Jul 26, 2018

Don’t Panic! Facebook Stock is Down, But Not Out

Facebook shares took a big hit, but that’s no reason to panic.

Facebook shares dropped by as much as 26% yesterday after the company’s second-quarter report revealed that it missed revenue and growth estimates.

In other words, Facebook isn’t growing the way everyone anticipated, and it’s not making as much money, either. This caused a panic among investors, leading to an after-hours sell-off and a plunge in the company’s stock price.

What should you do?

If you’re a Facebook stockholder or have other tech holdings that may be subject to a market ripple-effect, you may feel inclined to panic.

Don’t.

It’s important to remember that markets go up and down, as do individual stocks. One bad earnings report isn’t the end of the world, and stocks tend to recover with time.

With that said, there are a couple of things you can do to protect your portfolio:

- Stay informed – Keep up to date with the news so that you can anticipate changes in the market. While there are always surprises, getting a feel for the news cycle can help prevent mini-heart attacks when stock values fall.

- Diversify your portfolio – Let the Facebook crash also be a lesson as to why it’s important to diversify. If all you are holding is Facebook stock, then you’re in for a world of hurt. But if Facebook is only one of several investments, the impact will be much smaller. Check in with Stash Coach challenges for further guidance in diversifying your portfolio.

- Remember the magic of dollar cost averaging – Buying assets, like stocks, over time helps lower risk by smoothing costs over time. Read more about it here.

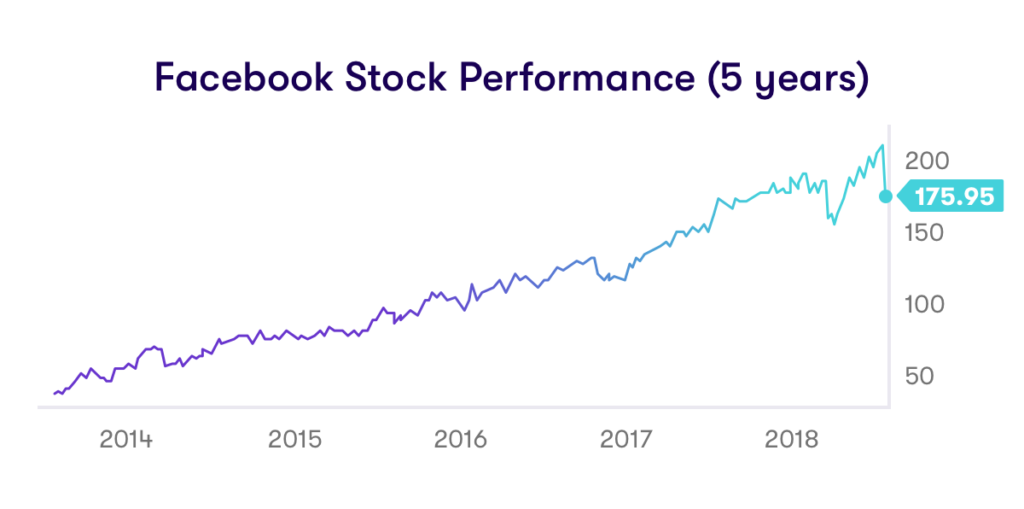

Taking a look at Facebook’s stock performance over the past five years helps provide some perspective:

What went wrong?

Facebook lost more than $120 billion in value as a result, one of the biggest drops in stock market history.

What you need to know:

- Facebook’s monthly active users declined for the first time in the company’s history.

- The company warned that revenue-growth rates will decline by “high single digit” percentages in future quarters.

- The company missed its targets on revenue ($13.23 billion vs. $13.3 billion expected) and monthly active users (2.23 billion vs. 2.25 billion expected), but its earnings per share were $1.74 (vs. $1.72 expected).

Facebook has been fighting through numerous scandals and PR failures, including the concern regarding its role in the 2016 election. But most of the blame is being placed on new regulation in the European Union, where Facebook saw its biggest decline.

Buying the dip?

Many investors consider drops in stock price as a buying opportunity—the price is lower, so why not buy?

This strategy, called “buying the dip”, isn’t risk-free, however. A stock’s price can continue to fall, for example, and large losses are possible. The volatility can simply be too much for many investors.

You can read more about “buying the dip” here.

Consider dollar-cost averaging as one method to smooth your risk profile by turning on Auto-Stash.

*The historical performance data quoted represents past performance, does not guarantee future results, is provided “as is” and solely for information purposes, is not advice or for trading purposes, may be subject to delays, should not be used for tax reporting, may not reflect actual future performance, and is gross of Stash fees. Prices may vary due to network availability, market volatility, and other factors. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. There is a potential for loss as well as gain that is not reflected in the information portrayed. The performance results shown do not represent the results of actual trading executed using client assets. Investors on Stash may experience different results from the results shown. The choices made by Stash to display this investment and time horizons have a direct effect on investment performance, and different choices would result in different historical performance results. Market data provided by Xignite.