Nov 1, 2023

How to Invest in the Dow Jones Industrial Average

| Investing in the Dow Jones Industrial Average (DJIA) The Dow Jones Industrial Average (DJIA) is a stock market index that measures the performance of 30 large, publicly-owned companies listed on the New York Stock Exchange (NYSE) and the NASDAQ. While you can’t invest directly into it, investing in the DJIA can be done through exchange-traded funds (ETFs) that track the index, mutual funds that invest in companies included in the index, or by purchasing shares in the individual companies that make up the index. |

In this article, we’ll cover:

- What is the Dow Jones Industrial Average (DJIA)?

- How to invest in the DJIA: ETFs vs. mutual funds

- Investing in the DJIA with a mutual fund

- Investing in the DJIA with an ETF

- Pros and cons of investing in the Dow Jones

- How to invest in the Dow: FAQs

Read on to learn how to invest in the Dow Jones Industrial Average.

What is the Dow Jones Industrial Average?

The Dow Jones Industrial Average, or simply the Dow, is a stock market index made up of 30 big, well-known ‘blue chip’ companies in the United States. Think of it as a group of companies that represent a quick snapshot of the overall health of the U.S. stock market. The Dow, in particular, is one of the oldest and most widely used indices to examine what’s happening in a stock market.

The Dow Jones includes companies across the spectrum, from energy to health care. Here are the 30 companies in the DJIA by price weight as of November 2023:

| Company | Date added to the DJIA |

|---|---|

| UnitedHealth Group Incorporated | September 24, 2012 |

| Microsoft Corporation | November 1, 1999 |

| Goldman Sachs Group Inc. | April 2, 2019 |

| Home Depot Inc. | November 1, 1999 |

| McDonald's Corporation | October 30, 1985 |

| Amgen Inc. | August 31, 2020 |

| Visa Inc. | September 20, 2013 |

| Caterpillar Inc. | May 6, 1991 |

| Salesforce Inc. | August 31, 2020 |

| Boeing Company | March 12, 1987 |

| Honeywell International Inc. | August 31, 2020 |

| Apple Inc. | March 19, 2015 |

| Travelers Companies Inc. | June 8, 2009 |

| Walmart Inc. | March 17, 1997 |

| Procter & Gamble Company | May 26, 1932 |

| Johnson & Johnson | March 17, 1997 |

| American Express Company | August 30, 1982 |

| Chevron Corporation | February 19, 2008 |

| International Business Machines Corporation | June 29, 1979 |

| JPMorgan Chase & Co. | May 6, 1991 |

| NIKE Inc. | September 20, 2013 |

| Merck & Co. Inc. | June 29, 2013 |

| 3M Company | August 9, 1979 |

| Walt Disney Company | June 5, 1976 |

| Coca-Cola Company | March 12, 1987 |

| Cisco Systems Inc. | June 8, 2009 |

| Dow Inc. | May 6, 1987 |

| Intel Corporation | January 11, 1999 |

| Verizon Communications Inc. | April 8, 2004 |

| Walgreens Boots Alliance Inc. | June 26, 2018 |

The Dow Jones holds companies from almost every stock market sector, falling into three main sectors: health care (20.8%), financials (19.8%), and information technology (18.8%). The only sectors excluded from its index are transportation and utilities, which have their own Dow Jones indexes.

So, how do you invest in the Dow Jones? For new investors, the best way is through an ETF or index mutual fund. While there are some differences between the two that we’ll explain below, funds are a low-barrier, low-cost way to gain exposure to the DJIA and diversify your portfolio.

| Investor tip: For new investors learning how to invest in the DJIA, we recommend buying an index fund over hand-picking individual stocks. Here’s why: passively holding an index often produces better results than individual stocks. Staying invested for the long haul also minimizes the effects of market volatility and increases your odds of seeing the positive returns that the market has historically provided. |

How to invest in the Dow Jones: index mutual funds vs. ETFs

Since the Dow Jones is simply a measure of its underlying stocks’ performance, you can’t invest in it directly—instead, you can invest with an index fund either through a mutual fund or an ETF that strives to match the performance of the market index.

A mutual fund is a basket of hundreds of stocks, securities, and other assets within a single fund. Instead of purchasing a single stock, funds give you exposure to all the different shares it contains, providing instant diversification for your portfolio.

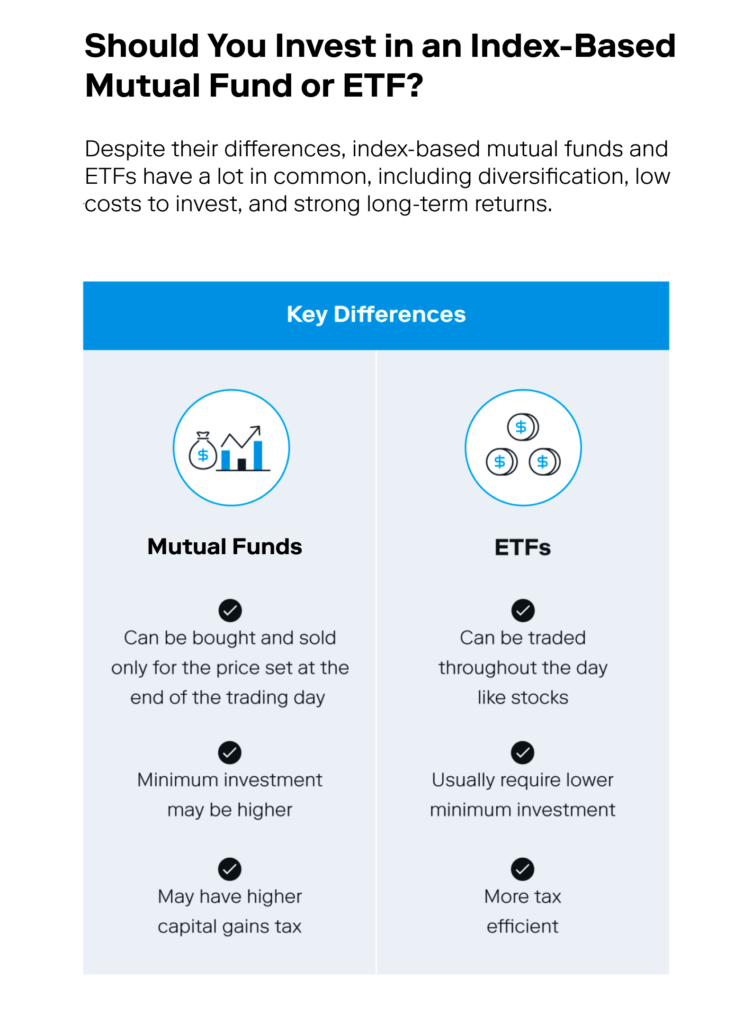

Index-based ETFs and mutual funds both aim to mimic the performance of an index like the Dow Jones, but there are a few differences between the two.

Investing in the Dow with a mutual fund

Index-based mutual funds that track the Dow Jones Industrial Average usually include most (if not all) of the index’s 30 companies. This is so they can match the performance of the index as closely as possible.

There’s a handful of Dow Jones mutual funds to choose from, but the following criteria can help guide your selection:

- Minimum investment: index funds will have varying minimum investments, so be sure to check that the minimum amount aligns with how much you have to invest.

- Expense ratio: since index funds are passively managed, the expense ratio (the ongoing cost of holding the investment) tends to be low. Look for a fund with the lowest expense ratio.

- Dividend yield: if your index fund comes with dividends, which many do, be sure to compare the dividend yield (the amount investors are paid in dividends) of different funds you’re considering. Some may be higher than others, and capitalizing on dividends is a great way to boost returns.

Investing in the Dow Jones with an ETF

Like index mutual funds, index ETFs allow investors to pool their money in a fund holding a selection of stocks, bonds, and other assets. Unlike index mutual funds, however, which can only be traded once a day at the end of each trading day, ETFs can be traded like a stock—meaning their share prices can fluctuate throughout the trading day.

There are different types of ETFs, and not all of them track a particular index. Some ETFs correspond to a particular sector, industry, or market. To invest in the Dow with an ETF, you’d want to purchase an index-based ETF. The key factors to pay attention to aren’t much different from that of an index mutual fund:

- Minimum investment: in many cases, ETFs will have a lower minimum investment than index funds—sometimes, you might only need to pay the amount of a single share to get started.

- Expense ratio: always compare expense ratios for ETFs you’re considering, and look for one with the lowest expense ratio possible.

- Dividend yield: compare the dividend yields of ETFs you’re considering, and ensure it’s as high as possible to boost your returns.

- Record of the ETF provider: consider the experience and track record of the provider of the ETF you are considering. Look for reputable providers with a strong track record of managing and administering ETFs.

Follow these steps to buy an ETF:

- Open an investment account: you can sign up with a traditional brokerage or through a robo-advisor, where you’ll find many ETFs to choose from.

- Add funds: decide how much capital you’re able to invest and add the funds to your account.

- Choose and buy your ETF: once you’ve decided on an ETF, purchase it through your brokerage account. Be sure to use the key criteria listed earlier to compare expense ratios and dividend yields.

Pros and cons of investing in the DJIA

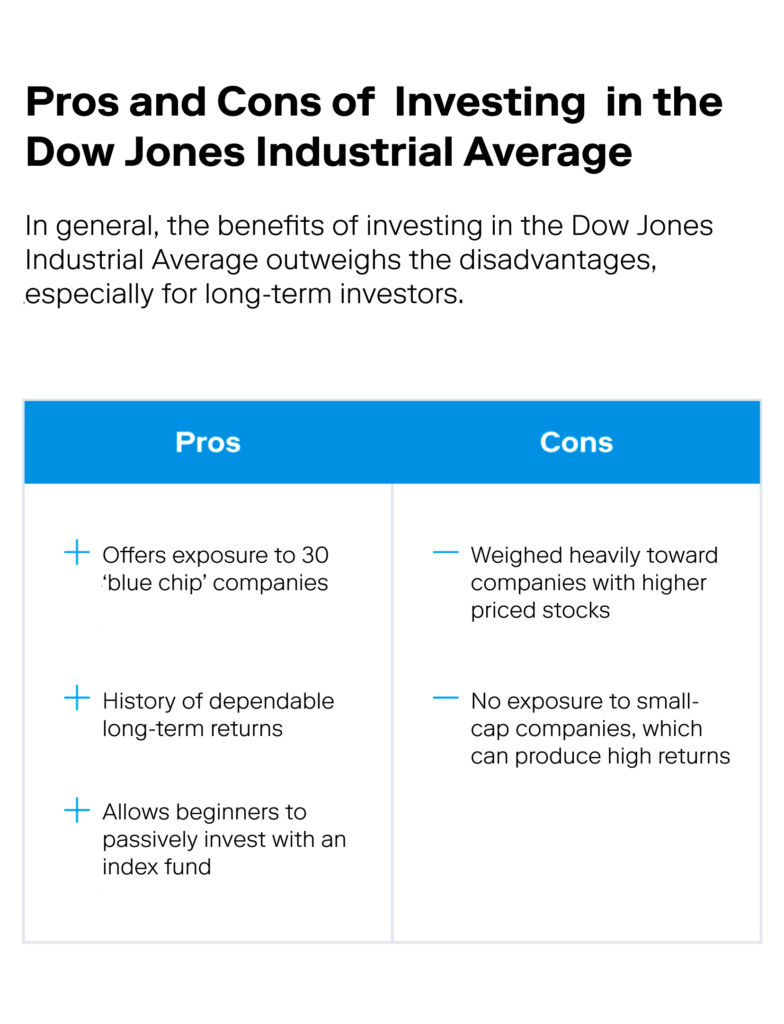

Investing in the Dow Jones Industrial Average is a popular way to diversify your portfolio and build wealth. In the case of a Dow Jones index fund or ETF, you gain exposure to some of the world’s most well-known and established companies without spending hours researching individual stocks.

Pros

In general, the benefits of investing in the Dow Jones Industrial Average outweigh the disadvantages.

- Consistent long-term returns: the Dow Jones has a long history of strong performance, with an average annual return of around 10% since its inception in 1896.

- Instant diversification: if you invest with an index fund, you gain exposure to an array of companies, industries, and sectors that instantly diversify your portfolio. This means that if one company or industry underperforms, the overall impact on the index and your portfolio is likely to be mitigated.

- Blue-chip stocks: the DJIA includes some of the most well-known and established companies in the world, such as Apple, Boeing, and Coca-Cola. These companies are often referred to as “blue-chip” stocks and are considered to be reliable long-term investments.

Cons

While the benefits of investing in the Dow Jones Industrial Average outshine the drawbacks, there are still a few to be aware of.

- Limited scope: the DJIA only includes 30 companies, which is a pretty small sample size compared to other indexes. This means that it may not be representative of the broader stock market or the economy as a whole.

- Price-weighted: the Dow is a price-weighted index, meaning that companies with higher stock prices have a greater influence on the index than companies with lower stock prices.

- No exposure to international companies: since the Dow only includes U.S.-based companies, it won’t provide stock exposure to companies in other parts of the world. This is less of a concern for new investors, but spreading your portfolio across different regions is another diversification strategy. Investors who want exposure to international markets will need to look elsewhere.

Investing made easy.

Start today with any dollar amount.

FAQs about how to invest in the Dow Jones

Still have questions about how to invest in the Dow Jones Industrial Average index? Find answers below.

What is the best way to buy the Dow Jones?

For new investors learning how to invest in the DJIA, buying an index fund over hand-picking individual stocks often produces better results. Staying invested for the long haul also minimizes the effects of market volatility and increases your odds of seeing the positive returns that the market has historically provided.

Should I invest in the Dow Jones through an ETF or index mutual fund?

One of the main differences between index-based ETFs and index mutual funds is that ETFs tend to require a lower minimum investment to get started. For new investors without much money to invest upfront, a DJIA ETF is a low-cost option.

What is the minimum investment for the Dow Jones?

For a Dow Jones index mutual fund, many come with no minimum investment. For a Dow Jones ETF, you might need to pay the full price of a single share—but some investment apps like Stash offer fractional shares for as little as $5.

Can you invest in the DJIA with individual stocks?

Yes. If you don’t want an index mutual fund or ETF, you can hand-select individual stocks of companies from the Dow you want to invest in. Keep in mind that investing in a single company increases the risk and volatility of your investment, and will require thoughtful research and stock performance analysis.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024