Jan 11, 2019

5 Smart Things To Do With Your Year-End Bonus

If you’re like a lot of workers, you may have found yourself with a little extra money at the end of the year, either for the holidays or as a year-end bonus based on performance.

In fact, an estimated 91% of businesses have programs that include some sort of bonus compensation, according to reports. The average year-end bonus is about $1,800, according to recent information from staffing and recruiting company Accounting Principals.

But what should you do with your extra cash—save it, spend it, or something else?

Here are some things to consider:

Pay off your credit card debt

Think about using your bonus to pay off any of high-interest debt. The average U.S. consumer has about $40,000 in debt, including from credit cards, auto loans, and student loans. And high-interest rates—the national average APR is 17%—can make it really hard to pay off.

The sooner you’re out of debt, the more financial freedom you’ll have, including letting you save for a rainy day, for a house, or for your retirement.

Put it toward your retirement

Your holiday bonus can keep on paying dividends long into your future if you invest toward your retirement.

You have lots of options if you plan to invest your bonus. Does your employer offer a workplace retirement plan that lets you invest part of your bonus in a 401(k)? Consider putting your holiday bonus to work there.

No 401(k)? No problem. You can also put it into a traditional or Roth Individual Retirement Account otherwise known as an IRA.

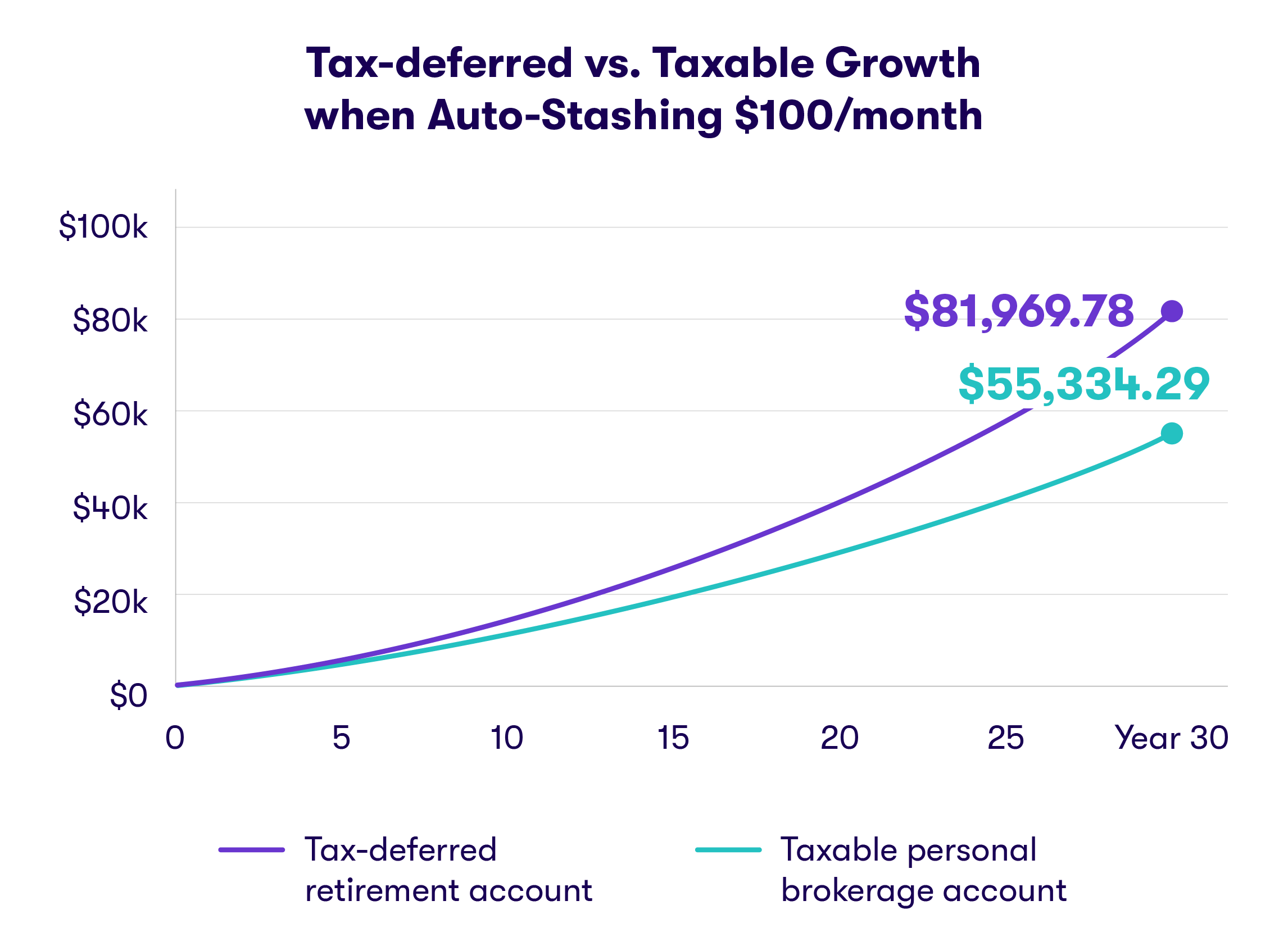

These retirement plans allow you to put aside money on a tax-advantaged basis, either reducing your taxable income for the year, or providing you with some tax-free income in retirement.

Annual limits for people under 50 are $6,000 for an IRA, and $19,000 for a 401(k), starting in 2019.

Special note: Investing in the stock market always carries risk. There is no guarantee that what you’ve invested in will make money.

Invest toward a longer term goal

We all have goals we want to hit before we retire. Maybe it’s a down payment on a house. Maybe it’s saving for a child’s wedding or for their college fund. Investing in an individual brokerage account can help you get there faster than just keeping it in your checking account.

You can invest in stocks, bonds, funds, and other securities. Plus you don’t have to wait until you’re ready to retire to use the money. Remember, there is always risk associated with investing in the stock market.

Build your emergency and rainy day funds

You can also use the money to flesh out your rainy day and emergency funds.

A rainy day fund should contain between $500 and $1000, and should be held in an easy-to-access account such as a bank account. An emergency fund, which you’d use for a bigger life event such as a layoff or illness, should hold between three and six months worth of expenses.

Think about putting your emergency cash into an account that will give you a higher yield than a standard bank account.

One important note: If you put your emergency cash in a higher-yielding account (like a CD, money market fund, or short-term bond fund), it might take longer to access it, since you’ll be selling shares of treasuries or some other financial instrument.

Invest in your children

With that extra money in hand, now’s a perfect time to set up a custodial account for your kids.

They’re essentially brokerage accounts that let you put money away for a child, and then invest that cash in stocks, bonds, mutual funds, and other securities. You might also think about funding a 529 plan.

Don’t forget about taxes

Your bonus is compensation in addition to your annual salary, and you’ll probably owe taxes on it. Depending on the size of the bonus, it could push your earnings for the year into a higher tax bracket.

Think about strategies for reducing your tax burden, which could include fully funding a tax-advantaged retirement account, such as a 401(k), IRA, even a Roth IRA.

Whatever you choose to do with your year-end bonus, one thing is sure to be true—the longer it sits around, the more tempted you’ll be to spend it.

Put that bonus to work for you!

*Expected returns or probability projections are hypothetical in nature and may not reflect actual future results. This is a hypothetical illustration of mathematical principles, is not a prediction or projection of performance of an investment or investment strategy, and assumes weekly contributions at an annual rate of return (compounded annually) and does not account for fees or taxes. It is for illustrative purposes only and is not indicative of any actual investment. Actual return and principal value may be more or less than the original investment.

Related Articles

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

Budgeting for Young Adults: 19 Money Saving Tips for 2024

The Best Personal Finance Books on Money Skills, Investing, and Creating Your Best Life for 2024

What Is a Financial Plan? A Beginner’s Guide to Financial Planning

How to Save Money: 45 Best Ways to Grow Your Savings