Jun 29, 2018

How To Declare Financial Independence

Money doesn’t have to be your ball and chain.

America’s path to independence was long and arduous and included stomping redcoats into the muck. In the spirit of those early Americans, you, too, can declare financial independence.

We’re talking about financial independence.

Though establishing a sense of personal financial independence is different from engaging in a military campaign, they both require the same aggressive attitude. Specifically, that you refuse to let an outside force control, intimidate, or bully you—be it a wig-wearing British monarch or your bank account.

Case in point: Many people are afraid to even look at their checking account balances. They’re scared to sit down and take a hard look at their finances, as it may require some abrupt and painful lifestyle changes.

But those changes are necessary if you want to tackle financial independence.

Get real about money

The first step, then, is to make an honest assessment of your financial situation. No more hiding from your bank statement and bills. No more praying that your next debit card swipe goes through.

The first step toward gaining financial independence is to identify the key issues that you, on an individual level, experience with money. It may be simply that you earn too little–or none at all. In that case, you may want to focus your energy on getting a second job, or a better-paying one than you have.

For others, it’s that they don’t know how much they’re spending, or what they’re spending money on. Look at your bank statements. Track every penny. Identify your financial weaknesses, and then put in some guardrails to keep you on track.

How to gain financial independence

While the path to financial independence is potentially long and winding and likely to include some double-backs, there are a few financial footholds that will keep you from straying too far off the trail:

Build a budget–Sit down and put together a spending plan. And stick to it. You can consider using this one as a model. Read more about how to make a budget.

Establish an emergency fund—If you think you don’t need one, you’re wrong. Stash recommends socking away six months of necessary expenses in case of emergency. Download Stash and turn on Smart-Save to start saving automatically.

Deal with your debt—Start by paying off your highest interest rate first–whether it’s that nagging credit card balance, student loan, car loan, or other debt. Learn more about handling your debt here.

Start investing—There are ways you can start putting money away for the long-term. Stash allows you to get started with as little as $5. Learn more about Stash invest.

Open a retirement account—You’ll be looking entering your retirement years before you know it. Start planning for that now, so you can live the life you want when you’ll no longer be working. Social Security probably won’t be enough to cover your expenses. Consider funding your 401(k), if you have access to one at work. If not, consider setting up an individual retirement account (IRA). Get Stash Retire here.

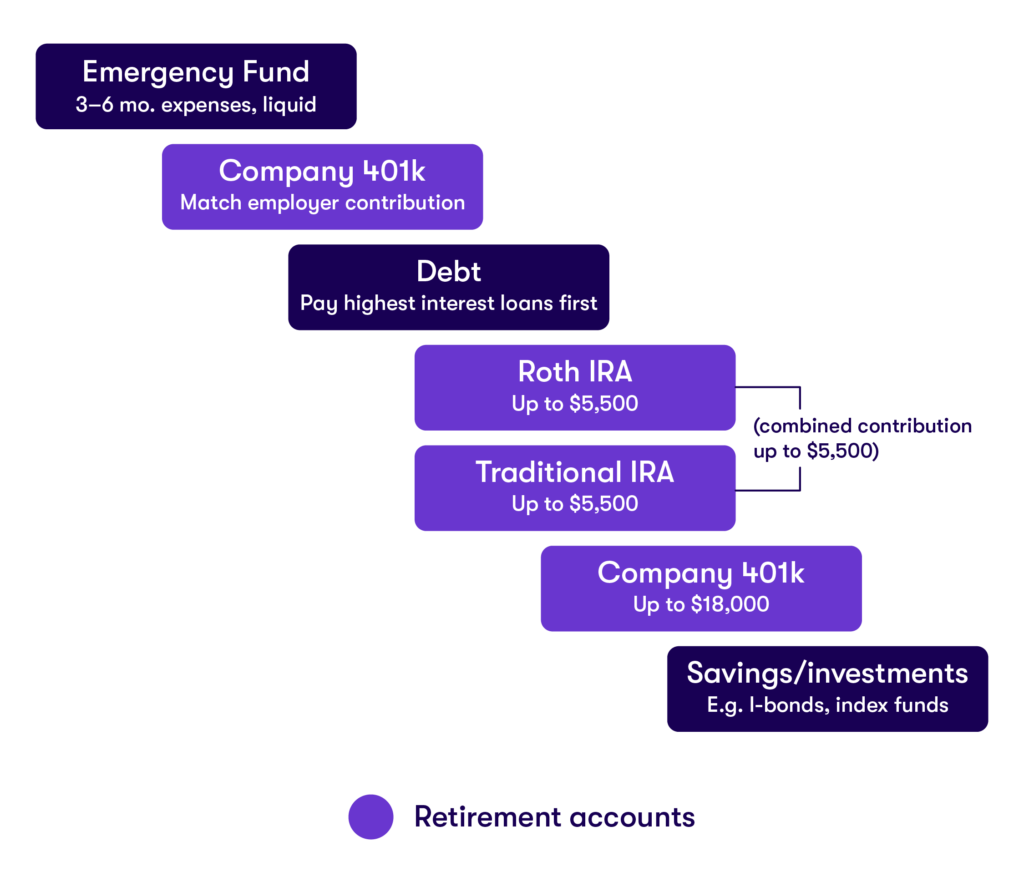

We’ve broken down some saving strategies in the following chart:

You’re not going to become financially independent overnight, so prepare to save for the long haul. In fact, building wealth will require sacrifice, and you’re likely to stray from the path at some point.

It’s all about your attitude. It may be unsatisfying in the short term as you refuse to give in to your purchasing impulses. But if your goal is financial independence, the delayed gratification should pay off in spades.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024