Jun 21, 2018

Can I Pay Off Student Loans While Saving for Retirement?

You actually can do both at the same time

If you’re one of the estimated 44 million people holding student loan debt today, you may wonder whether you should pay off your student loan before you start putting money away for retirement.

Here’s the thing. The two don’t have to rule each other out.

Every dollar you save now, even if it’s small amounts, can really add up over time thanks to the power of compounding.

Credit card debt vs. student loan debt

First of all, paying off your debt–whether that’s credit card, auto loan, or home mortgage–and staying out of debt is always a smart idea. Debt can really weigh you down and harm just about every aspect of your life.

Credit cards, for example, tend to have double-digit interest rates that make it very difficult to get out of debt once you’re in it. In fact, the average interest rate on a new credit card ticked up to 16.75%, according to a recent survey by Creditcards.com, which is 0.6 percentage points higher than it was at the start of 2018.

Credit cards also often have variable rates that move up when interest rates increase, as they have been.

About half of people with student loan debt say they’ve delayed making a contribution to their retirement as a result of their debt.

In contrast, student loans usually have lower, fixed interest rates, and longer repayment terms. The average federally subsidized student loan interest rate ranges between 4.45% and 7%, according to Navient, the student loan processing company.

Student loan debt

The average student loan debt these days is about $37,000, almost double what it was more than a decade ago, according to research.

While federal loans are structured to be paid back in 10 years, the truth is that most people take 20 years or more to pay them back, or twice as long.

In fact, about half of people with student loan debt say they’ve delayed making a contribution to their retirement as a result of their debt, according to a survey conducted in 2016 by the American Institute of CPAs. (AICPA hasn’t updated that segment of its data since.)

But various experts say putting off saving for retirement when you have student loan debt is a mistake.

Start saving in your 20s

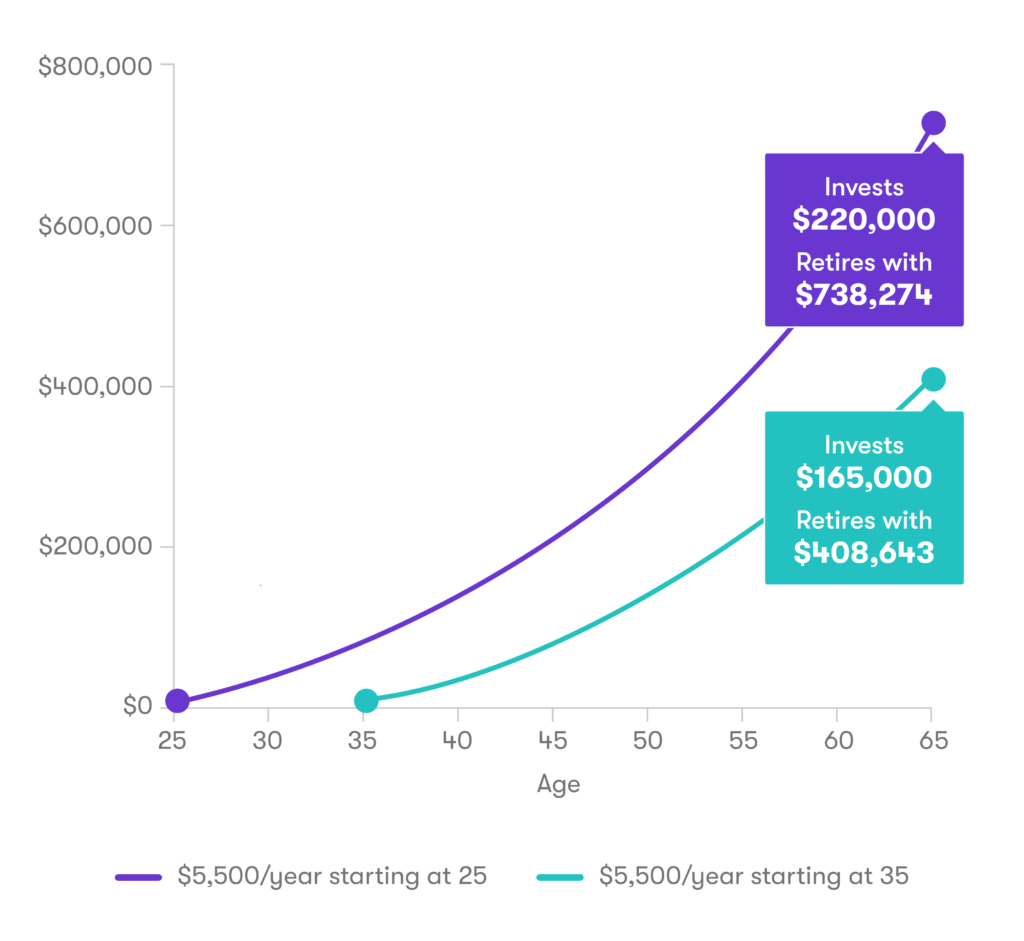

The longer you can put money away in a retirement fund, the longer you can benefit potentially from something called compounding. That’s when the interest on the principle—or cash—you’ve put into a fund also earns interest. It can really add up over time.

Here’s an example that illustrates the difference between saving starting at age 25 and 35. The example assumes a 5% return, and annual contributions of $6,000, which is the maximum contribution an individual is allowed to make to either a traditional Individual Retirement Account (IRA) or a Roth IRA when they are under age 50. (Forecasts for long-term large cap stock appreciation are 6%, according to some analysis.)

The investor who starts a decade earlier could possibly save twice as much for retirement as the person who waits.

Other things to think about

The interest you pay on your student loans is tax-deductible, up to $2,500. That means you can potentially get a tax break as you pay off student debt.

By refinancing your existing student loans you could see a dramatic reduction in your interest rate – lowering your monthly payments. And that can mean more money to put aside for your future.

Related Articles

How to Start a Roth IRA: A 5-Step Guide for 2024

What Is a Traditional IRA?

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Budgeting for Young Adults: 19 Money Saving Tips for 2024