Apr 27, 2018

What’s Expense Ratio? Get Smart About Fees

Learn how fees on funds are calculated.

There’s no shortage of fees in the finance world. And yes, there are even fees attached to most investments. For some investment funds, they aren’t labeled as “fees”, but expense ratios.

What’s an expense ratio?

There are costs associated with owning shares of a fund (ETFs, index funds, mutual funds, etc.), and those costs are levied in the form of annual fees called expense ratios.

An expense ratio is an annual fee charged by investment fund managers, and paid by shareholders of a fund.

The fee covers management fees, administrative expenses and other costs incurred to operate the fund. These costs are built into the price of the fund, not charged separately. You won’t get a separate bill for management costs, in other words.

In a nutshell, the fund manager incurs costs to operate a fund, and the expense ratio covers those costs.

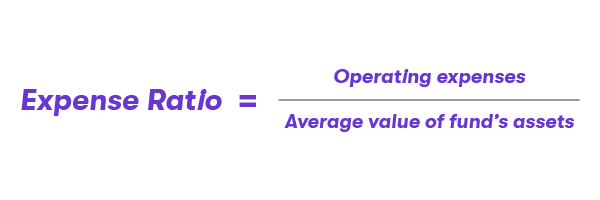

It’s calculated by dividing a fund’s operating expenses by the average value of the fund’s assets. Here’s the formula:

How do you pay it?

Again, these fees are charged to shareholders daily through small deductions to a fund’s assets, and are used by fund managers to cover management and administrative costs incurred to operate the fund.

They’re also not separate fees–instead, they’re included in the price of the fund, making them different from commissions or brokerage fees charged to actually purchase shares.

You’ll find a fund’s expense ratio listed in its prospectus.

How much are the fees?

Generally, you should look for expense ratios that are less than 1%. They vary from fund to fund, and from fund manager to fund manager.

For ETFs, the average expense ratio is 0.23%, according to industry data.

The average expense ratio for a mutual fund was 0.63% in 2016, according to industry data. For historical context, the average was 0.99% in 2000, meaning that the costs of owning shares has decreased in recent years.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024