Mar 17, 2020

How Your Investments Earn You Money

You invest to grow your money, but how does that work, exactly?

It pays to invest, kids.

But how, exactly, investing pays is something of a mystery to many investors. For some people, the idea that you can stash money away in an account or security and that it could grow into more money seems at best, like magic and at worst, suspicious.

We all know people that have made money “investing”. But what they actually did (and where they figured out how to do it) can seem like a Mulder and Scully-level mystery.

So how does your money actually make money?

While almost everyone invests their money with the goal of turning a profit, investing involves risk.

Markets can be volatile and investors need a sound strategy to weather the ups and downs over the long term.

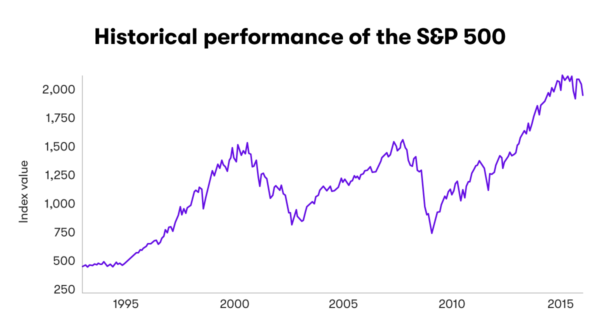

That said, over the long run, though, markets (and returns) trend up:

Disclosure: This is not a prediction or projection of performance of an investment or investment strategy. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections are hypothetical in nature and may not reflect actual future performance. The rate of return on investments can vary widely over time, especially for long term investments including the potential loss of principal. For example, the S&P 500® for the 10 years ending 1/1/2014, had an annual compounded rate of return of 8.06%, including reinvestment of dividends (source: www.standardandpoors.com). Since 1970, the highest 12-month return was 61% (June 1982 through June 1983). The lowest 12-month return was -43% (March 2008 to March 2009). The S&P 500® is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market. Source: Yahoo Finance. Source: Yahoo Finance.

The Dow Jones Industrial Average, for example, saw big gains over the past two or three decades. After the market bottomed-out during the financial crisis in 2009, the Dow more than doubled, briefly topping out above 29,000 points in early 2020.

Here are the three primary ways that companies pay back their shareholders, or, by which investments can earn you money.

1. An increase in share value

Perhaps the most obvious way in which an investment can make you money is that it gains value. As stock prices rise, shares become more valuable. And if you’re a shareholder, you can sell your stocks, earning you a profit, or return, on your initial investment.

The same applies to bonds, exchange-traded funds (ETFs), and other investments. When a company’s shares are worth more, shareholders reap the benefits.

2. Dividends

A dividend is your cut of a company’s earnings. If you own shares in a company, you own a part of the company — and therefore, you get a cut of the profits.

Typically, dividends are cash payouts to shareholders which can be reinvested, or sent to your accounts t through a dividend reinvestment plan (DRIP). With Stash, you can turn on DRIP and have dividends automatically reinvested. They can, however, be issued in the form of additional shares.

3. Interest payments

Interest payments are generally associated with fixed-income securities, like bonds. Bonds are a form of debt, meaning that you’ve loaned a company your money. In exchange, a bondholder is due interest payments and the bond’s full amount upon maturity.

If you’re a bondholder, then, you can expect periodic interest payments.

A quick note about stock buybacks

Sometimes, companies will engage in stock buybacks, which is when a company buys its own stock on the market. There are a few reasons why a company might do this, but one of the most common is to consolidate stakeholder value, and to increase share prices.

While somewhat controversial, a stock buyback is another way that companies can effectively “pay back” their shareholders.

*For Securities priced over $1,000, purchase of fractional shares starts at $0.05.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024