Nov 1, 2018

Investing Lessons From Warren Buffett

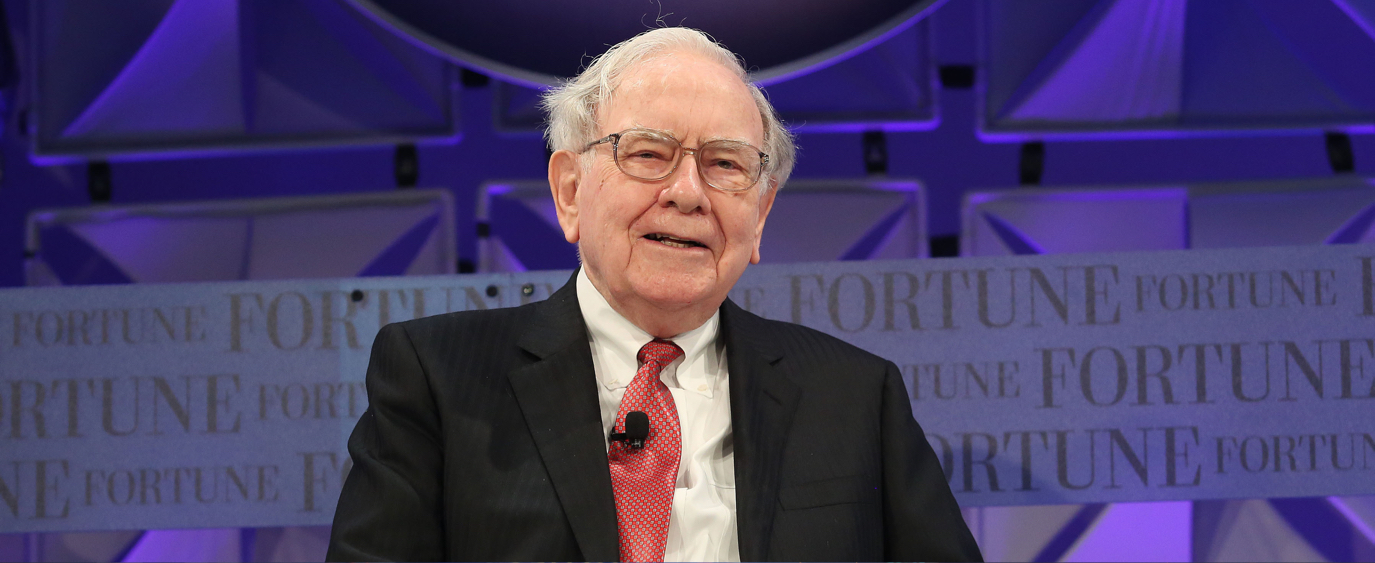

Need investing advice? Here are some tips from the undisputed champ, Warren Buffett.

Investors are generally thirsty for guidance. Unfortunately, divining rods and tea leaves aren’t going to be much help when it comes to investment advice.

So, where can you turn when you want some sort of direction? Why not look to one of the most successful investors of all time—Warren Buffett?

Who is Warren Buffett, and why should you listen to him?

Warren Buffett is a businessman and investor from Omaha, Nebraska, who has served as the chairman and CEO of the holding conglomerate Berkshire Hathaway since the 1960s. He’s also one of the richest people in the world, with a net worth estimated to be more than $80 billion.

Buffett’s is best known for his investing activity, which has earned him a fortune, and the nickname the “Oracle of Omaha.” Over the years, Buffett bread-and-butter method is to find “diamond in the rough” companies, buy or invest in them at a discount, and letting them appreciate.

Examples include investments in razor blade manufacturer Gillette, See’s Candies, and Coca-Cola.

Buffett’s guidance is followed closely by millions of people. When Buffett (or, by proxy, Berkshire Hathaway) buys or sells a specific stock, it can cause a ripple-effect in markets as other investors mimic his moves.

Warren Buffett’s most valuable investing lessons

If you want to invest like Buffett, you’ll want to stick to his script. Luckily, he lays out his magic formula in Berkshire Hathaway’s annual letters. In the 1977 letter, Buffett actually laid out his investment criteria (for stocks) in simple terms, mostly buying up promising companies at a discount, and watching them appreciate. So, if you want to roll like Buffett, here are the basic investing principles and guidelines to consider when buying stocks.

1. You understand the company.

If a company is engaging in a business you don’t understand, it may be wise to invest elsewhere. Do your research, of course, but if you’re uncomfortable investing in something you don’t understand, go with your gut and avoid it.

2. The company shows long-term promise.

Buffett writes that he wants a business to have “favorable long-term prospects,” and you should consider those prospects when investing. Again, do some research and ask yourself some questions.

For example, is a brick-and-mortar retailer a smart investment with the industry gravitating to the digital world? Consider what advantages a company has over others in its sector, and what new technologies, services, or products people will want in five, ten or twenty years, and which companies may be in a position to offer them.

3. You trust the company’s leadership.

You don’t want to get stuck holding shares of the next Enron. Research the company’s leadership team, and determine whether you find the team trustworthy and competent.

4. The price is right.

Buffett writes that he likes stocks that are “available at a very attractive price.” Obviously, you can’t predict whether a stock will increase or decrease in value, but you can research a stock’s history to try to judge how well it’s valued.

Read more: Growth vs. Value Stocks, A Quick Guide

Warren Buffett’s investing principles and Stash

Warren Buffett managed to stick to his investing principles all these years, and his method has proven successful. We’ve developed our own set of criteria, which we call The Stash Way, that embodies some of the same ideas.

These are the guidelines:

- Invest for the long-term

- Invest regularly

- Diversify

Pair these principles with Buffett’s advice, and your portfolio should be in good shape.

Stash Learn Weekly

Enjoy what you’re reading?

[contact-form-7 id="210" title="Subscribe" html_id="default"]Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024