May 1, 2020

Recurring Transactions Can Help You Double Your Savings

Recurring Transactions makes saving money easier by making it automatic. Learn how a few taps can help get you to your goals faster.

Light a fire under your cash with just a tap of a button.

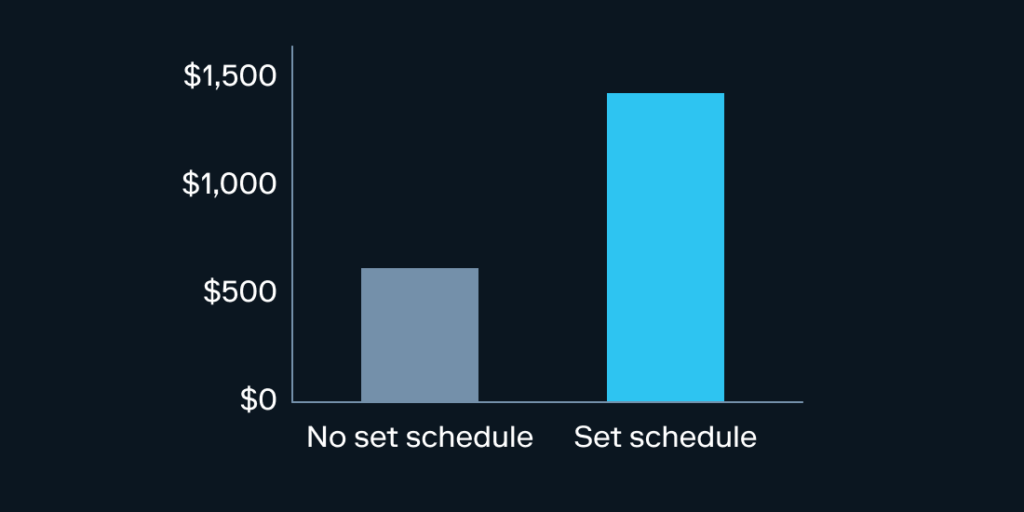

We tested it: As of August 2018, Stash customers that kept Recurring Transactions (formerly Auto-Stash) turned on for a year saved twice as much on average as Stashers who didn’t. (We also found that if you used Recurring Transactions from the Great Recession of 2008 to March 2020, you could’ve doubled your savings.)

Stash customers who had Recurring Transactions turned on for a year saved $1,432. Customers who didn’t? $665.59.

That’s a big difference.

What is Recurring Transactions?

With Auto-invest through Recurring Transactions, you can easily build a schedule to save and invest a set amount. You select the amount you want to set aside, when and how often you want to set it aside, and whether you’d like Stash to automatically invest it in your ETFs and stocks, or simply place the money in your cash to invest balance.

Convince me, why should I invest automatically?

Making small deposits and investments on a regular basis is one of the keys to smart investing. When you invest a little bit on a regular basis, you don’t need to worry about picking the right time to invest. If you invest on a schedule, you’ll get some at a higher price, and some at a bargain and your average price will be somewhere in the middle.

Regular investing has dollar-cost averaging benefits and is a key part of the Stash Way.

One thing to remember: When turning on Recurring Transactions is that this money will be taken out of your account automatically so if you don’t have enough money to cover the Recurring Transactions, your bank may charge you an overdraft fee.

Yes, I want to automate my savings!

Right on, just go to the Stash app and turn on Recurring Transactions.

Don’t have Stash yet? You can sign up now.

1Chart disclaimer: The data is for the one year period after a user makes their first transfer. The example is a hypothetical illustration of mathematical principles and is not a prediction or projection of performance of an investment or investment strategy. The example does not account for fees.

Methodology: This analysis was done by comparing Stash users who had Recurring Transactions on for at least a year (86,718 users) vs. users who had never turned on the Recurring Transactions feature (24,101 users) but continued to save without Recurring Transactions throughout that year. The amount saved is the average dollar amount users were able to save in their Stash accounts in a one year time period starting on the date of their first transfer or first Recurring Transactions.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024