Apr 25, 2018

Jargon Hack: Tracking Error

We’ll help you find the trail when it comes to financial jargon, like “tracking error”

Unsuccessfully hunting a deer in the woods could be considered a “tracking error”. And when it comes to tracking errors and your investments, the concept isn’t too different.

What is a tracking error?

A tracking error is a difference between a portfolio’s performance, or return, and the benchmark or index it attempts to track. In essence, it’s the deviation from a portfolio’s desired return.

Let’s say, for example, that you shot an arrow at a target. But you miss–your arrow instead hits a tree 12 feet to the right of the target. In this case, you were off by 12 feet; That would be your “tracking error”.

Continuing with our archery metaphor, if our arrow represents our portfolio or investment, then the target we’re shooting at is the benchmark or index.

Benchmarks and indexes

A benchmark is a standard or point of reference. It’s what you’re using for comparison, in other words, when judging the performance of a portfolio. An index, likewise is a tool that helps you measure or track the market.

Back to the archery range–if the target is our benchmark, then an index would be a tool that helps us aim. Ultimately, we would judge our arrow’s performance based on how far off from the target it landed. The goal, of course, is to get as close as possible. And the closer we are, the better our performance.

The same logic applies to your investment portfolio. The closer you are to your target, or benchmark, the lower your tracking error.

Calculating tracking errors

How do you calculate a tracking error? There are a couple of calculations–with varying degrees of complexity–that you can use.

The simple formula only requires you to take the performance of your portfolio or security and subtract it from the benchmark to find the difference:

T E = Portfolio performance – Benchmark performance

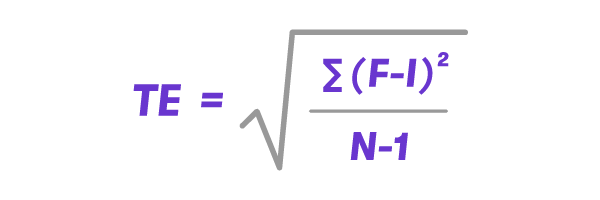

The second, more accurate but vastly more complicated way to calculate the tracking error requires you to find the standard deviation, or, how to spread out points of data are across different periods of time.

To calculate a tracking error using this formula, you’ll need to know the fund’s return (F), the index’s return (I), and the number of time periods, likely quarters, you’re including (N). From there, it’s a matter of plugging in the variables and cranking out the calculation to land at a percentage, the tracking error.

Related Articles

15 Largest AI Companies in 2024

The 12 Largest Cannabis Companies in 2024

What Is a Traditional IRA?

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024