Jul 25, 2018

What Are Payday Loan Stores? The Sharks of the Financial Industry

A payday loan may get you out of a jam, but beware what lurks beneath the surface.

Much like the sea, the financial industry is filled with predators. And much like a dip in the ocean, if you see fins start breaching the surface, it can be tough to know whether they’re harmless dolphins or sharks.

Predatory lenders can turn your dreams of financial independence into a (metaphorical) bloodbath.

And when it comes to money, payday loan providers are the hammerhead sharks you might want to watch out for.

Read more: Get started building your financial lifeboat right now.

In honor of Shark Week, let’s talk about payday loans stores and why they’re more likely to sink your finances than rescue them.

What are payday loans?

Payday loans are short-term, high-interest loans designed for borrowers who need some extra cash to make it to payday. Generally, borrowers are expected to repay their loans within a couple of weeks or face paying sky-high interest rates.

Here are a few key qualities of payday loans, according to the Consumer Financial Protection Bureau:

- Payday loans are typically less than $500.

- Repayment is usually made within two to four weeks.

- Interest rates for payday loans can be very high—fees can be as much as $15 per $100 borrowed, or an effective 400% APR.

The payday loan market

Why would people be willing to pay so much in interest and fees? It’s hard to say for sure, but there’s clearly a market for short-term lenders. Or, if you want to think of it another way, there’s plenty of blood in the water.

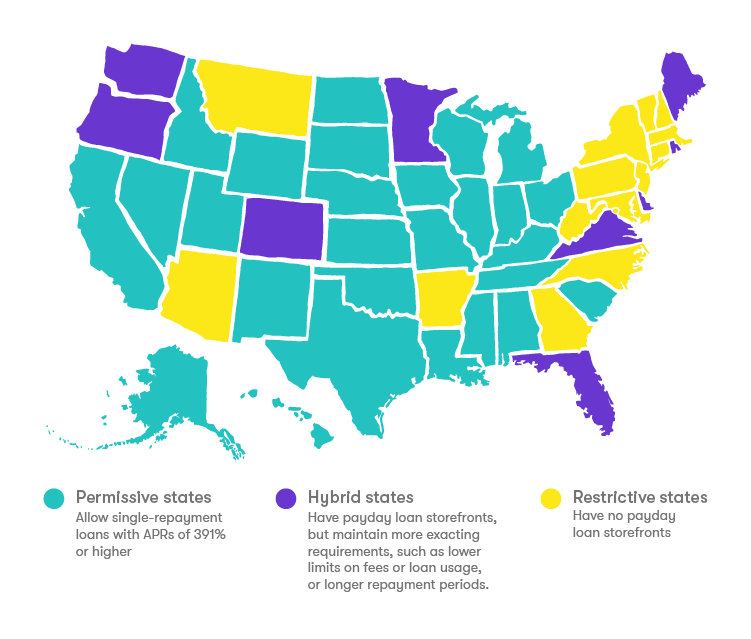

The industry has grown over the past two decades, though it’s been at odds with government regulators for most of that time. Payday lenders are barred from operating outright in a number of states and operate under stringent rules. Generally, states on the east coast have tougher laws regulating payday loan shops:

Here are some statistics about the payday lending market:

- Around 12 million Americans use payday lenders annually, according to research from Pew Charitable Trusts.

- An average borrower spends $520 in fees to take out a $375 loan (Pew).

- There are more payday loan stores (~20,000) in the U.S. than McDonald’s (~14,000) and Starbucks (~13,000), and combined, these loan shops facilitate $46 billion in loans and rake in $7 billion in fees every year.

Blood in the water (or in your bank statement)

Why do so many Americans choose to swim with the sharks and borrow from payday lenders?

The answer isn’t so simple—reports indicate that more than 75% of Americans live paycheck to paycheck. Almost 70% have less than $1,000 in savings, and 34% have absolutely nothing saved.

On average, payday loans account for 38% of a borrower’s paycheck:

But the average a borrower can afford to pay back is only 5%, creating an endless cycle of debt:

So, where do you turn if you have no financial backstop, perhaps coupled with a bad credit score that prohibits you from getting a credit card or personal loan? A payday lender may be the answer.

This is why payday lenders are often referred to as “predatory”—while lenders aren’t necessarily out to con people out of their money, they are targeting a desperate and often financially illiterate class of consumers who don’t realize what they’re signing up for.

Avoid shark bites

While there are many consumers who use payday loans wisely, they can be dangerous—sometimes leading into a debt spiral—if you’re not careful. If you want to swim with the sharks, remember that you run the risk of getting bitten.

The single best way to avoid the need for a payday loan? Start saving, and build up an emergency fund that you can dip into when payday is days away.

*Stash is not affiliated with Discovery Channel’s Shark Week

Related Articles

Credit Cards vs. Debit Cards: The Differences Can Add Up

How To Pay Off Your Student Loans Faster

How To Pay Off Credit Card Debt

What Is the Debt Snowball Method?

Planning Your Finances as a Member of the Military

How to Build Credit: Why You Need It and How to Get It