Jan 16, 2020

How to Use Your IRS Refund To Jumpstart Your Retirement Savings

Instead of a new gadget, invest in your future.

It’s tax time again, and for most people, that means getting back some green.

In fact, about 73% of taxpayers got money back from the Internal Revenue Service (IRS) in 2019, and the average refund for 2019 was about $2,700, according to the IRS.

And while people have a range of plans for that money—from purchasing a big-ticket consumer item such as a car, or refrigerator, to paying down debt—it might surprise you to learn that many consumers saved and invested their refunds in 2018, according to recent research.

Here’s what taxpayers did with their refunds in 2018:

Retirement saving

Stash believes in smart saving and investing, and we think one of your goals should be saving for retirement. Why? About one-third of U.S. consumers have $5,000 or less saved for retirement. (Various estimates suggest you may need as much as $1.5 million to support 30 years without working.)

Additionally, fewer of us are likely to have pensions, and Social Security probably won’t cover your expenses after you’ve stopped working.

Meanwhile, career paths are likely to be unpredictable, and healthcare costs probably will be expensive when you can no longer work.

But the sooner you start investing for retirement, the more money you can potentially accumulate.

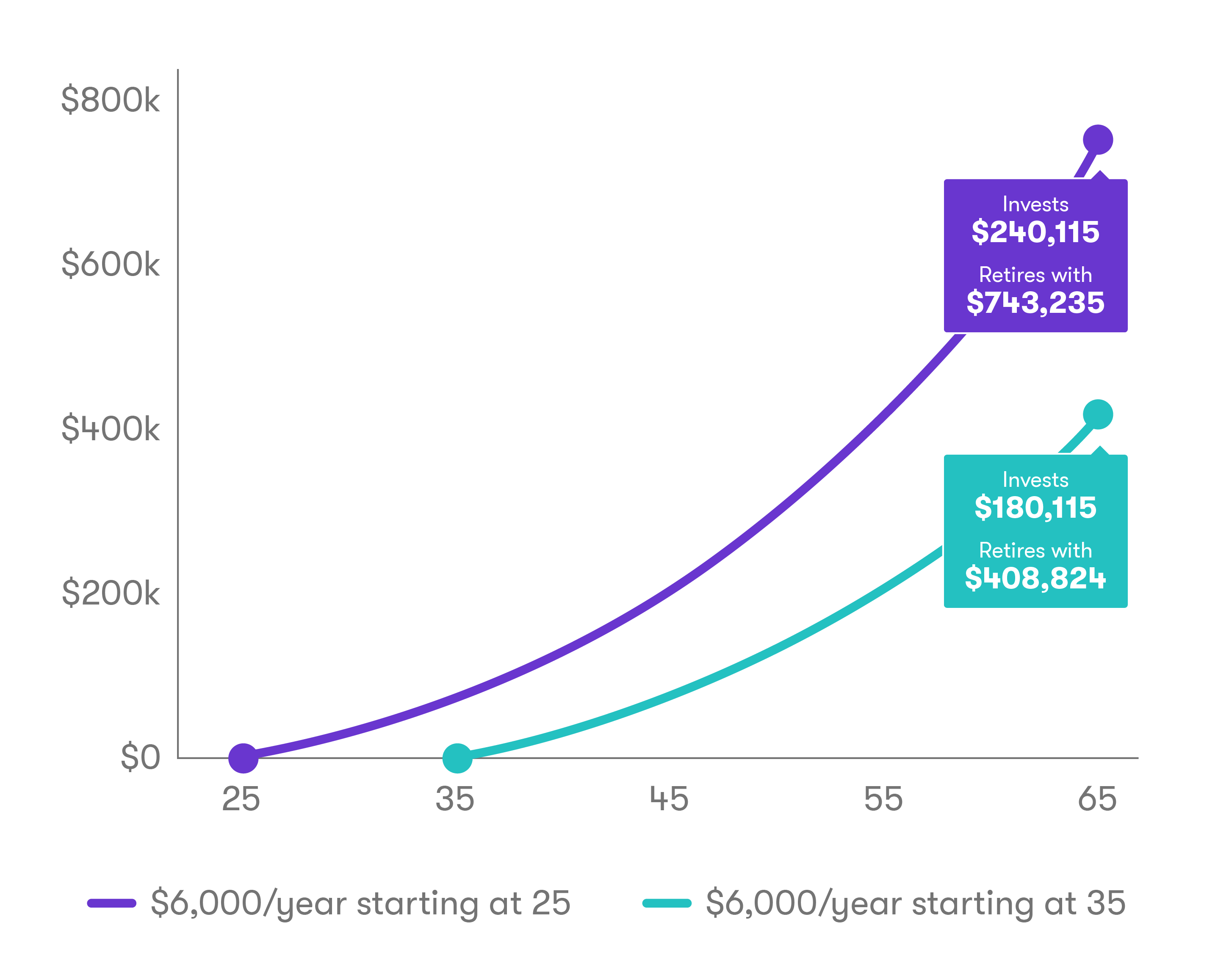

Waiting even a few years can dramatically reduce your retirement savings. The following chart shows the difference in your potential nest egg if you start at 25 compared to 35. The person who waits ten years might have almost half as much money in retirement.

Consider Stashing it

Stash offers both traditional and Roth individual retirement accounts (IRAs). The maximum you can contribute to your Stash retirement account in 2020 is $6,000. People who are age 50 and older can contribute an additional $1,000 each year as a catch-up contribution.

Have a tax refund coming your way? Consider stashing it in a Stash Retire account.

1Expected returns or probability projections are hypothetical in nature and may not reflect actual future results. This is a hypothetical illustration of mathematical principles, is not a prediction or projection of performance of an investment or investment strategy, and assumes weekly contributions at an annual rate of a 5% return (compounded annually) and does not account for fees or taxes. It is for illustrative purposes only and is not indicative of any actual investment. Actual return and principal value may be more or less than the original investment.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Budgeting for Young Adults: 19 Money Saving Tips for 2024