Mar 12, 2020

Why Should You Invest in Stocks?

Before you start investing, it’s fair to ask yourself an obvious question: Why invest?

People usually invest for two main reasons:

- To earn a return

- To keep ahead of inflation

Earning a return

Getting a return on your investments—or making money from your investments—is the primary motivation for most investors. It basically means that you’re putting your money into a vehicle in which it will grow.

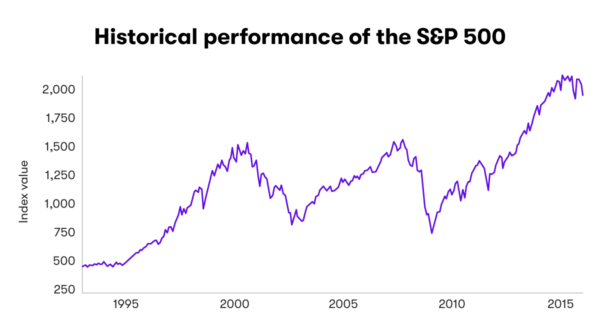

For example, if you buy $50 in stocks, you’re hoping to see that money grow so that your stocks will be worth more than you initially purchased them for. While returns can be positive or negative (all investments involve risk), over the long run, markets and returns have tended to trend upwards:

Disclosure: This is not a prediction or projection of performance of an investment or investment strategy. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections are hypothetical in nature and may not reflect actual future performance. The rate of return on investments can vary widely over time, especially for long term investments including the potential loss of principal. For example, the S&P 500® for the 10 years ending 1/1/2014, had an annual compounded rate of return of 8.06%, including reinvestment of dividends (source: www.standardandpoors.com). Since 1970, the highest 12-month return was 61% (June 1982 through June 1983). The lowest 12-month return was -43% (March 2008 to March 2009). The S&P 500® is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market. Source: Yahoo Finance.

Your investments actually earn you money in three different ways:

- An increase in share value—an increase in a company’s stock price

- Dividends—a portion, via a cash payout, of a company’s earnings to shareholders.

- Interest payments—a periodic interest payment on debt to bondholders.

Staying ahead of inflation

Aside from making money via a return, investing can help you stay ahead of inflation.

Inflation is the tendency of money to lose value over time. It refers to the rising cost of goods and services with time, and effectively, measures the rising cost of living.

The inflation rate has slowly crept up over the past several years and is eating into the paychecks of many Americans. While you’re not guaranteed a return on any investment, investing your money is a way to try and stay ahead of inflation—hopefully, your return will outpace the rate of inflation.

If the inflation rate is currently 2%, for a simple example, and your portfolio had a return of 7%, your real return would be 5%.

For comparison, the average annual return for the S&P 500 index over the past 90 years has been slightly less than 10%. If you were to invest your money into a fund that tracks that index, your money would stay way ahead of the inflation rate.

Make investing a habit

How can you get in the habit of investing? With Stash, all you need is $5 and a disciplined approach. Here are some tips:

- Invest a little bit on a regular basis—Even small investments add up over time.

- Hold onto your investments—Buying and holding helped make Warren Buffett rich, and the strategy could work for you.

- Diversify your investments—Don’t put all of your eggs in one basket, in other words. Investing is risky, but you can mitigate that risk with a diversified portfolio.

How to get started

If you want to start investing, you may want to consider setting some money aside for it as part of your budget. (If you haven’t made a budget yet, that should be your first step.)

The good news is that you can invest with Stash with any amount of money. Beginners should consider making investing a habit. Regular investing is part of the Stash Way, which also includes investing for the long-term and diversifying your portfolio of investments.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024