Jan 30, 2019

5 Tips for Young Investors

Young investors have a huge advantage: Time is on your side.

If you’re young, chances are that investing may not be on your radar yet. But young investors have a huge advantage over most people when it comes to building wealth, and that’s time.

Maybe you’ve just graduated from college, or rented your first apartment with friends. Life’s an adventure filled with so many possibilities, and it’s all about discovering who you are in the world.

But the sooner you start investing, the more time you give your money to grow—and the easier it might ultimately be for you to meet your long-term financial goals.

To help you get you off the sidelines, here are a few tips for investing while you’re young.

Jump in

With investing, you can learn by doing. It’s a little bit like learning to play a new sport or instrument.

Imagine if you wanted to kayak the Colorado River. You’d start by paddling on lakes and then progress to class I and II rivers, before moving up to more difficult whitewater. Eventually, with enough practice and experience, you might be ready to tackle the rapids of the Colorado River.

Investing is very similar. And as a young investor, you have the advantage of more time to study the markets, refine your investing strategies, and to learn from both your successes and failures.

The important thing is to take the first step.

Embrace compounding

If you invest while you’re young, you’ll also be able to take full advantage of the power of compounding as you build wealth over the next four, five, even six decades.

In simplest terms, compounding is any return earned on your principal, plus your past returns. For example, if you have money in a bank account, it’s the interest on that sum plus the past interest it has earned over time. If you have money in an investment account, it’s the percentage you may earn on top of your original investment, plus its previous earnings.

The sooner you start, the more time compounding can work in your favor.

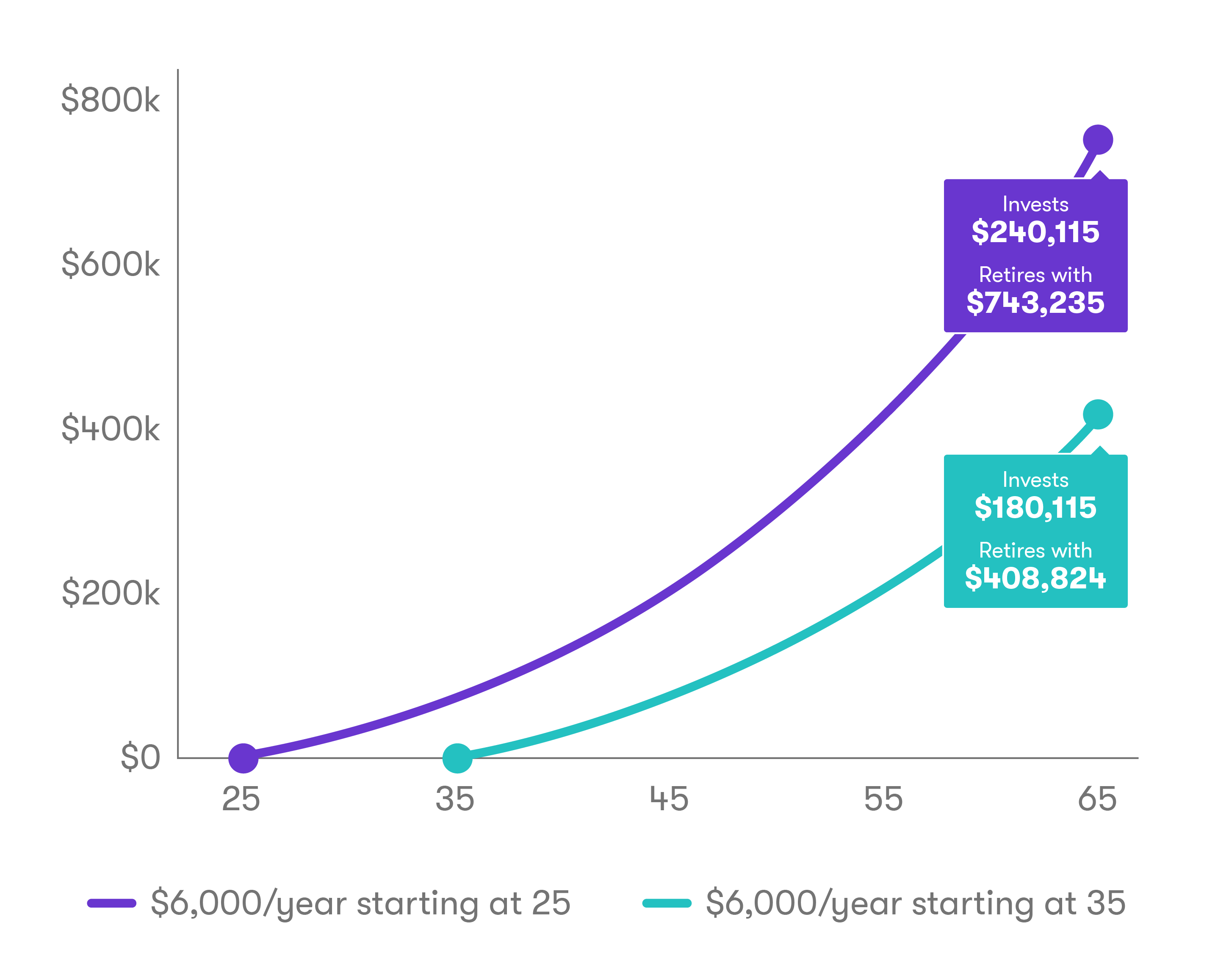

The following chart* shows what would happen if you invested $6,000 annually until retirement at age 65, starting at age 25 compared to age 35, assuming an annual return of 5%.

Build saving into your budget

If you haven’t created a budget, now’s the time to start.

Not only can a budget help you determine how much you have for essential costs such as rent, student loans, groceries, and transportation, it can also show you how much you have left over to save each month.

While experts recommend putting away as much as 20% of your take-home pay into savings, if that’s too much to start out with, try a smaller amount. The point is that you put something away each month. (Find out more about setting a budget here.)

Once you’ve set up a cash buffer of between three and six months worth of savings in both a rainy day and emergency funds, then you can start thinking about investing.

Tools like Auto-Stash can help automate your investments, so you never miss a month.

Retirement savings accounts

Want to relax in your older age? If you’re investing for the long term, you should seriously consider putting money into a retirement account.

IRAs are tax-advantaged retirement savings accounts that can help you build a nest egg. There are two main types of IRAs—traditional and Roth—and the main difference between the two is when you pay taxes on the contributions and earnings.

With traditional IRAs, you make tax-deferred contributions, and then pay taxes when you take money out. With a Roth, you pay taxes on contributions, but withdrawals later on are typically tax-free.

The contribution limits for 2019 are the same whether you have a traditional or Roth IRA: you can contribute up to $6,000 each year (that bumps up to $7,000 a year if you’re age 50 and up).

If you have an employer-sponsored plan, such as a 401(k), consider contributing to this as well. (Generally speaking, you can contribute to both an IRA and a 401(k) in the same year, however, you may not be eligible for the full tax advantages of both accounts. You can put away as much as $19,000 a year in a 401(k), and catch-up amounts of an additional $6,000 once you turn 50. Similar to a traditional IRA, your contributions to a 401(k) are tax-deferred.

Follow the Stash Way

Our investing philosophy is simple, and we’ve boiled it down into three basic steps that we call the Stash Way:

Over the years, market gains have outpaced standard savings rates in bank accounts. Looking ahead, experts expect markets to return about 5%. With the power of compounding and regular investing, you have the ability to build wealth for the financial future you want.

And by diversifying, you’ll hold a variety of investments that are not all subject to the same market risks, including stocks, bonds, cash, and commodities.

You’ll also be choosing investments in numerous economic sectors—not just the hot industry of the moment—as well as in different geographies around the globe. We offer exchange-traded funds (ETFs) which can help make diversification easy.

Special note: All investing involves risk. You can lose money when investing in stocks, bonds, mutual funds, exchange traded funds, and other market securities. Find out more about investment risk here.

Check out Stash

With Stash, you can easily invest in dozens of funds and individual stocks. And while you’re at it, check out Stash Learn. We have hundreds of stories to help educate you about investing.

So get off the sidelines and start Stashing today! You can start with just $5.

Disclosure1 This is a hypothetical illustration of mathematical principles, is not a prediction or projection of performance of an investment or investment strategy, and assumes weekly contributions at an annual rate of return (compounded annually) and doesn’t to account for fees or taxes. It is for illustrative purposes only and is not indicate of any actual investment. Actual return and principal value may be more or less than the original investment.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024