Nov 23, 2018

Investors: Here’s How to Think Long-Term With Your Money

Investors, here’s how to keep your eye on the long-term, and brush off the small stuff.

Life comes one day at a time. And it’s easy to get caught up in your daily dramas, or chasing the dragon of immediate gratification without keeping the bigger picture in mind.

For example, you may feel the urge to eat an entire package of Oreos. But that type of behavior can be highly destructive over the long term, both for your health, and maybe for your dating prospects.

And the same goes for your finances. You may want to spend, spend, spend, but when you think years down the road, it’s clear that you should probably be considering a strategy fit for the long term.

It’s part of the Stash Way. Wait, what’s the Stash Way?

- Invest for the long term. Over the years, market gains have outpaced standard savings rates in bank accounts. Looking ahead, experts expect markets to return about 5%. With the power of compounding, regular investing, and a long term approach, time is on your side.

- Invest regularly. It may seem counterintuitive to invest when the market is dropping, but it actually makes financial sense. Why? Because you’re likely to be getting investments at a discount. An easy way to make sure you’re sticking to your schedule is by using Auto-Stash.

- Diversify. You can attempt to curb your risk by diversifying your investments—that means you’re spreading your money around into stocks and bonds (and other securities) from different sectors and countries.

When thinking long-term, zoom out

As an investor, you’re probably focused on what’s happening with your money—possibly on a day-to-day basis. That means every hiccup in the market—including dips into correction territory—bring with them opportunities to panic.

And the market has bad days, and there are times when investors have to endure bear markets, or prolonged market declines. It happens. But what’s important to remember is that, historically, the markets have recovered.

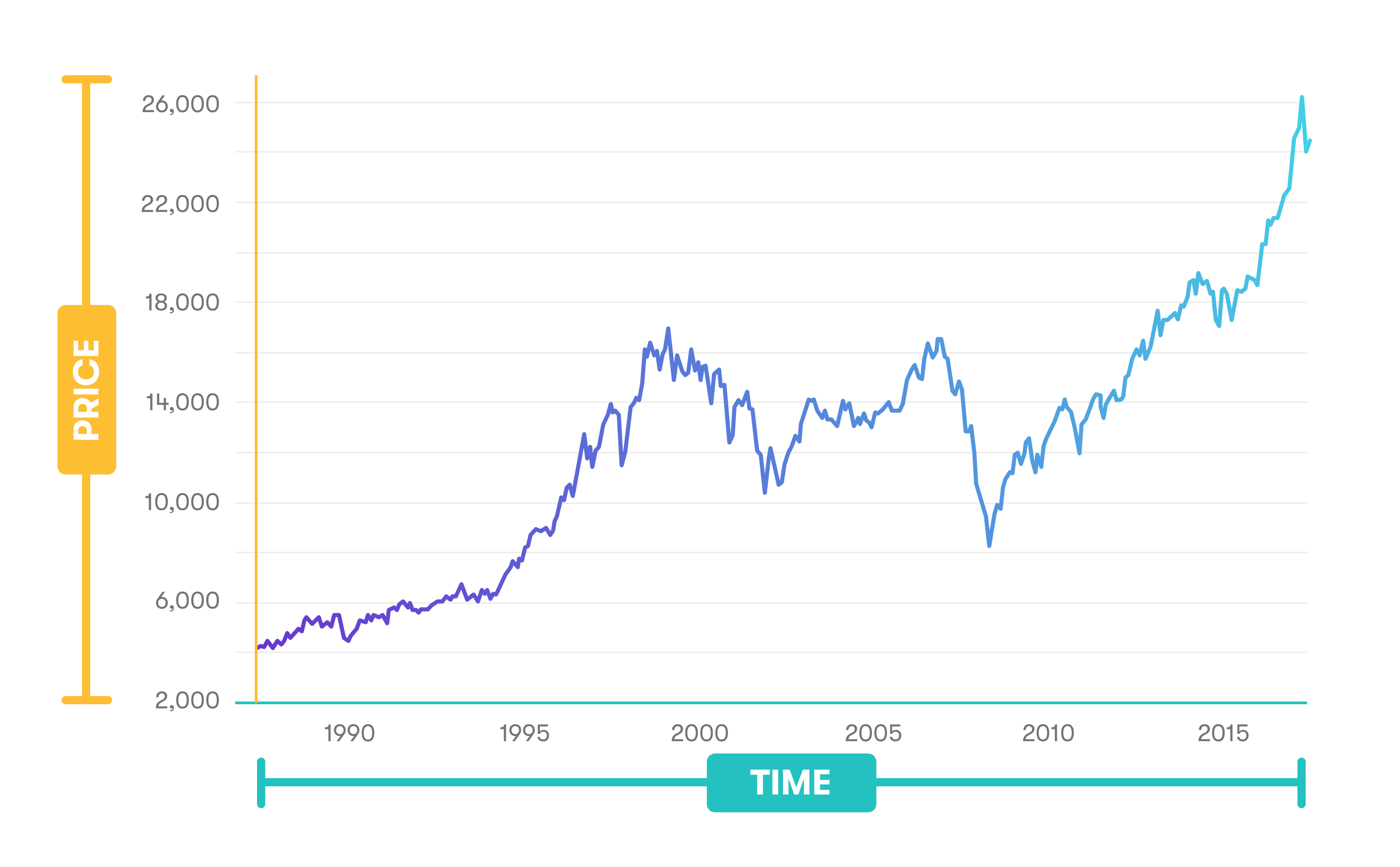

If you look at the performance of the Dow Jones Industrial Average index over the past few decades, you’ll see that despite some downturns, the market trends upward over time:

An investor focused on the short-term may have sold during one of the downturns over the years, afraid that they’d see all of their investments disintegrate. But had they “zoomed out”, or kept the bigger picture in mind, they’d know that it’s all a part of the cycle.

If you sell your investments during a downturn, you’re effectively locking in your losses, and potentially missing out on future market gains.

Case study: The 2008-2009 financial crisis

The economy crashed in 2008 and stocks entered a bear market for roughly a year and a half. Many investors panicked, sold their investments, and as they sold and pessimism spread and the markets were dragged down even further.

Eventually, the Dow bottomed-out at around 6,500 (a loss of more than 50%) the U.S. stock market shed $13 trillion in value from its previous highs. Since then, however, the market has been bullish. As of October 2018, the Dow is hovering around 25,000—it’s nearly quadrupled over the past ten years.

Think about this

How can you stop worrying about the day-to-day ebbs and flows of the market, and become a steadfast, steely-nerved investor like Warren Buffett? While you can prepare your portfolio by adopting The Stash Way, here are some other things to consider:

- Don’t forget the risks. While you should have a strategy in mind, don’t forget that there is always going to be a degree of risk to investing.

- Remember, the market moves in cycles. While it may not come as much comfort when your portfolio is losing value, keep in mind that markets ebb and flow. They go down, and historically, they’ve recovered. There’s no guarantee of a recovery, of course, but history is probably on your side.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024