Aug 3, 2018

How to Declare Financial Independence From Your Student Loans

Education was supposed to free you, not imprison you in debt. Let’s try to fix that.

Most people go to college or otherwise pursue higher education to improve their career prospects. Or, to earn more money and eventually achieve a level of financial independence in which they can retire and live out their lives as they see fit.

The issue, as many recent college grads are discovering, is that the cost of a college degree can be so astronomically high that it is instead acting as a financial roadblock to their future instead of opening up doors.

Student debt, in effect, becomes a pair of financial handcuffs.

How are you supposed to build a future when, straight out of the gate, you’re buried in student debt?

Financial independence: What is it?

If you’re not familiar with the term “financial independence”, it means exactly what you’d suspect—that you have enough wealth built up that your day-to-day and even month-to-month decisions aren’t dominated by what’s in your bank account.

Reaching financial independence is a long and difficult task, and for most people, is the ultimate achievement. Afterwards, you can typically retire and take life as it comes. Some people take the concept to the extremes, saving more than 50% of their income, and stashing away every last cent.

Read our full breakdown: Meet FIRE: “Extreme Couponing” For Retirement Planning

But if you have significant amounts of student loan debt, becoming financially independent may seem like a Herculean feat.

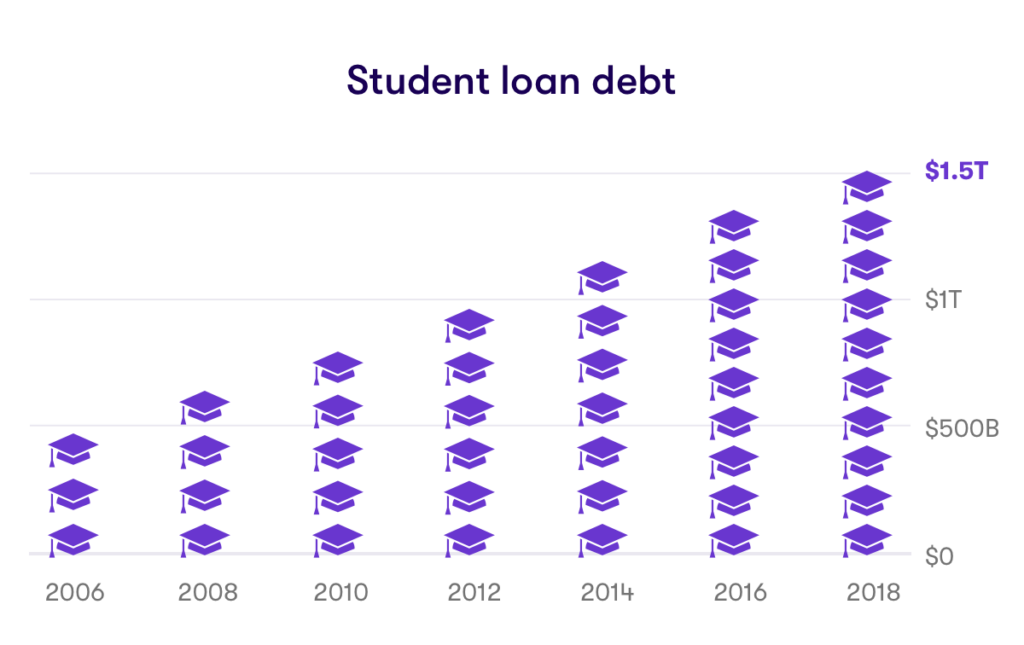

The state of student loan debt

Depending on how much student debt you’re dealing with, it may, indeed, be Herculean. For context, is a snapshot of the student debt crisis in America:

- The average college graduate in the U.S. owes more than $37,000 as of 2018.

- Around 2 million people have more than $100,000 in student loan debt.

- Total student loan debt in the U.S. is more than $1.5 trillion.

With these statistics in mind, how can you get started building your financial future while fighting for breathing room under your student debt?

Listen: How Can I Pay Off My Student Loans?

Your student loan debt game plan

There’s no getting around it—the average college graduate has a big hole to climb out of. But if you’re thinking about how to knock out your debt and simultaneously start saving for your future, you’re already on the right track; And likely well-ahead of many of your peers.

While you may be deep in the woods with no easy path out, you can frame a long-term plan to get out of debt and start building wealth. Here’s a cheat sheet:

- Get real about your financial situation-Don’t be in denial about your debt. Sit down, see what you owe, and get organized. Do your due diligence and create a budget and save up an emergency fund; These are the two cornerstones.

More: How to create a budget.

- Can you increase your income?-There are two ways to get ahead—earn more, or spend less. Aim for both. Start by asking for a raise, or looking for a better-paying job. There are opportunities out there, so don’t be afraid to shop around.

Check out: Who’s hiring in America?

- See what you can do about your debt-You’ll need to throw everything you can at your debt. But you can also see if you qualify for forgiveness programs (typically reserved for public employees), or if you can refinance for lower interest rates, potentially saving you thousands of dollars.

Go deeper: Qualifying for student loan forgiveness programs

- Keep the future in mind – Again, throw the kitchen sink at your debt. But it might be a good idea to slowly start to stash money away for the future, too. That means opening up investment accounts (all you need is $5 to start!) and retirement accounts, like an IRA.

More details: Can I Pay Off Student Loans While Saving for Retirement?

- Strap in for the long haul – Getting out of debt isn’t a quick or easy process. It’ll take time and discipline, but it’s achievable. While you’ll start out worrying about money on a day-to-day basis, it’ll soon become a week-to-week and month-to-month concern as you claw closer to financial independence.

There are also plenty of further tips on how to get out of debt, and strategies for tackling your student loan debt.

And of course, don’t forget about life after debt—don’t shortchange yourself by forgoing saving and investing.

Related Articles

Credit Cards vs. Debit Cards: The Differences Can Add Up

How To Pay Off Your Student Loans Faster

How To Pay Off Credit Card Debt

What Is the Debt Snowball Method?

Planning Your Finances as a Member of the Military

How to Build Credit: Why You Need It and How to Get It