings account. Have somebody in HR walk you through the different options, or use the online tools they’ll probably give you

And make sure that, in the unlikely event that you shuffle off this mortal coil early, your 401(k) is earmarked for a loved one.

Envision your ideal financial future

Here’s a set of questions to get your imagination going. We’re going to work backwards, which may feel a little odd, but will hopefully jog your brain in a good way.

- Where do you hope to be at the very end of your days? Let’s imagine you are fortunate enough to have a long and healthy life. When you’re elderly, do you expect to want to live in the fanciest of eldercare facilities? Do you want to spend your final days in a home that you own? (In that case, you’ll likely need full-time in-home health aides at some point—keep contributing to that 401(k)!) I know this is a wild thing to consider, and it may seem unnecessary at your young age, but there’s no harm in imagining it for a moment.

- Let’s look at your life when you’re retirement age—say, 65. You may very well live into your nineties or beyond, so retiring at 65 means you may have a few decades left to enjoy! Are you the type of person who loves to travel? You’ll probably still enjoy it at your advanced age, and have more time to do it. There’s no way of knowing if you’ll have kids or grandkids, but we can be fairly certain you won’t want to be a financial burden on them. The choices you make now can help ensure your independence in later age.

- And now let’s envision your life ten years from now. Where do you hope to live then? Do you want to own a home? What would that home look like? Where might it be? Every time you start to think, “Well, I’m sure my husband can help share expenses,” stop yourself. You may very well be right! But since we’re thinking about single lady finances, reframe the question. “How can I put myself in the best position to be able to afford my happiest, healthiest lifestyle in ten years?”

- Now let’s look at the next year. What are some things you might realistically be able to accomplish in the next year? Making a move to a town you truly love? Finding a better apartment in the city where you live? Adopting a dog and providing for its care? Maybe your goals are simply: “Paying every bill in full on time, and paying more than the minimum on my credit cards each month.” That’s great!

Check out your answers to the above questions. Walk away from them for a week and return to them. Edit and revise as necessary. Then maybe purchase a helpful book, or even seek out a certified financial planner (CFP), a person trained in the fine art of helping adults get their money right. Many CFPs deal with estate planning, investing, and more. They usually don’t get into the nitty-gritty of day-to-day budgeting.

Read a good book on personal finance

Or more than one good book! Try one of these: Suze Orman’s “Young, Fabulous and Broke;” Allen Carr’s “Get Out Of Debt Now”; Anna Newell Jones’s “The Spender’s Guide to Debt-Free Living”; or something that just happens to appeal to you in the bookstore. Set aside, donate, or sell the books that don’t jibe with your sensibility. Read and re-read the ones that do!

It took me until my mid-thirties to start getting on top of this, but whether you’re younger or older, it’s the right time to begin!

So don’t avoid looking at reality like I did for many years—start taking small, sensible steps now to save and provide for your own health and happiness.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Budgeting for Young Adults: 19 Money Saving Tips for 2024