Jan 29, 2023

How to Invest $1000: 7 Smart Ways to Grow $1K in 2023

Contrary to popular belief, you don’t need a ton of money to start investing or to see significant returns—you just need to invest regularly. If you’ve found yourself with an extra $1,000 to spare, why not invest it somewhere that can make your money work for you?

There are many low-cost investment options that can help you maximize your lump sum—and help it grow. The specific investment you choose will depend on your time horizon, goals, and risk tolerance. That said, the following ideas are great starting points if you’re wondering where to invest $1000:

- Deal with debt

- Invest in Low-Cost ETFs

- Invest in stocks with fractional shares

- Build a portfolio with a robo-advisor

- Contribute to a 401(k)

- Contribute to a Roth IRA

- Invest in your future self

Read along to learn the best ways to invest $1,000 in 2023.

1. Deal with debt

Best for: Those with high-interest debt or loans

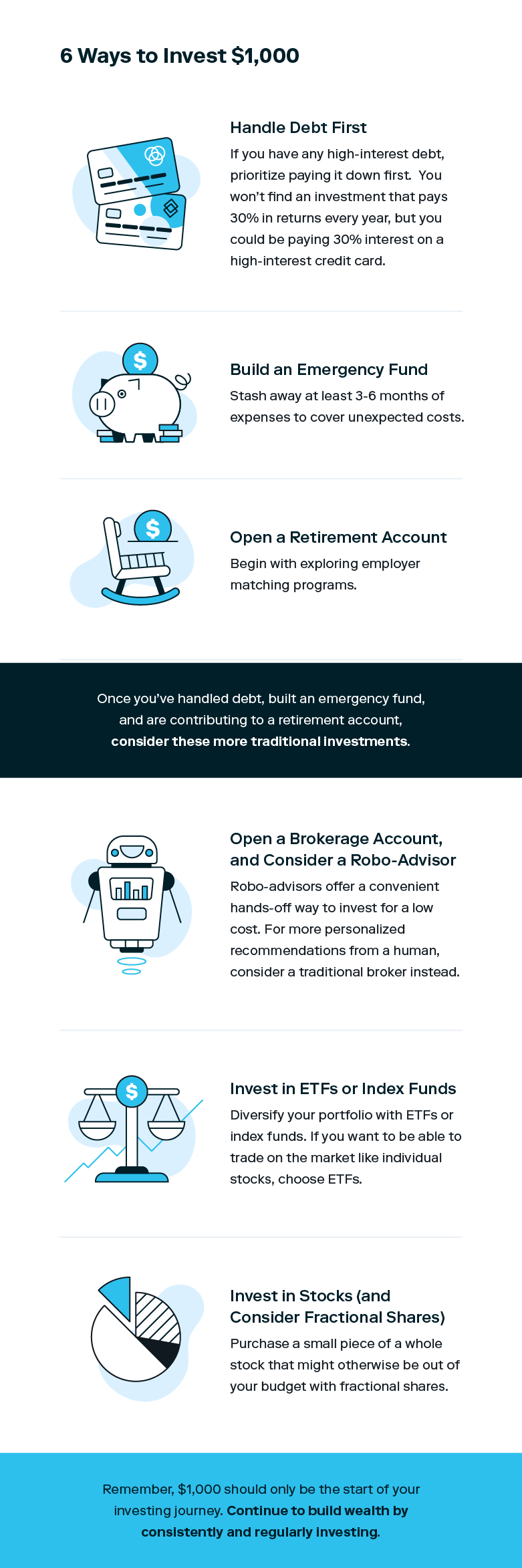

The least-glamorous but necessary answer to “how should I invest $1,000” should almost always be to handle any debt you’re carrying.

Consider this—you might not ever find an investment that pays 30% in returns every year, but you could be paying 30% interest on a high-interest credit card. High-interest fees will plummet you further into debt at a rapid speed, eating away at your ability to save, invest, and build wealth.

While dealing with debt may not be the most glamorous $1,000 investment, it’s something that will move you closer to financial security and freedom. Your debt may be far more than what $1,000 can cover, but chipping away at it little by little should be the top priority if you want to build long-term wealth.

| Investor tip: If you don’t have any debt (congratulations!) but haven’t yet built up an emergency fund, prioritize building one. When the inevitable unexpected expense arises, whether it’s replacing a car engine or an unforeseen medical emergency, an emergency fund can give you peace of mind—and prevent you from having to use a credit card to cover the costs. |

2. Invest in Low-Cost ETFs

Best for: First-time investors

If it’s your first time investing, you may want to invest $1000 in an exchange-traded fund (ETF). A beginner-friendly alternative to traditional mutual funds, ETFs contain a mix of stocks, bonds, and other securities, giving you access to a broad range of asset classes within a single fund.

ETFs offer an inexpensive way to instantly diversify your portfolio across a variety of investments, and many come with low (or no) investment fees, making them an affordable pick. Be sure to read up on the ETF you’re considering, so you’re aware of its holdings, expense ratio, and fees.

| Pros | Cons |

|---|---|

| Lower fees if passively managed | Fees can be higher for actively managed ETFs |

| Built-in diversification | Diversity not guaranteed if ETF is concentrated in a single segment or asset class |

| More flexible than mutual funds—Intraday trading allowed (trades on the market during the day like stocks or bonds) | May have lower dividend yields |

| Investor tip: Whichever assets you choose, it’s usually wise to protect your portfolio with a diverse investment strategy. A single investment in an ETF can provide diversification and the flexibility you need to stay defensive as your portfolio grows. |

3. Invest in stocks with fractional shares

Best for: Diversifying your portfolio for a small amount of money

Instead of investing 1000 dollars in stocks that you pick individually, consider fractional shares instead. Fractional shares let you purchase a small piece of a whole stock that might otherwise be out of your budget—for example, if you’re eyeing a stock that costs $2,000, you could purchase a fractional share of that stock for, say, $100.

Not only do fractional shares make investing in big-name company stocks (like Apple, Amazon, or Microsoft) more accessible, but they also allow you to spread your investment dollars across a wider variety of securities—creating more opportunities to diversify your portfolio, even if you’re starting small.

To invest in fractional shares, simply find a brokerage firm that offers them (not all do) and purchase them like you would any other security, like whole shares of stocks, mutual funds, or ETFs.

| Pros | Cons |

|---|---|

| Start investing with an amount that fits your budget | Limits on when, how, and what you can sell |

| Get access to more expensive stocks | Fees for trading fractional shares |

| Invest in stocks that match your interests and strategy | Typically lower dividend income and profits |

4. Build a portfolio with a robo-advisor

Best for: New investors who want support choosing the right investments

A robo advisor is an automated financial advisor that builds and manages your portfolio on your behalf using algorithm-driven technology. New investors are increasingly turning to robo-advisor platforms like Stash, Wealthfront, and Acorns to take advantage of an actively managed portfolio for far less than what you’d pay at a traditional brokerage firm with human advisors.

When you invest with a robo-advisor, you’ll start by sharing information about your risk tolerance, time horizon, and financial goals. Your robo-advisor will use that information to craft a personalized investment portfolio tailored to your preferences.

You can start investing with many robo-advisors for as little as $5, so $1,000 is beyond sufficient if you want to get started. As far as what to invest in, you can invest in many of the investment ideas listed in this article, but ETFs and stocks are great starting points. You may decide to put $1,000 into a single ETF, or you could pick and choose individual stocks—and if you don’t know what to choose, that makes a robo-advisor all the more suitable for you.

| Pros | Cons |

|---|---|

| Lower fees than traditional brokerages | Limited flexibility with certain platforms |

| Low-to-no minimum balances | No face-to-face human advisors |

| Quick and easy to get started | Less personalization than a human advisor may offer |

5. Contribute to a 401(k)

Best for: Saving for retirement

If you haven’t opened a retirement account and your employer offers one, you could be missing out on a serious wealth-building opportunity. An employer-sponsored retirement account like a 401(k) may be one of the best $1,000 investments you could make.

A 401(k) is a tax-advantaged retirement plan that an employer offers to its employees, often along with an employer match program. The money in the plan is invested, like the money in a Roth IRA, but the employer decides what options are available.

That matching program is what makes a 401(k) such a great investment—if your employer offers one, they’ll match your contributions up to a certain percentage. That’s free money! If you’ve been wondering how to invest $1,000 and double it, a 401(k) can help you get there—and to truly make the most of this investment, we recommend contributing more than the minimum requirement for employer matching.

| Pro | Cons |

|---|---|

| Employer matching contributions | Fewer investment options |

| Pre-tax contributions and tax-deferred growth | Potential for higher taxes, as tax benefits aren’t guaranteed |

| High contribution limits | Strict withdrawal rules and penalties for withdrawing your funds before the age of 59 ½ |

6. Contribute to a Roth IRA

Best for: Those who want tax-free income in retirement but have no access to an employer-sponsored 401(k)

A Roth IRA is another type of retirement account to consider. People often opt for an IRA for a few reasons, like when their employer doesn’t offer matching contributions for a 401(k), they’ve already maxed out the 401(k) contribution limit, or if their employer doesn’t offer a 401(k).

Unlike a 401(k), IRAs are not employer-sponsored. While that means there’s no company match to take advantage of, the upside is Roth IRAs let you invest with post-tax dollars—or the money you’ve already paid income tax on.

This allows your money to grow tax-free, and if you follow the withdrawal rules, you won’t pay any taxes on your earnings when you withdraw your funds in retirement.

As you continually make contributions, the goal is that the value of your investments will increase over time. You can invest Roth IRA funds in just about any security, like stocks, bonds, mutual funds, and ETFs. You can open a Roth IRA with any standard brokerage that offers them (including Stash!).

| Pros | Cons |

|---|---|

| Tax-free growth | Must pay taxes up front |

| Tax-free withdrawals | Income limits |

| Penalty-free withdrawals of contributions (not earnings) at any time | Contribution limits |

7. Invest in your future-self

Best for: Those who want to learn a new skill or improve their overall well being

If you’re financially stable, investing in yourself is hardly ever a bad idea—especially in the realm of your career or education. While this isn’t a traditional stock market investment, it could easily be one of the best $1,000 investment opportunities out there if it allows you to, say, land a new job with a higher salary.

There are countless ways to use $1,000 to invest in yourself. For example, maybe there’s a skill gap you need to fill so you can land the promotion you’re after. Sites like Udemy have a plethora of online courses available for every topic under the sun, from communication and marketing to design and programming.

Do you have a goal of starting a business? Use your $1,000 investment to kick it off. Alternatively, you can put your money towards hiring a career or business coach. Investing in yourself doesn’t have to be career-related either—perhaps you put it towards mental health services like a therapist, or use it to dive into a hobby you’re passionate about.

While these ideas won’t technically earn you money directly or immediately, improving your skills or your mental health will undoubtedly impact your overall well-being or earning potential. Don’t overlook the potential ROI of investing in yourself!

The bottom line of how to invest $1,000 dollars? It doesn’t matter as much how you invest it—what matters most is that you do.

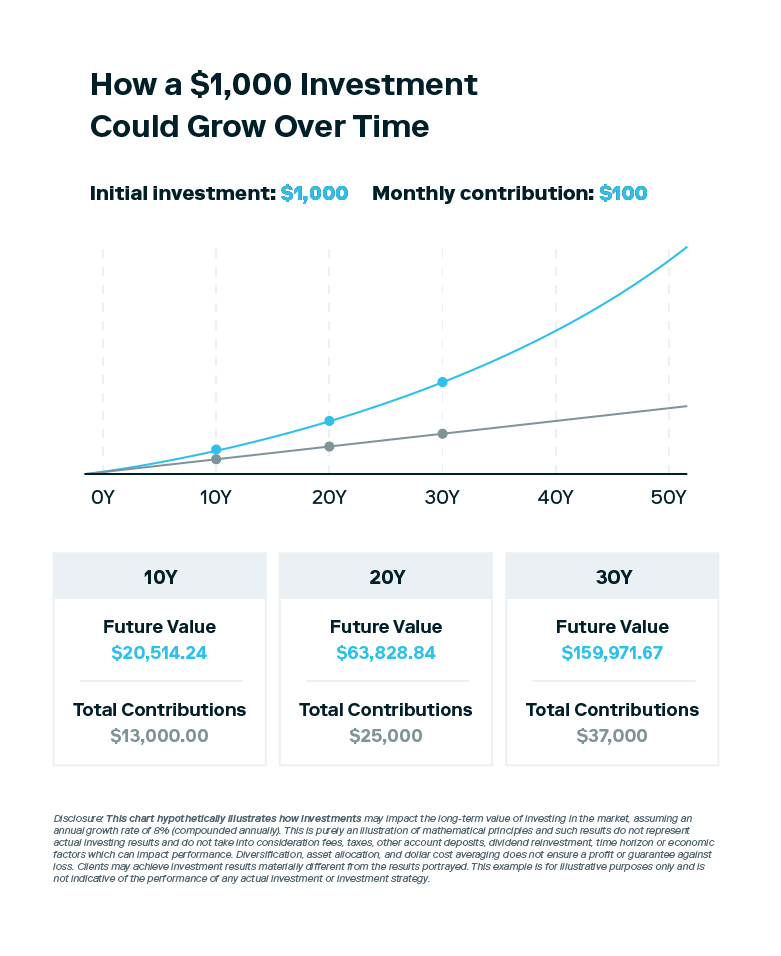

Investing long-term is an incremental process, so it doesn’t matter how much you can invest right now or how much (or little) money you earn. The truth is, you simply don’t need a ton of money to start investing. To begin building long-term wealth, you simply need to start, even if you start small.

Once you’ve made your first investment, commit to investing on a regular basis. Thanks to the power of compounding, making consistent investments (no matter how small) can allow your money to work for you and grow over time. And if you still have a ways to go until retirement, your ability to accumulate long-term wealth grows exponentially.

No matter where you choose to invest $1,000, know that the sooner you start investing, the more time your money has to grow. Your $1,000 investment now can lead to big returns down the line—just remember to invest for the long-term, invest regularly, and watch your money grow.

Investing made easy.

Start today with any dollar amount.

FAQs about how to invest 1000 dollars

Still have questions about how to invest $1,000? Find answers below.

Is $1,000 enough to start investing?

Yes. While $1,000 is a relatively small sum of money, investing on a regular basis—even just $30 or $100—is worthwhile. Successful wealth-building depends on investing regularly and consistently, not on whether you have a huge amount to invest at this moment.

How can I invest $1,000 dollars for a quick return?

In general, avoid attempting to earn a quick return with a $1,000 investment, as this generally involves high-risk investments that could leave you with nothing.

However, dividend stocks that offer regular cash payouts are a good option if you want immediate positive returns. Alternatively, short-term investments like short-term bonds, certificates of deposit, or high-yield savings accounts are safer options for short-term earnings.

How can I invest $1,000 dollars and double it?

If your employer offers a 401(k) with matching contributions, it’s entirely possible to double your $1,000 investment. How much money your company matches will vary, but many offer to match half or even all of your contributions. If they offer 100% matching, you can double your money in no time.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024