Mar 20, 2023

When To Exercise Stock Options: A Beginner’s Guide

When should I exercise my stock options? In short, you should exercise your stock options when they have value. But there are other factors to remember, including tax implications and your current financial situation.

Whether you’re changing careers or your current company is going public, you may have questions about when to exercise stock options.

After all, you wouldn’t want to miss out on the opportunity of a lifetime if your company becomes an overnight success.

Employee stock options are a form of compensation that give employees the right to buy shares of their company’s stock at a predetermined exercise price.

So when should you exercise your stock options? We’ve gathered some considerations to keep in mind, as well as different exercise methods you can use to your advantage.

Let’s dive in!

Considerations for determining when to exercise stock options

If you remain with your current company, you can exercise your stock options anytime between their vesting date and expiration date. The vesting date is the official date that you are able to exercise your options. While this time can vary depending on your company, this is usually up to 10 years.

Of course, you’ll want to read the fine print of your stock options before making any decisions. In addition, you may also have early exercise options, which will allow you to exercise your shares before their vesting date. Be sure to look over the company’s stock option plan as soon as possible.

Whether you’re interested in exercising your options early or want to hold them for the long-term, ask yourself these six questions to help you decide if it’s the best time to exercise stock options:

1. Do they have value?

One of the first things you should consider as you decide when to exercise stock options is value. You can determine if your stock options have value by comparing their exercise price to their current stock price.

The exercise price, also referred to as the strike price, represents the price per share you’re entitled to if you decide to exercise your options, whereas the current share price is the price the stock is selling for on the market.

You’ll know if your stock options have any value based on whether the exercise price is higher or lower than the current share price.

- If your stock option’s exercise price is lower than your company’s current share price, your options are in the money (ITM) and currently profitable.

- If your stock option’s exercise price is higher than your company’s current share price, your options are out of the money (OTM) and not currently profitable.

You can think of exercising ITM stock options as buying your company’s shares at a discounted rate. On the other hand, if your stock options are OTM, you’d be purchasing the stock at a higher price than they are currently valued.

Because of this, you want to exercise your stock options while they have value, as you’d have the option to immediately turn around and sell them for profit.

For example, let’s say you have 100 shares of your company’s stock with an exercise price of $25 and a current stock price of $35. Because the exercise price per share is lower than the current stock price, your options are ITM.

If you exercised your stock options, you’d own 100 shares for $2,500. If you turned around and sold your stock at its current price, you’d sell them for $3,500, with a return of $1,000.

2. Is your company public or private?

Another thing you’ll want to consider when deciding if you should exercise your stock options is if your company is public or private.

If your company is private, you won’t be able to trade your shares on the stock exchange, meaning you can’t easily sell your shares to cover the cost of purchasing them. On the other hand, if your company is already on the stock exchange, you can quickly sell your shares and use your profits to help cover the cost of exercising them.

In addition, if you exercise your options with a private company, you risk holding onto shares you can’t sell. This will depend on how long until the company’s initial public offering (IPO) when you can trade your shares on the stock exchange. Otherwise, you’ll have to wait until someone wants to buy your stake in the company directly.

Because of this, exercising stock options for a private company may be riskier, as you may not always know when you’ll be able to sell your shares.

3. Does it match your current financial situation?

Just like any other decision, you’ll want to determine if exercising your stock options aligns with your current financial plan and goals. If you can already comfortably afford all of your expenses, you may benefit from holding onto them if you believe your company’s stock price will increase.

But if you need an extra boost of cash and your options are in the money, exercising them could be the right decision for you and your investing or saving goals.

4. Can you afford the taxes?

Before deciding whether or not to exercise your stock options, you’ll want to check and see if there are any tax implications you should consider. Tax implications can vary based on your income, how many stock options you have, and whether your stock options are incentive stock options (ISOs) or nonstatutory stock options (NSOs).

- ISOs: This stock option is exclusively for employees and may be subject to preferential tax treatment if held for the required holding period.

- NSOs: This stock option may be given to outside parties other than employees, such as advisors or consultants, and are subject to income tax rates upon exercise.

To help you understand what taxes you may be subject to pay and when, we’ve gathered a general overview of what you can expect throughout the employee stock options process, whether you have ISOs or NSOs.

| Tax implications for ISOs | Tax implications for NSOs | |

|---|---|---|

| When you receive an options grant | None | None |

| When your options vest | None | None |

| When you exercise your options | Alternative minimum tax | Ordinary income tax |

| When you sell your shares for profit | Capital gains tax | Capital gains tax |

If you determine that the tax cost of exercising your stock options outweigh the profits, then it may not be the right time for you to exercise them. For example, if additional income from your stock options pushes you into a higher income tax bracket, you might hold off on exercising your options if you can’t afford the increased taxes.

And remember, many factors can determine the taxes you’ll pay when exercising your options. Because of this, be sure to reach out to a tax expert if there is anything you’re unsure of.

5. Are you leaving your company anytime soon?

For those who believe they will be leaving their current company soon, you’ll want to do your research and figure out if there are any specific deadlines by which you should exercise your shares.

In many cases, companies will have a 90-day post-termination exercise period (PTEP) in which you can still exercise your options even after leaving the company. If you miss this period, you won’t be able to exercise your options and may miss out on profits.

6. How is your company doing?

Lastly, you’ll want to consider how you think your company will perform. If you think that your company’s stock price could fall below your exercise price in the near future, you may want to exercise them while they are still in the money.

Alternatively, if your stock options are currently out-of-the-money but you believe your company’s stock will begin to grow, you might want to wait before exercising your options.

Pros and cons of exercising options early

| Pros | Cons |

|---|---|

| Reduced ISO tax implications | Must use your own money |

| Longer holding period for capital gains tax | Stock value could decrease |

| Lower risk of additional taxes |

Starting with the pros, you may want to exercise your stock options early to take advantage of the following:

- Reduced ISO tax implications: To qualify for favorable tax treatment for ISOs, you need to hold your shares for one year after exercising them and two years after you’re granted the stock options. By exercising your stock options early, you can get a head start on the one-year holding period.

- Longer holding period for capital gains tax: By starting your holding period earlier, you may be eligible to pay long-term capital gains tax when you sell rather than short-term capital gains tax, which is more expensive.

- Lower risk of additional taxes: If you decide to exercise your stock options as soon as they’re granted and the exercise price is the same as their current share price, you may not have to pay the taxes that you’re subject to due to capital gains.

But, exercising your options early may not be for everyone, as it has the following cons:

- Must use your own money: By exercising your stock options before you’re able to sell them, you won’t be able to sell all or some of your shares to help cover the cost of exercising them.

- Stock value could decrease: If you decide to wait until your vesting date, you’ll have time to get a sense of whether or not you believe the stock is performing well. By skipping this period, you may risk paying for a stock early that may go downhill in price due to a bear market or poor performance.

Now that you have an idea and what to consider when exercising your stock options and the pros and cons of doing it early, let’s take a look at the different ways you can exercise them.

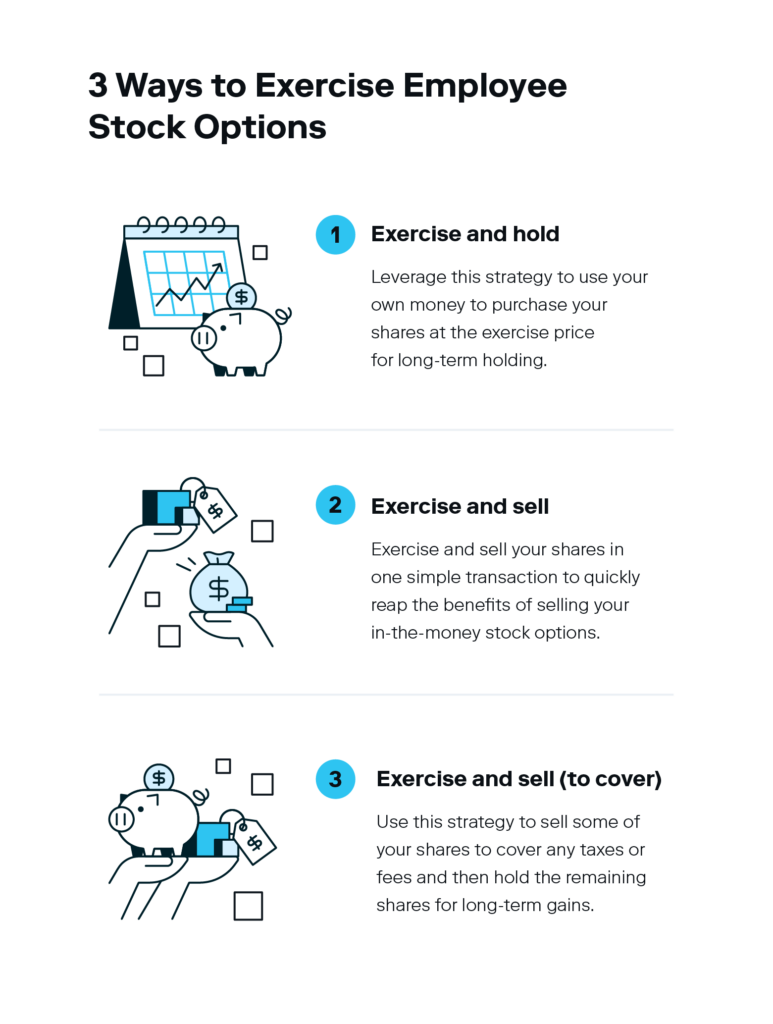

How to exercise stock options: 3 methods

Once you’ve decided that the time is right to exercise your stock options, you may wonder exactly how you should do it. To help you make your decision, we’ve gathered three popular methods for exercising stock options:

- Exercise and hold: In this method, you’ll use your own money to purchase your shares at the exercise price and then hold them for a short or long term period. This method can be risky because there is no guarantee you’ll make any money, as the stock price could plummet after your purchase.

- Exercise and sell: As long as your company is public, you may be able to exercise and sell stock options in one transaction. This is a great method for those that are looking to sell their in-the-money shares without a desire to hold onto them any longer.

- Exercise and sell (to cover): Similar to the method described above, you can also exercise all of your shares and only sell a partial amount to cover any applicable fees or taxes. Once you’ve sold enough shares to cover the cost of exercising, you can do whatever you want with your remaining shares.

The method you decide to use can vary depending on what you’d like to do with your shares. If you expect your company’s share price to grow, you may decide to exercise and hold. On the other hand, if you feel your company’s stock price is at its peak, you may want to exercise and sell them in one simple transaction.

No matter your investing goals, employee stock options are a great way to diversify your portfolio and purchase shares of your company’s stock, whether you decide to sell them upon vesting or keep them long-term.

When to exercise stock options FAQ

Read along to learn the answers to some common questions surrounding when to exercise a stock option.

When should I sell my exercised shares?

Once you’ve exercised your stock options and have ownership of your shares, you can decide to sell them whenever you want. Because the stock market is always changing, the right time to sell your shares can vary based on market conditions and your investment goals.

What is the difference between a stock option plan and stock purchase plan?

The difference between a stock option plan and a stock purchase plan is that an option plan gives you the right to buy stocks at a predetermined exercise or strike price, and a purchase plan is a company-run program that allows eligible employees to purchase company stock at a discounted price. With a stock purchase plan, employees may have to pay into the program through payroll deductions.

What happens to your stock options if you leave your job?

Generally speaking, you will have up to 90 days to exercise your stock options once leaving your job. As always, remember to read the fine print on your stock options to ensure you aren’t missing out on any exercise deadlines or requirements.

Do stock options expire?

Yes, stock options do expire. To find out when your stock options expire, refer to your agreement.

How do employee stock options work?

Employee stock options are a form of compensation that gives employees the right to buy a specified number of shares at a set price after the vesting date.

What are the different types of employee stock options?

The two main types of employee stock options are incentive stock options (ISOs) and nonstatutory stock options (NSOs), which differ based on when and how they are taxed.

When can options be exercised?

You can exercise your employee stock options any time between the vesting date and the expiration date. In some cases, you may also be able to exercise options early to get a head start on certain holding requirements. To be sure, double-check your stock options agreement to figure out when you can exercise your options.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024