Sep 14, 2018

The Great Recession Was 10 Years Ago: What Happened?

The economy is in full recovery today; here’s a look back

What was the Great Recession? How did it start?

Ten years ago this week, an investment bank called Lehman Brothers collapsed, ushering in the worst financial crisis the U.S. had experienced since the Great Depression.

The bank’s failure set off a chain reaction with other banks and the stock market, stoking a financial panic that led to a severe recession in the U.S. and ultimately throughout the globe.

But a decade later, the U.S. economy is in full recovery, and many of the world’s other economies have recouped their losses too. Unemployment is at a near-record low. Housing prices have rebounded from their depths. And workers’ wages are rising at the fastest pace since 2008.

Still, it’s important to remember our financial history, and to see what caused the worst recession in nearly 80 years, and to understand how things have changed.

Here’s a look back at the most important events:

Why was Lehman Brothers’ failure such a big deal?

In September 2008, Lehman became the first in a series of big banks to collapse, following risky bets in the housing market. The banks became illiquid—essentially a term that means they ran out of money to fund their operations.

Lehman Brothers was one of the oldest and most prominent investment banks in the U.S., founded in 1844, with assets worth hundreds of billions of dollars.

An investment bank is different from a commercial bank, where you do your daily banking. Investment banks specialize in giving corporations, governments, and other entities access to markets, by allowing them to sell stocks and bonds. They also help new companies sell their shares to the public in a process called an initial public offering.

Government officials discussed a bailout for Lehman but ultimately decided against it. As the bank collapsed, it set off a ripple effect that endangered or bankrupted dozens of other financial institutions, including investment and commercial banks and insurance companies, including AIG, Merrill Lynch, Washington Mutual, and Wachovia.

Good to know: An investment bank called Bear Stearns failed months before Lehman, but before it could go bankrupt, it sold itself to the bank JPMorgan Chase, following pressure from the U.S. government.

In hindsight, many financial experts say the federal government could have limited financial damage to the economy if regulators had rescued Lehman Brothers.

Ultimately, hundreds of other banks failed in the two years following Lehman’s meltdown, and the government stepped in with $700 billion in funding to either rescue them or shut them down, in a program that was known as the Troubled Asset Relief Program (TARP).

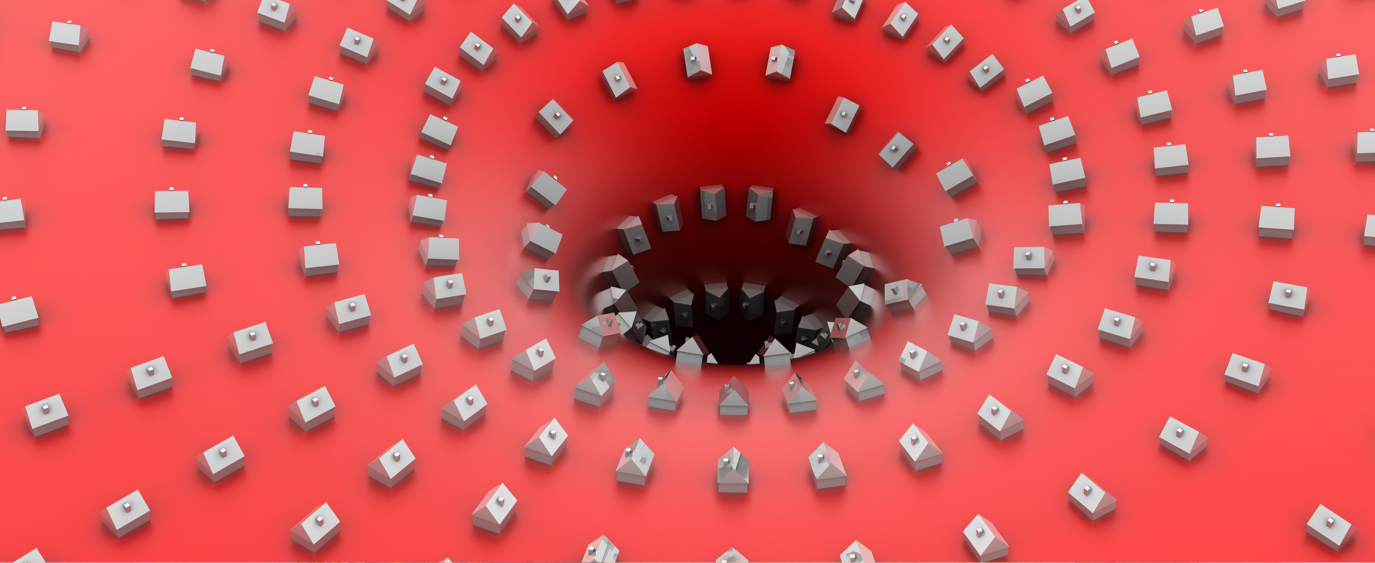

The Housing Crisis

The financial crisis had its roots in the housing market, specifically with home mortgages.

In the 2000s, banks loosened their credit standards for mortgages and sold trillions of dollars of high-dollar loans to risky borrowers. These were known as “subprime mortgages,” because they were given to borrowers with either bad or low credit scores. Investment banks packaged the loans together and sold them to investors, who had little insight about the underlying risks of these securities.

The investments were also resold as something called derivatives, which are complex trading instruments. These were referred to as “collateralized bond obligations” (CBOs), and they grew so complicated, that few people actually knew what they contained.

Ultimately, a tidal wave of subprime mortgage borrowers defaulted on loans they could not afford when home values started to fall in 2007. That set off a chain reaction with banks that had loaned money that would never be repaid.

These unpaid mortgages became known as “toxic assets,” because they were essentially trillions of dollars in worthless debt.

Financial institutions had more debt than cash, and wound up short of funds to pay their investors, and even customers.

Impact on the stock market

In the six months that followed the crisis, indexes such as the S&P 500, which represents 500 of the largest company stocks in the U.S., fell 40%. Investors lost trillions of dollars of wealth.

Good to know: The S&P 500 has since regained its pre-recession value, gaining 130% over the last decade, with total annual returns of 11%. Investors who kept their money invested over the last decade are likely to have made back all of their losses.

The federal government took action in the months following the crisis. Here’s a look at some of its key actions.

Quantitative easing. The nation’s central bank, known as the Federal Reserve, played an active role in rescuing the U.S. economy during the financial crisis of 2008. It did this—through a process that came to be known as quantitative easing—by lowering interest rates, purchasing government bonds known as U.S. Treasuries, thereby pumping money into the banking system.

Federal regulation. In an attempt to prevent banks from taking risky bets with customer money, Congress passed something known as the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010.

More about Dodd-Frank

Dodd-Frank established new regulations to ensure that banks wouldn’t seize up and threaten the foundation of the economy again in the case of a financial crisis. Regulators concerned themselves particularly with large banks, deemed “Too Big to Fail,” whose collapse could jeopardize the entire financial system.

Among the new rules, most big banks were required to keep more money on hand to make sure they had a cushion in the event of another financial crisis. They also were forced to undergo strict “stress tests” to ensure they could handle a sudden economic downturn.

Dodd-Frank also restricted the kinds of business activity banks could pursue. Remember the mortgage disaster? Something called the Volcker Rule, a part of the new regulations, prohibited banks from taking risky bets with customer deposits, as they had done in the run-up to the mortgage crisis.

Our economy in 2018

So where are we now?

Ten years into a recovery, the stock market is at an all-time high and housing prices have returned to their pre-recession levels. Unemployment is at a 20-year low, wages are rising. Consumers are spending again.

The Fed has ended its quantitative easing program and is increasing interest rates once more. Meanwhile, Congress has begun rolling back some of the regulations affecting banks.

For the time being, the economy appears in sound shape. But it took many years to get here, and experts are still watchful about the next financial crisis.

“What we all learned in that particular panic is that we’re all dominoes,” Berkshire Hathaway founder and world-famous investor Warren Buffett recently told CNBC in an interview about the financial crisis. “And we’re all very close together.”

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024