Jun 10, 2019

How to Manage Student Loan Debt

Pay off principal and consider extra payments.

Student Loan Debt Repayment Strategies:

- Try to pay more than your monthly minimum payment, which can primarily be interest.

- By paying more than your interest, you’ll be paying down your principal.

- Consider making extra payments if you can, as it will help you pay down principal faster.

- Aim to pay off your loans in ten years or less, which is the standard for federal student loans. The longer you take to pay off your loans, the more interest you will pay, and the more expensive your original loan will become.

- If you’re confused by what you owe, call your lender and discuss how your payments are applied to your loan or loans.

Jargon Hack.

What is principal?

Principal

Principal is the original amount that you borrow on a loan. It’s different from interest, which is a percentage charged annually and added to the principal.

Principal

Principal is the original amount that you borrowed on your loan. It’s different from interest, which is a percentage charged annually and added to the principal. (Special note: Principal can also be a sum of money that you save or invest, on which you earn interest.)

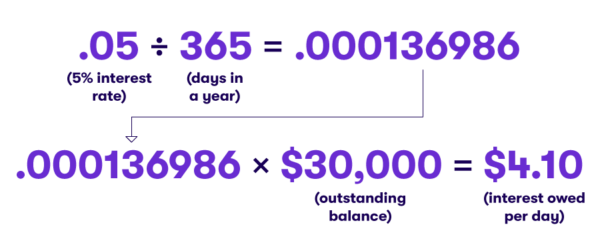

Example: Say you borrow $30,000, with an interest rate of 5%. The principal of the loan is $30,000. The interest rate is 5%, and your loan will accumulate interest charges on a daily basis.

To calculate your daily interest, divide the interest rate by the number of days in a year: 0.05/365=0.000136986.

Then multiply that number by your outstanding balance: 30,000 x 0.000136986=4.1. (So, $4.10 is approximately how much interest you owe per day.)

Next, multiply that amount by the number of days in the month: 4.1 x 30=123, or $123. That’s roughly how much interest you will owe each month.

If you had the option of making minimum payments of $123 per month, you’d only be paying interest and not paying down any of the $30,000 of principal. To pay off your loan with interest in ten years, you’d have to pay $308 per month, according to the federal student lender Sallie Mae.

Good to know: As you pay off your principal, the dollar amount of interest you owe will also decrease each month. (You can see how that works with this calculator.)

Learn more about student loans

Top Strategies for Paying Off Student Loans

Paying more than your minimum, tackling high interest loans first, and refinancing are some important pay-off strategies that we explore.

They Paid Off Their Student Loans In Under 5 Years

Living at home, living abroad, and living modestly are just a few ways these former students got rid of massive education loans. Let their stories inspire you to pay off your loans faster.

Have Student Loans But Didn't Get The Degree? Read On

The situation is more common than you think. And if it describes you, don’t despair. We’ll show you some things to consider if you have the debt but not the degree.

Podcast: How to Pay Off My Student Loans with Jodi Okun

Over half of college attendees under 30 took on debt to pay for their education. Among those making payments on their student loans, the typical monthly payment is between $200 and $300 per month.

Related Articles

Credit Cards vs. Debit Cards: The Differences Can Add Up

How To Pay Off Your Student Loans Faster

How To Pay Off Credit Card Debt

What Is the Debt Snowball Method?

Planning Your Finances as a Member of the Military

How to Build Credit: Why You Need It and How to Get It