Sep 21, 2017

Why Tech Stocks Are Driving Gains in Emerging Markets

It’s been a great year for stocks in developing economies.

It’s been a great year for stocks in developing economies. And it turns out that the tech industry has been driving much of the gains.

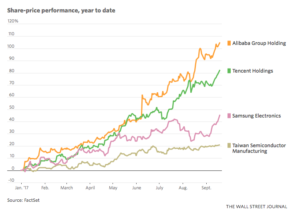

The MCSI Emerging Market Index, which is a composite of some of the biggest company stocks in developing nations is up 30% for the year. But tech stocks in the same index are up 54% over the same time period, which means they’re increasing at a rate nearly twice as high as the total index, the Wall Street Journal reports.

There are also roughly 30 emerging market economies primarily in Africa, Eastern Europe and Asia

The tech gains in the emerging nations reportedly represent a turnaround from previous years, as the major industries that drove index gains were commodities, financial services, and utilities. In the 1990s, technology stocks only made up 5% of the index, today they represent more than a quarter.

It’s been a strong year for tech stocks in the U.S. as well, with the S&P North American Technology index up 26% for the year.

A few of the big drivers of emerging market gains are China’s eCommerce platform Alibaba, Internet services company Tencent Holdings, and electronics powerhouse Samsung.

Source: Wall Street Journal and FactSet

What are emerging markets?

There are also roughly 30 emerging market economies primarily in Africa, Eastern Europe and Asia. Some of the largest emerging nations are referred to as the BRIC nations of Brazil, Russia, India, and China. But there are as many as two dozen others, including Malaysia, Mexico, South Africa, Taiwan, Turkey, and Vietnam.

(China is something of a paradox. It’s the world’s second largest economy, but it’s also considered a developing nation.)

Generally speaking, these countries are less affluent, and the standard of living tends to be lower. Literacy may not be as high as in developed countries, and there also can be less political and economic stability. The currency of these countries can also be subject to dramatic swings, which can affect investments.

Stash Learn Weekly

Enjoy what you’re reading?

[contact-form-7 id="210" title="Subscribe" html_id="default"]Manufacturing tends to be less advanced, and it tends to focus on components that find their way into finished products made elsewhere. Many of these countries also supply natural resources that are necessary in manufacturing, such as petroleum, wood and non-precious metal.

While investments in developed nations carry the potential for rapid growth, there’s also more risk involved for a variety of factors related to the stability of these economies, including currency fluctuations and the potential for political unrest.