May 10, 2023

What Are Fractional Shares?

Fractional shares are slices of a whole share of an investment like a stock, mutual fund, or exchange-traded fund (ETF). They can make investing more accessible by allowing you to buy a portion of a share that might otherwise be outside your budget. For instance, if Stock A costs $400 per share, a brokerage might sell one-tenth fractional shares for $40 each ($400/10 = $40). Fractional shares are also sometimes created in dividend reinvestment plans (DRIPs), during stock splits, and as a result of mergers and acquisitions.

In this article, we’ll cover:

- Fractional shares vs. whole shares

- How fractional shares work

- The benefits of fractional share investing

- The disadvantages of fractional shares

- Things to know about fractional share investing

The difference between fractional shares and whole shares

A whole share is a single share of a company’s stock, an ETF, or some other investment. Shareholders might sell for a profit, receive dividends, and vote on important company issues. But whole shares can cost hundreds or even thousands of dollars, putting them far out of reach for many investors.

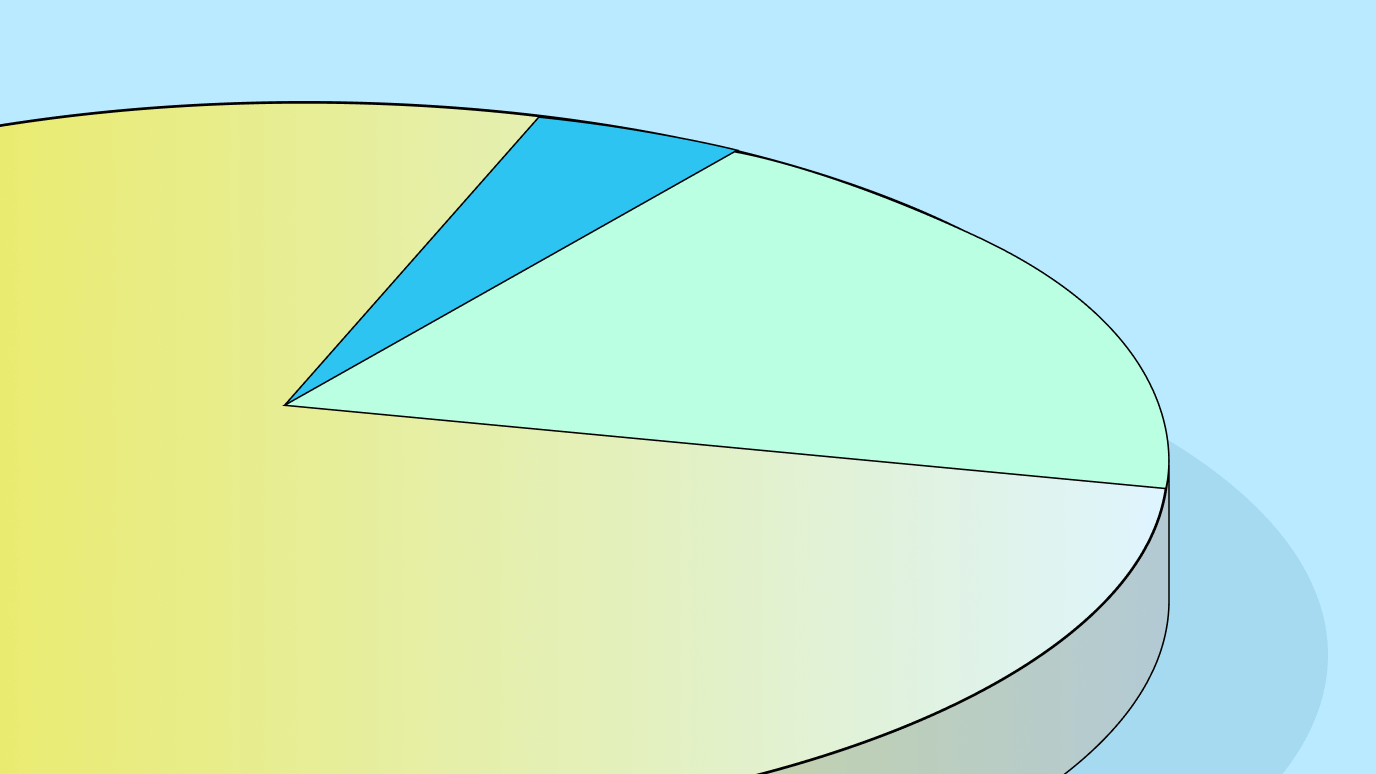

If you imagine a whole share is a pie, fractional shares are slices of that pie. The pie can be divided into a few slices or a great many. Fractional shares offer many of the benefits of whole shares at a lower purchase price.

Here’s an example:

- Alex wants to invest $100 in Company B, but a single share costs $1,000.

- Alex’s brokerage offers fractional shares of Company B’s stock.

- Alex invests $100 and receives a 0.1 share of Company B. ($100 / $1,000 = 0.1)

- When Company B’s stock price rises or falls, the value of Alex’s investment rises or falls proportionate to the fractional share.

While fractional shares allow you to invest with less money compared to whole shares, they aren’t available at every brokerage, and they may come with certain fees and limitations.

How fractional shares work

If you invest with a brokerage firm that offers fractional shares, you can purchase them like you would any other investment, like whole shares of stocks, ETFs, or mutual funds.

Until 2019, it was virtually impossible to purchase fractional shares directly from a brokerage. Many retail investors, however, were priced out of higher-value securities in the stock market. So brokers created fractional shares of popular investments, some priced at only a few dollars, to woo younger, middle-income investors. Nowadays, many brokerage firms offer fractional shares of both stocks and funds.

To create fractional shares, brokerages purchase full shares, slice them into fractions, and parcel out the slices to multiple investors. That’s why fractional shares typically can’t be transferred to a different broker if you switch investment firms; instead, your broker will usually buy back your fractional shares. In that case, you’ll owe taxes on any profit you make from selling your shares back to the broker.

Fractional shares created through DRIPs, stock splits, and mergers

Fractional shares are sometimes created as a consequence of dividend reinvestment programs (DRIPs), stock splits, and mergers and acquisitions. In some cases, whole shares you own may become fractional shares.

DRIPs, which repurpose dividend payments to purchase additional shares of the same investment, result in fractional shares whenever share prices exceed dividend payments.

A type of stock split may also produce fractional shares. There are two types of stock splits: a forward stock split, in which more shares are created, and a reverse stock split, in which shares are consolidated to create fewer whole shares. The value of your overall investment doesn’t change; the only alteration is the number of shares you own.

A reverse stock split might result in whole shares you own becoming fractional shares. Here’s a hypothetical example of it might work:

- Imagine Jaylen owned two shares of stock in Company X, each worth $100. The total investment is worth $200. ($100 * 2 = $200)

- Company X conducts a 1:4 reverse stock split. In a reverse split, shares are consolidated to create fewer overall shares. Thus, after a 1:4 reverse split, every $100 share is a 0.25 fractional share worth $100. A full share costs $400.

- The reverse split converts Jaylen’s two whole shares, worth $100 each, to two 0.25 fractional shares worth $100 each.

When a company merges with another company or is acquired, fractional shares may also be created, depending on how the merger or acquisition is structured.

Benefits of buying fractional shares

The availability of fractional shares has opened new doors for many investors. It takes less money to invest in stocks, giving you access to a wider pool of investments, especially stocks with high share prices. As a result, you might be able to start investing sooner and find it simpler to diversify your portfolio.

Key fractional share investing benefits include:

- Start investing with an amount that fits your budget

- Invest in stocks that match your interests and strategy

- Get access to investing in more expensive stocks

- Explore investments in more types of securities

- Find more options for portfolio diversification

Fractional shares allow you to start out small, but you can still potentially earn a return on your money. That’s especially true if you have a long time horizon for your investment. Even small beginnings can earn you money, and with the power of compounding, they can grow significantly given enough time.

Disadvantages of fractional shares

So what are the drawbacks of purchasing a fraction of a share? They vary significantly among brokerages; you may find differences in trading rules, costs, fees, and more. It’s always critical to do your research before investing, and fractional shares are no exception.

Potential disadvantages to consider include:

- Limits on when, how, and what you can sell

- Fees for trading fractional shares

- Lower dividend income and profits

- Lack of stock voting rights

- Risk of illiquid shares that are difficult to sell

- Tax consequences when changing brokerages

Fractions or full shares: multiple paths for your portfolio

Fractional shares may be worthy of careful consideration, especially for new investors. They can open opportunities to investing that align with your budget, allowing you to start investing and diversifying your portfolio more easily. At the same time, they can come with restrictions that could surprise an unwary investor.

If you’re interested in fractional share investing, you’ll find options at many brokerages, like Stash. Take the time to do your research, and you may find yourself investing in the stock market with more confidence.

Investing made easy.

Start today with any dollar amount.

Fractional shares FAQ

1. Do fractional shares add up to whole shares?

Yes, although not in your portfolio. The brokerage buys a full share, divides it into slices, and sells the slices to different investors. It is possible to buy enough fractional shares of one stock to equal a whole share. For example, if a stock was available to purchase as 0.25 fractional shares, buying four of those fractional shares would equal a whole share. (0.25 x 4 = 1)

2. Do fractional shares pay dividends?

If an investment pays dividends, fractional shareholders receive a proportional share. For example, if Stock D paid a dividend of $10 per share and you owned a 0.5 share, the dividend payment would be $5. ($10 * 0.5 = $5)

3. Is it better to buy fractional shares or whole stocks?

Ultimately, that’s a question every investor must answer for themselves. But fractional shares might be a good fit for your portfolio if you’re new to investing, or want more diversification in your portfolio without investing a lot more money. It’s also important to understand your brokerage’s rules and costs. In some cases, you might face limitations or fees that tip the scales away from fractional share investing.

4. Is it worth buying fractional shares?

The answer depends on your financial situation, your investment strategy, and the brokerage you’ve chosen. For example, you might discover fees that make fractional shares seem less worthwhile. Or you might want the freedom to transfer your portfolio; fractional shares are typically not transferable between brokerage firms, and liquidating them can have tax consequences.

That said, fractional shares offer a great deal of flexibility. To decide whether fractional shares are right for you, consider your long-term goals, brokerage fees and costs, and how closely its rules align with your financial strategy. And remember that all investments involve risk, including the risk that you could lose money.

5. Are ETFs available as fractional shares?

Sometimes. Each brokerage chooses the securities it will sell as fractional shares; some offer fractional shares in ETFs.

6. Can you sell fractional shares?

As a general rule, brokerages allow you to trade your fractional shares, although each has different rules and costs. But your brokerage may not guarantee liquidity. Liquidity measures how quickly and easily you can sell an investment without taking a loss. Lack of liquidity, or illiquid shares, can take longer to sell, and you might lose money.

7. Are fractional shares included in DRIPs?

A DRIP uses dividends you earn to purchase more shares of the same security. DRIPs frequently result in fractional share ownership, because any given dividend payment might not be enough to buy a full share of stock.

How to invest in fractional shares with Stash

Learning how to invest in fractional shares can be simple with Stash. Just open an account, choose the investments that interest you, and Stash does the rest. Stash offers fractional shares of ETFs and single stocks, starting at any dollar amount. If you’re not sure where to start, you might try the Smart Portfolio, which creates a portfolio aligned with your risk profile.

If you’ve ever wished you could get in on an exciting stock but found the share price too steep, you might want to consider fractional shares. Investing can be accessible when you take it one slice at a time.

***1For securities priced over $1,000, purchase of fractional shares starts at $0.05.

Not all stocks pay out dividends. And there’s no guarantee any stock will pay dividends in a quarter or year. Dividends may be subject to additional taxes, and are considered taxable income. Refer to the IRS for additional info.

Stash has full authority to manage a “Smart Portfolio,” a discretionary managed account.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024