Mar 15, 2019

4 Reasons Millennials Can Benefit From Investing Early

Investing may not always be at the top of the financial to-do list, but there can be benefits to starting early.

For millennials—a term used to describe people born between 1981 and 1996—investing isn’t always at the top of the financial to-do list.

There are student loans to pay off, high rent and housing prices to contend with, and stagnant wages that are making saving and investing more difficult than ever, especially for young Americans.

But in spite of all that, millennials tend to be good savers, at least compared to other generations. For example, more than 70% of Millennials have started saving for retirement, according to industry data.

Millennials still struggle with investing, however. Many might feel that they don’t know enough about the market, or that they can’t afford to invest. Additionally, some simply don’t feel ready to put their money in the market, or that investing is too risky.

While those are legitimate concerns, investing can be a financial boon, despite the associated risks. If you’re a millennial and are still on the fence about investing, here are a few reasons why you may want to consider investing sooner rather than later.

1. When you invest at a younger age, time is on your side.

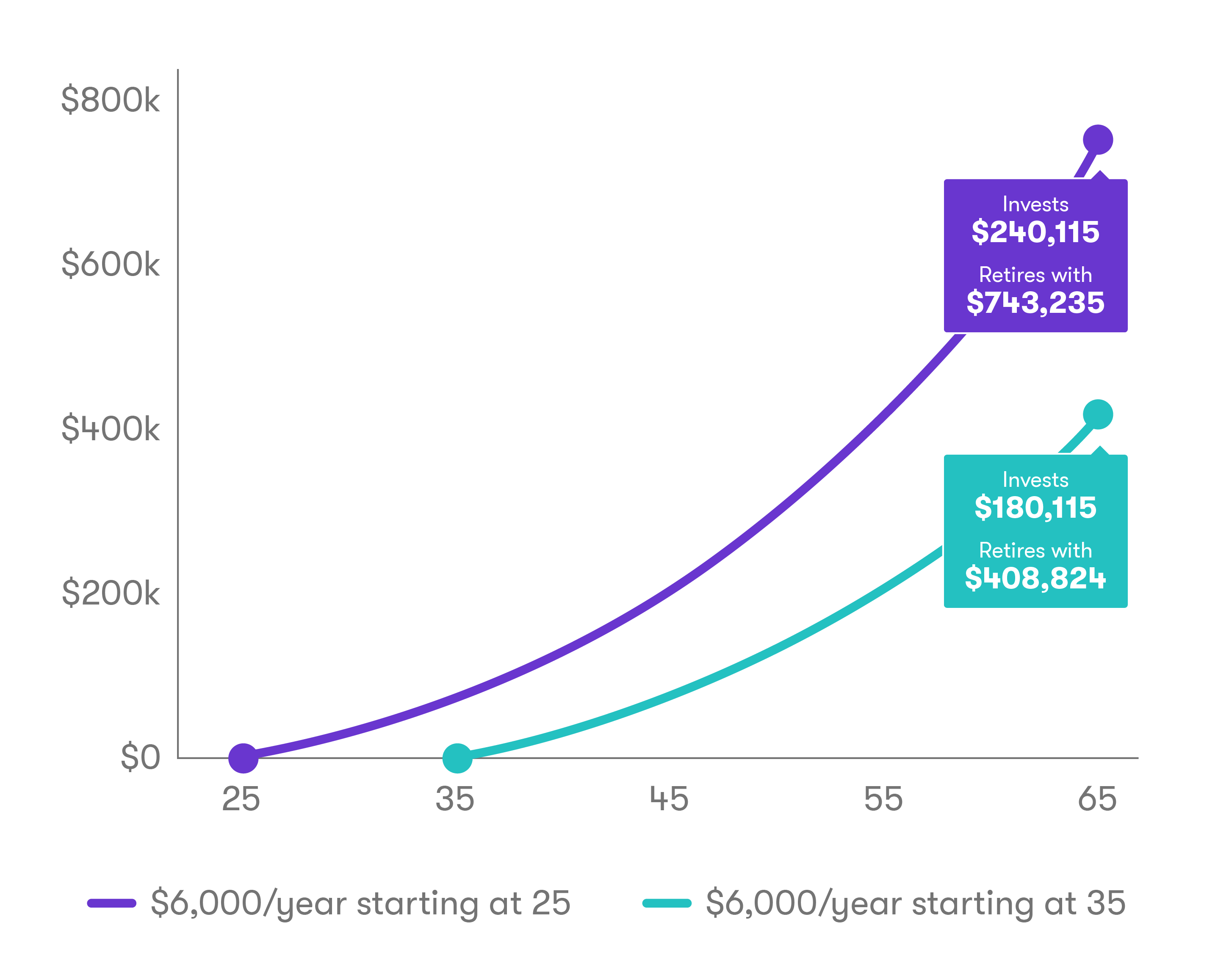

One big advantage millennials and younger generations have compared to older generations is that they have more time to accumulate wealth. They can maximize returns through a process called compounding, a way to potentially increase your savings, just by staying invested in the market.

Investments can also earn investors dividends, or small cash payouts, which can further grow your money. And, of course, investments tend to (but don’t always) appreciate.

2. Investing puts your money to work.

Instead of allowing your money to sit in a bank account and slowly be eaten away by inflation, investing can earn you a return, effectively putting your money to work.

Investing does have risks, but when you buy stocks, there’s a chance that the companies you’re investing in will grow—meaning that your shares can increase in value. Conversely, money that sits in a savings account, uninvested, is almost certain to lose value over time due to inflation, or a creeping higher cost of goods and services.

3. Investing can help you reach your financial goals, such as retirement, sooner.

If your money is growing or earning you a return (because it’s been invested!), it’s going to help you reach your financial goals faster.

Perhaps the most common financial goal is retirement. Many financial experts recommend setting aside between 10% and 15% of your paycheck to save for retirement, but most people don’t come close to that. In fact, 21% of Americans have never saved a cent for retirement, according to industry data.

And while many Americans are offered 401(k) plans—which invest money for long term goal such as retirement—by their employers, as many as two-thirds of them do not use them.

Without compounding, dividends, and annual growth, reaching goals such as retirement may prove to be more difficult or time-consuming.

4. You can save money on taxes

Some investment accounts, such as a traditional IRA and a Roth IRA, can have tax advantages. For example, you can make contributions to a traditional IRA with income before you pay taxes on it, which can also reduce how much you pay annually in taxes.

With a Roth IRA, you make contributions to your account with income after you’ve paid taxes on it, but your withdrawals in retirement are typically tax-free.

Convinced? All it takes is $5 to get started investing using Stash.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024