Oct 20, 2022

How To Trade Options: The 4-Step Beginner’s Guide

Options are a popular investment tool for a number of reasons. They can be a great way to grow your income, limit risk, and hedge against market fluctuations at the same time, making them a good addition to your portfolio. That said, the mechanics of options trading aren’t all that straightforward, and there are a variety of options strategies ranging from fairly simple to more complex.

Options are an instrument that sets a contract to buy or sell stock at a certain price by a certain date. When you buy an options contract, you then have the option—but not the obligation—to buy or sell stock at a predetermined price (or the strike price) by a certain date (or the expiration date). Investors may use options trading for income, speculative investments (betting on price fluctuations to turn a quick profit), or to hedge risk.

Here’s what we’ll cover in our guide to trading options:

- 1. Open an options trading account

- 2. Pick your options

- 3. Examine the option strike price

- 4. Determine the option time frame

- Plus: what beginners should know about trading options

- FAQs about how to trade options

Read along to learn how to buy and sell options.

1. Open an options trading account

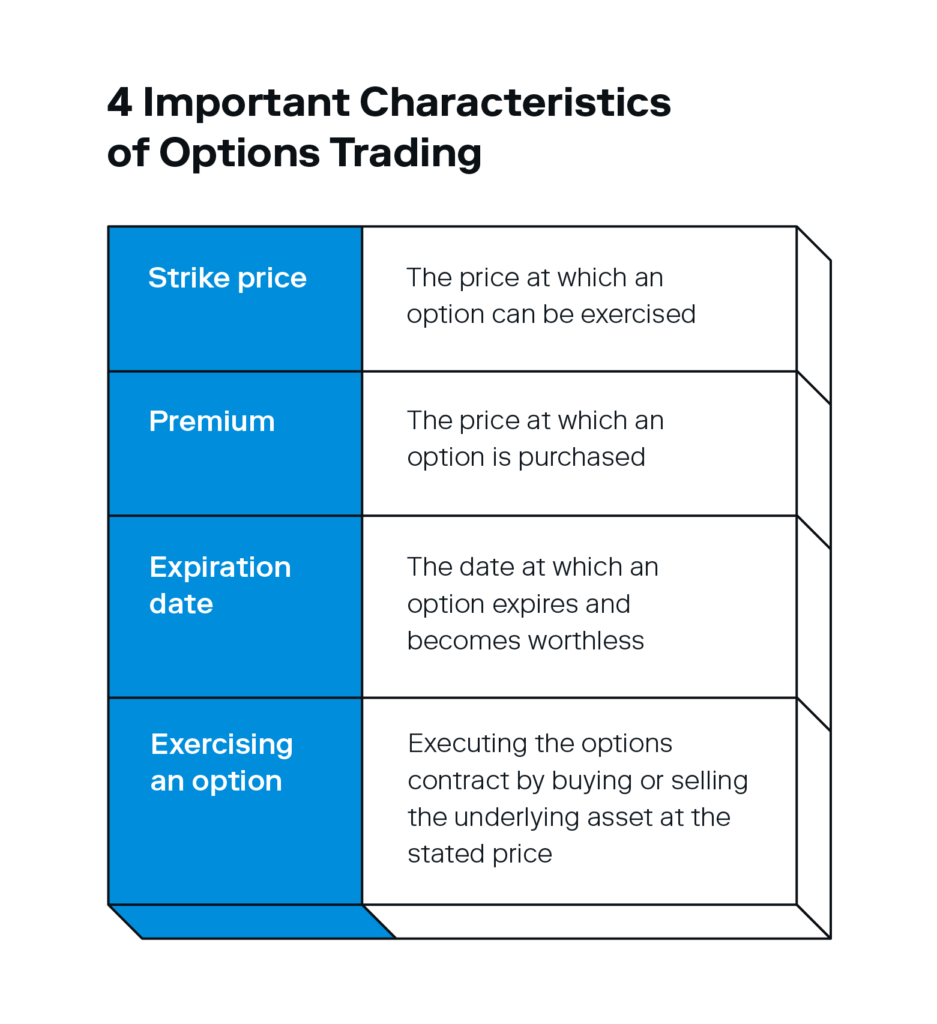

Before we cover how to trade options, here are a few key terms to know:

- Underlying stock: the stock represented by the option

- Strike price: the predetermined price at which an option can be exercised

- Premium: the price of the option

- Expiration date: the last day options can be exercised

- Options contract: the vehicle by which options are sold

In order to trade options, you’ll need to open an options trading account. Given the complexity of options trading, it requires more capital upfront than a regular stock trading brokerage account.

Brokers are more thorough in screening potential investors who want to trade options—they’ll assess things like your market knowledge, trading history, and understanding of the risks involved. These details will be compiled in an options trading agreement and sent to a broker for approval. You’ll also need to include the following information when you open an options trading account:

- Investment goals: this may include income generation, growth, or speculation.

- Trading history: you’ll need to show a strong history of trading experience and investment knowledge, in addition to things like how long you’ve been trading or how often you trade annually.

- Financial details: you’ll need to provide your annual income, employment information, total net worth, and liquid net worth.

- Types of options you want to trade: the two most common types of options contracts are calls or puts, and you’ll need to note which type of contract you want.

Once you’ve provided the necessary information, your broker will review your contract request before confirming its approval.

| Investor tip: Options aren’t stock; they’re adjacent to stock. Think of an option like a mini version of the stock it’s attached to. |

2. Pick your options

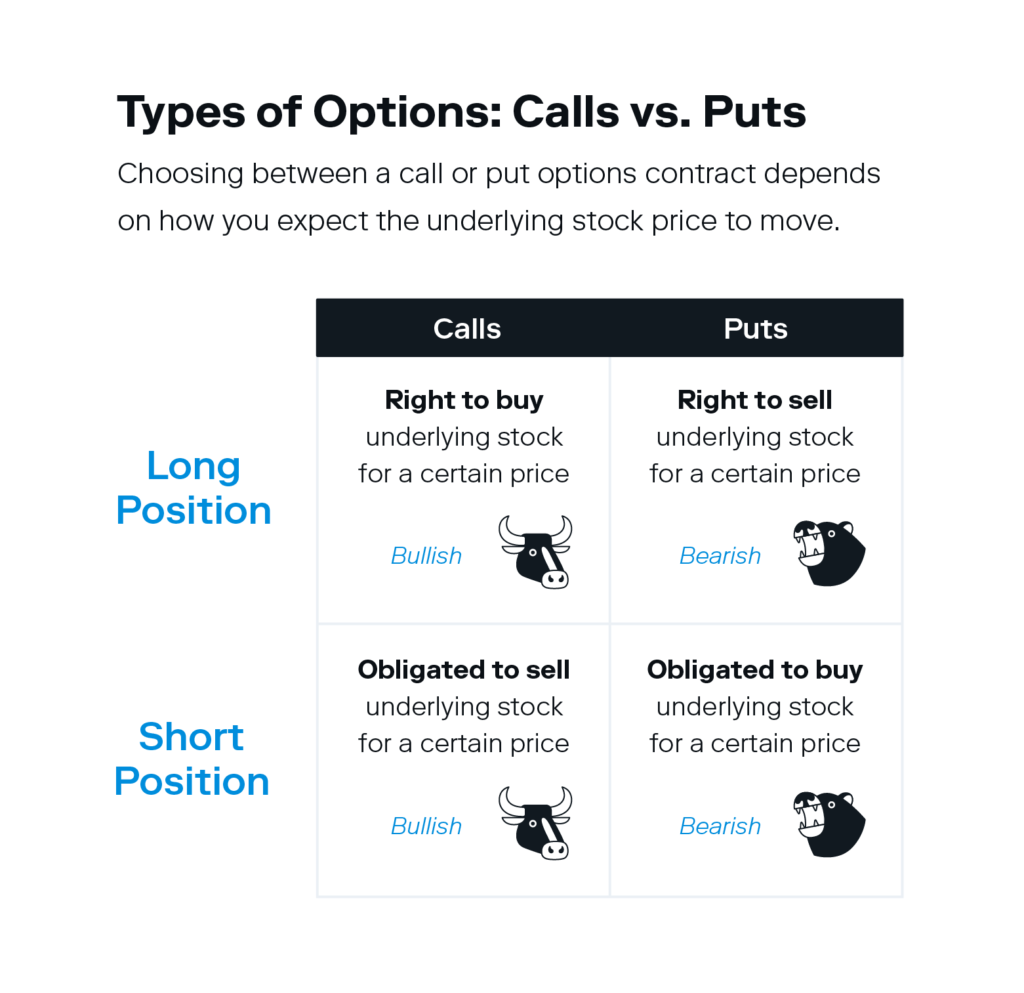

There are two basic types of options: “call” and “put” contracts.

- Call options: the right to buy (call) a stock or underlying security

- Put options: the right to sell (put) a stock or underlying security

A trader who believes a stock will go up would buy call options, and a trader who thinks a stock will go down would buy put options. For selling options, a trader who believes a stock will drop in price would sell call options, and they would sell put options if they believe a stock will go up.

So, the options contract you choose will depend on how you expect the underlying stock price to move. Generally:

- If someone believes a stock price will go up, they buy call options and/or sell put options.

- If someone believes a stock price will go down, they buy put options and/or sell call options.

- If someone believes a stock price will remain stable, they could sell call or put options simply to collect the premium.

On a high level, knowing how to buy options begins with taking either a bullish or bearish strategy—bullish if you predict a rising stock price, bearish if you predict a declining stock price—based on your specific goal (such as to generate income or hedge against risk).

3. Examine the option strike price

The option strike price plays an important role in choosing which contracts to buy because they greatly affect how the options will trade.

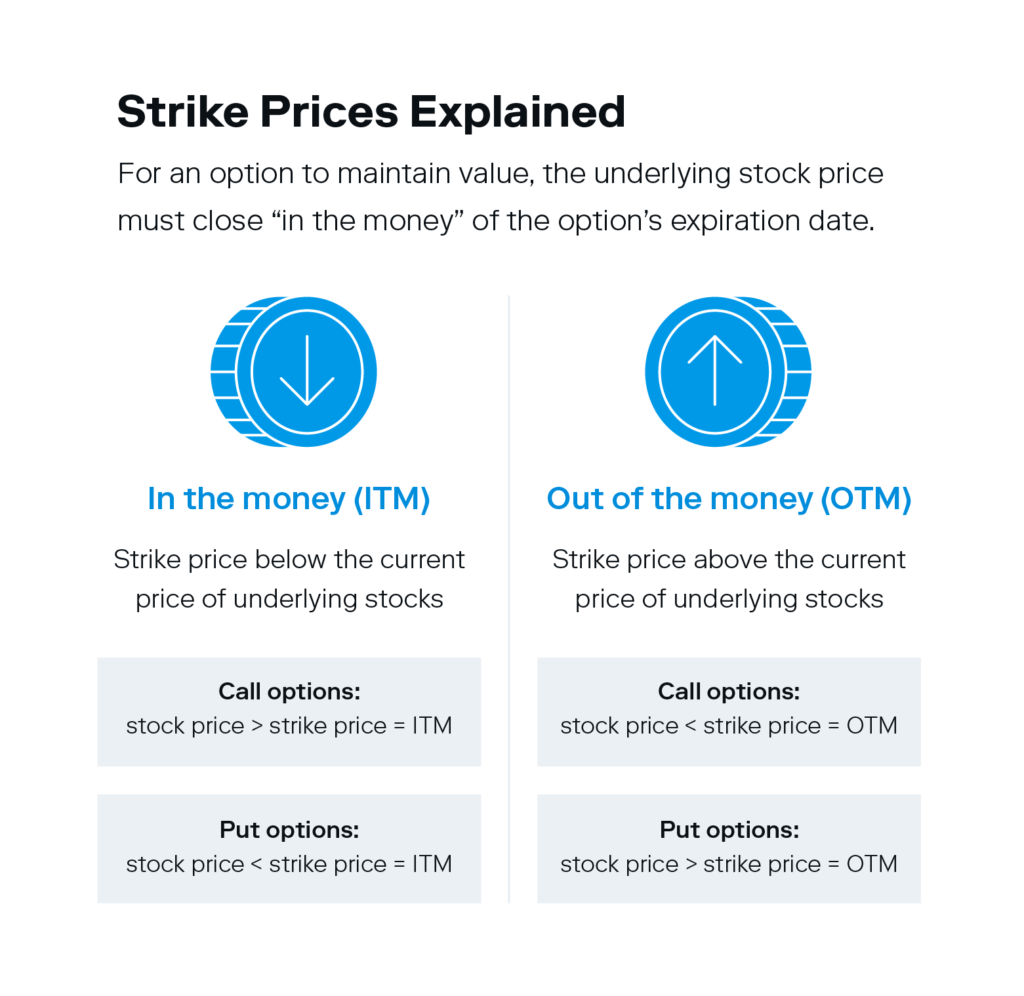

A strike price can fall into one of two categories: “in the money” and “out of the money.” These refer to the underlying stock’s price in relation to the strike price of the options contract.

- In the money (ITM): calls with a strike price below the current price of the underlying stock (or for puts, a strike price above the current stock price)

- Out of the money (OTM): calls with a strike price above the current price of the underlying stock (or for puts, a strike price below the current stock price)

Remember, the strike price is the predetermined price that you can either buy or sell your shares for. To maintain an option’s value, the underlying stock price must close “in the money” of the option’s expiration date.

For example: if you think the share price of a stock that’s currently trading at $100 is going to rise, a call option with a strike price of $90 would be ITM, since the underlying stock price is higher than the strike price. If you think that share price is going to drop to $75, you would look for an option with a strike price higher than $75 with the hopes that when the price falls you can capture the difference. Once the share price falls below the strike price the option becomes ITM and you would want to exercise the option.

4. Determine the option time frame

The last step on how to trade options is determining the option time frame. Unlike stocks, all options contracts eventually expire—the closer they are to the expiration date, the less value they have. That’s because the chances of price movement in the underlying stock decrease as the expiration date draws near. Conversely, the longer your time frame, the more time the underlying stock has to move in your favor (and the more expensive the options contract will be).

Option expiration dates and time frames may be as short as a few days or as long as a few years, but daily and weekly options are best saved for advanced options traders. For long-term investors, monthly and yearly expiration dates are ideal.

Plus: what beginners should know about trading options

With dedicated time and practice, options trading for beginners is possible. A covered call is a good options trading strategy to start with—it offers limited return in exchange for limited risk, with the goal of generating income through options premiums.

A covered call is when a trader sells a call option (also known as “going short”) for 100 shares of an underlying stock they already own. The underlying stock acts as a hedge against risk because it limits the potential losses you’d normally be exposed to by going short on stocks you don’t yet own (which is a riskier strategy known as short selling).

As the seller, you hope the option will decrease in value so you can buy it back for less, or let it expire worthless at the expiration date. In that scenario, you’d get to keep the premium and your underlying shares of the stock.

However, there’s also the possibility of being obligated to sell the stock if the option buyer (the person you sold your call option to) chooses to exercise the option. For this reason, only consider this strategy if you’re comfortable selling your shares if the trade doesn’t go in your favor.

As risky and complex as options trading tends to be, it can offer high returns over shorter periods of time if you know what you’re doing. Learning how to start options trading comes down to not only choosing the right strategy based on stock price predictions, but also being able to time that strategy correctly. If you make a wrong move, you could lose your entire investment in a matter of weeks.

If your goal is to generate income with less risk, a long-term investment strategy is a far safer alternative. Buying and holding your investments for long periods of time is a dependable avenue for wealth-building—one that doesn’t require any in-depth stock analysis, market timing, or the risk of short-term bets.

FAQs about how to trade options

Still have questions about how to start trading options? We have answers.

Why trade options?

There are different reasons an investor may choose to trade options, and different options trading strategies can enhance a portfolio in different ways. The most common reasons for trading options include generating extra income, leveraging existing assets for potential returns, or hedging against market volatility.

What is the difference between American options and European options?

American options can be exercised at any time before the expiration date, while European options can only be exercised on the day of expiration.

How much money do you need to trade options?

You can start trading options for as little as $200, but such a small investment makes it difficult for certain strategies to be profitable—most advisors recommend $5,000 as a strong minimum investment to see sustainable returns. If you’re a beginner, however, starting out with smaller investments is a good way to gain some options trading practice.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024