Jun 3, 2019

How to Manage Credit Card Spending

Prioritize cash or debit over credit.

Credit Card Spending Strategies:

- Prioritize spending with cash, or a debit card. Cash is a physical thing, and you can actually see it leaving your wallet or purse when you use it for purchases. That may help you spend less.

- When you use a debit card, the money comes directly from your checking account. Generally speaking, you won’t be able to spend using the card unless you have funds in the account. (Consider opting out of overdraft protection.)

- If you must spend using a credit card, always try to pay off your balance in full each month. That way you won’t have to pay interest.

Jargon Hack.

What is an interest rate?

Interest Rate

It’s the amount that’s charged on any unpaid amount, or balance every month. The interest rate is also called the annual percentage rate, or APR, which is the amount your monthly interest translates to annually.

Interest rate

Every credit card account comes with an interest rate. It’s the amount that’s charged on any unpaid amount, or balance every month.

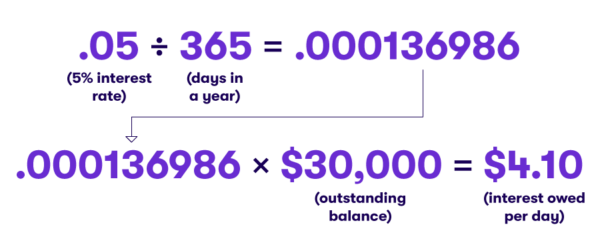

Here’s something else that’s important to know: When you have credit card debt, or an unpaid balance, the interest is charged daily. It’s called the daily periodic interest rate. Here’s an example:

Good to know: Credit card companies give you a grace period, generally between the statement closing date and the payment due date, to pay for your new charges. During that period, no interest will be charged. If you don’t pay your balance at the end of the grace period, you will owe interest. And any new charges will also accrue interest.

Learn more about credit cards

Credit Cards vs. Debit Cards: The Differences Can Add Up

Credit cards and debit cards may seem like the same thing, but they’re actually not. Find out why debit cards might be better for your daily spending.

5 Ways to Cut Down on Credit Card Spending

From disconnecting from online shopping sites to ditching plastic completely, we share some great ways to kick your credit card habit.

How to Build Credit: Why You Need It and How to Get It

Having good credit and a good credit history are essential for everything from buying a car or a home, to renting an apartment or finding a job. Read on to find out what credit actually is and how to build it.

Podcast: All About Credit and Credit Cards with Brianna McGurran

Learning the difference between healthy and unhealthy credit card use is key to having a strong financial life.

*Calculation: 1000 x 0.004931=49.31

Related Articles

Credit Cards vs. Debit Cards: The Differences Can Add Up

How To Pay Off Your Student Loans Faster

How To Pay Off Credit Card Debt

What Is the Debt Snowball Method?

Planning Your Finances as a Member of the Military

How to Build Credit: Why You Need It and How to Get It