Nov 14, 2018

What If The Market Takes a Downturn? Should I Consider Selling My Investments?

Market downturns and recessions can be scary. Here’s why you should resist the temptation to sell your investments

Market downturns can be scary.

When the Dow and S&P 500 and other important indexes take a nosedive, and your stock holdings and other investments lose money, you may have the overwhelming temptation to sell them.

We understand that impulse. But selling based on the day’s market news is one of the easiest mistakes for new investors to make.

Beginner investors may be tempted to buy when the markets are high and sell when they go down. It’s just human nature to want to be part of the good times and to exit when things get tough.

Here are some things to consider.

Don’t try to time the market

But trying to predict which way the market is heading is called market timing. It’s when you try to make guesses, often with incomplete or incorrect information, about whether markets will go up or down, and then buy or sell according to whether you think your investments will make or lose money.

Over time, various studies show investors who try to time the market tend to lose money relative to those who just buy and hold diversified portfolios.

Here are some things to think about before you hit the “sell” button:

Over time, markets tend to rise

From 1928 through the end of 2017, the S&P 500 had an annual return of 9.65 %. Going forward, experts predict its returns will be closer to 5.5%.

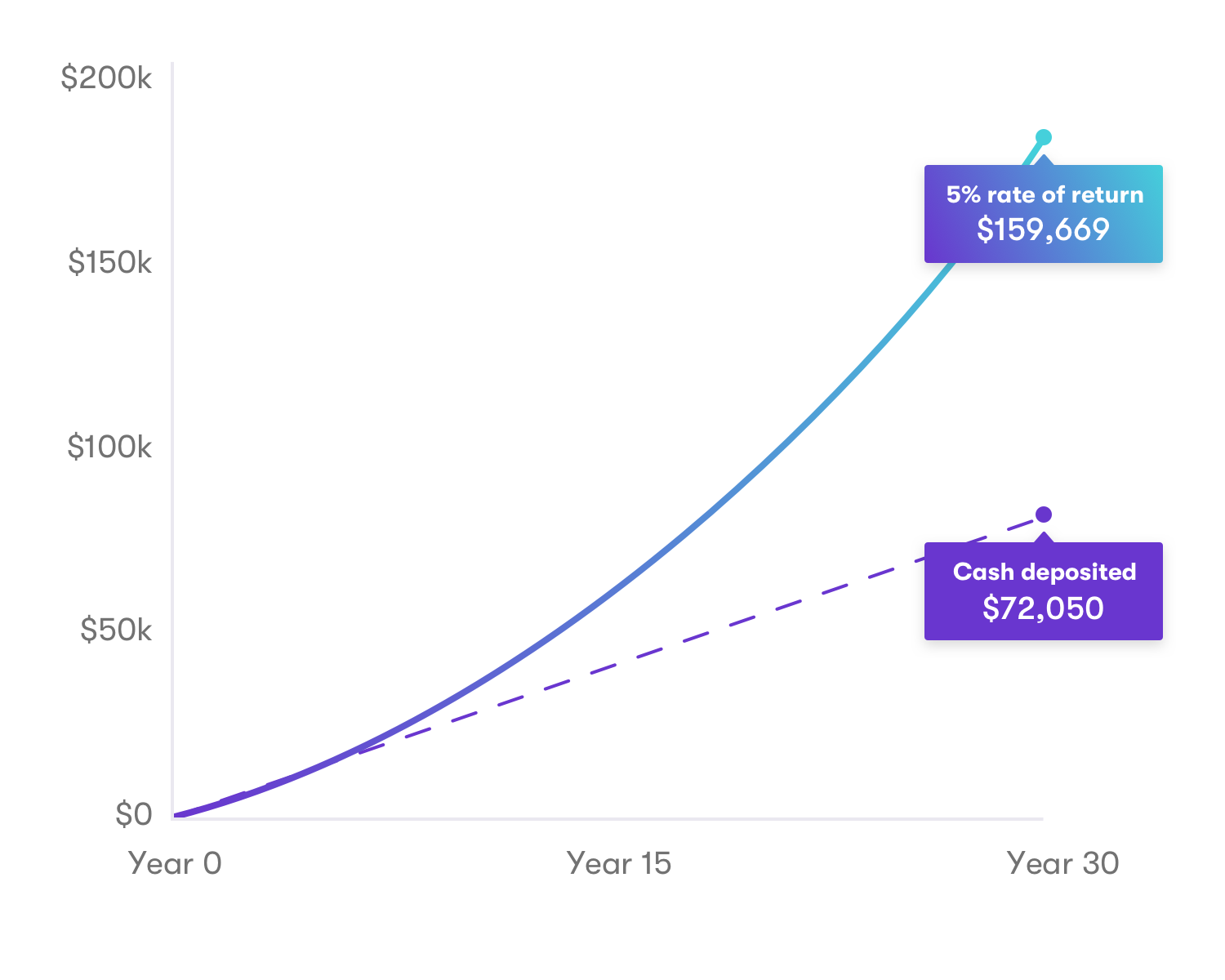

If you make even small, regular investments, your money is likely to grow over time. This is particularly true, thanks to the power of compounding. Compounding is when the interest and earnings on your principal investment also earn interest and returns.

By selling when markets go down, you’ll be locking in your losses.

If you invest for the long run, meaning you stay invested for 20, 30 or even 40 years, you can put yourself in a better position to partake in the gains of the market over time.

Consider adjusting your portfolio.

For example, when your holdings perhaps grow too big in one area, such as technology, financial services, or some other industry. Then you should consider shifting assets in your portfolio to other areas, to achieve better balance and diversification.

You can also adjust your portfolio to invest more in bonds.

Bonds have their own risks, including being subject to interest rate increases and inflation. But in addition to being a good way to diversify your portfolio, bonds are generally considered safer than stocks as their performance tends not to move in tandem with equities. For example, when stocks go down, bond prices tend to increase, particularly when the economy is entering a recession. You should never panic as there is a relatively simple way to reduce the volatility of your portfolio—just allocate more of your portfolio holdings to bonds.

Some bonds, such as U.S. Treasuries, are considered among the least risky investments.

Always important to note: All investing requires risk. There is no reward otherwise. It’s possible for markets to go through a period of sustained losses, as they did during the financial crisis of 2008, which can result in a negative return on your investments.

Get to know the Stash Way

We think the best approach is to take a long-term view of the money you invest. It’s part of the Stash Way.

- Invest regularly.

- Diversify your portfolio.

- Invest for the long-term

Learn more about The Stash Way.

Disclaimer: Expected returns or probability projections are hypothetical in nature and may not reflect actual future results. This is a hypothetical illustration of mathematical principles, is not a prediction or projection of performance of an investment or investment strategy, and assumes weekly contributions at a 5% annual rate of return (compounded annually) and does not account for fees or taxes. It is for illustrative purposes only and is not indicative of any actual investment. Actual return and principal value may be more or less than the original investment.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024