Feb 26, 2019

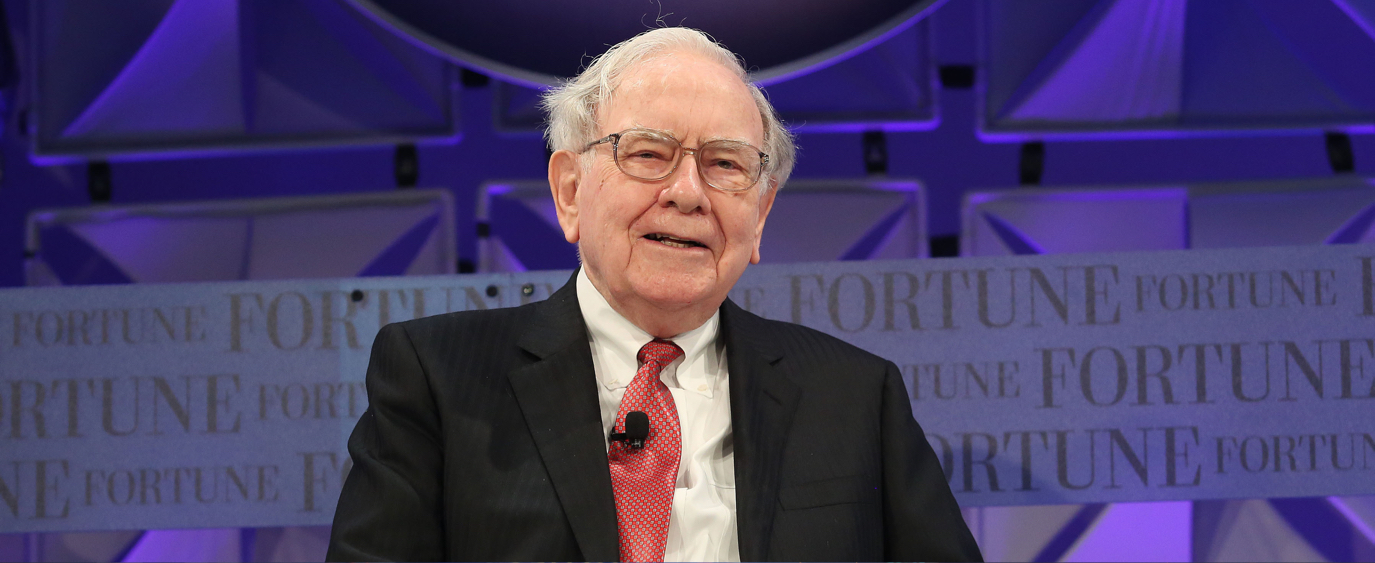

What’s Warren Buffett Buying Next?

The Oracle of Omaha says he’s looking to buy something really big.

Warren Buffett, who controls the business conglomerate Berkshire Hathaway, is a lot like any investor–his portfolio sometimes takes a hit when the stock market goes down.

His solution? Hold steady and keep looking for deals.

“Our advice?… [Pay] little attention to gains or losses of any variety,” Buffett writes in his most recent annual shareholder letter, which he published on February 23, 2019.

Buffett is considered one of the most experienced investors around, having amassed a net worth of nearly $87 billion. His annual letter is a much-anticipated event, which investors pay attention to for indications about market trends and for guidance regarding what to do with their money.

Here are some highlights from the letter and annual report.

Berkshire Hathaway’s annual report: The highlights

- Berkshire Hathaway earned $4 billion in 2018.

- The company lost $25 billion in the fourth quarter of 2018, due to stock market volatility.

- Roughly $3 billion of Berkshire’s fourth-quarter losses were related to its stake in the ketchup and mayonnaise maker Kraft-Heinz. Kraft posted large losses in the fourth quarter of 2018, due to a reduction in the value of its Kraft and Oscar-Meyer businesses, as well as a Securities and Exchange Commission (SEC) probe into its accounting practices, according to reports.

- The company used its savings from the 2017 tax cuts to repurchase $418 billion of its own shares. Generally speaking, that tax cut reduced the U.S. corporate tax rate to about 21%, about half the previous rate, saving businesses money.

Good to know: When a company repurchases its own shares, it reduces the number of shares that are available for investors to buy in the market. A stock repurchase, or buyback, tends to drive up the price of a company’s stock, because there are fewer shares.

- Buffett said he and business partner Charlie Munger, the company’s vice chairman, are on the hunt for an “elephant sized” acquisition—meaning that Berkshire is seeking to purchase a very large company. In addition to owning outright companies such as Duracell and Fruit of the Loom, Berkshire owns sizable stakes in many other U.S. corporations, including American Express, Apple, Coca Cola, and Wells Fargo.

Berkshire hasn’t made a big acquisition of another company since 2015, when it purchased an aerospace parts maker called Precision Castparts Corp. for $32 billion.

More About Warren Buffett, the Oracle of Omaha

Buffett is known as the Oracle of Omaha because Berkshire Hathaway is headquartered in Omaha, Nebraska and because he has made smart stock picks over a nearly 60-year career. He built Berkshire Hathaway from a small cloth mill and manufacturer in New England, to a multi-billion dollar enterprise whose market value has increased 2.4 million percent since the 1960s, according to the company’s most recent annual letter.

Invest with Stash

Warren Buffett started small, and so can you. With Stash, you can invest in dozens of funds and single stocks, and you can get started for as little as $5.